Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An economy is populated by N identical consumers. They consume two goods X and Y. Utility is given by U = In(X) + In

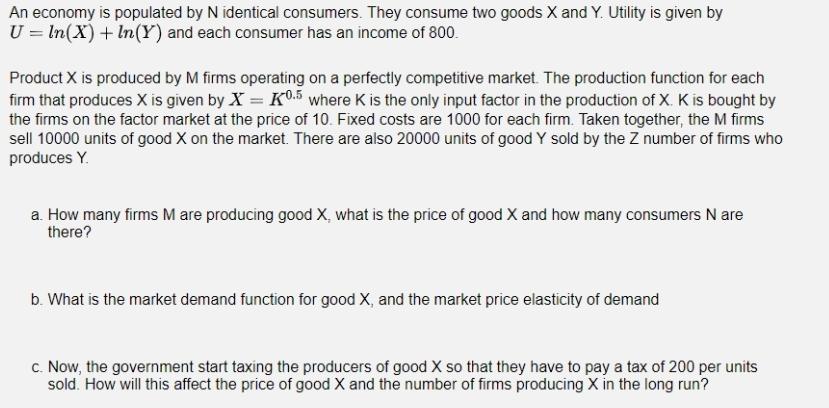

An economy is populated by N identical consumers. They consume two goods X and Y. Utility is given by U = In(X) + In (Y) and each consumer has an income of 800. Product X is produced by M firms operating on a perfectly competitive market. The production function for each firm that produces X is given by X = K0.5 where K is the only input factor in the production of X. K is bought by the firms on the factor market at the price of 10. Fixed costs are 1000 for each firm. Taken together, the M firms sell 10000 units of good X on the market. There are also 20000 units of good Y sold by the Z number of firms who produces Y. a. How many firms M are producing good X, what is the price of good X and how many consumers N are there? b. What is the market demand function for good X, and the market price elasticity of demand c. Now, the government start taxing the producers of good X so that they have to pay a tax of 200 per units sold. How will this affect the price of good X and the number of firms producing X in the long run?

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 8 T Ti Given Equation TT dx UInx Iny 0 inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started