Answered step by step

Verified Expert Solution

Question

1 Approved Answer

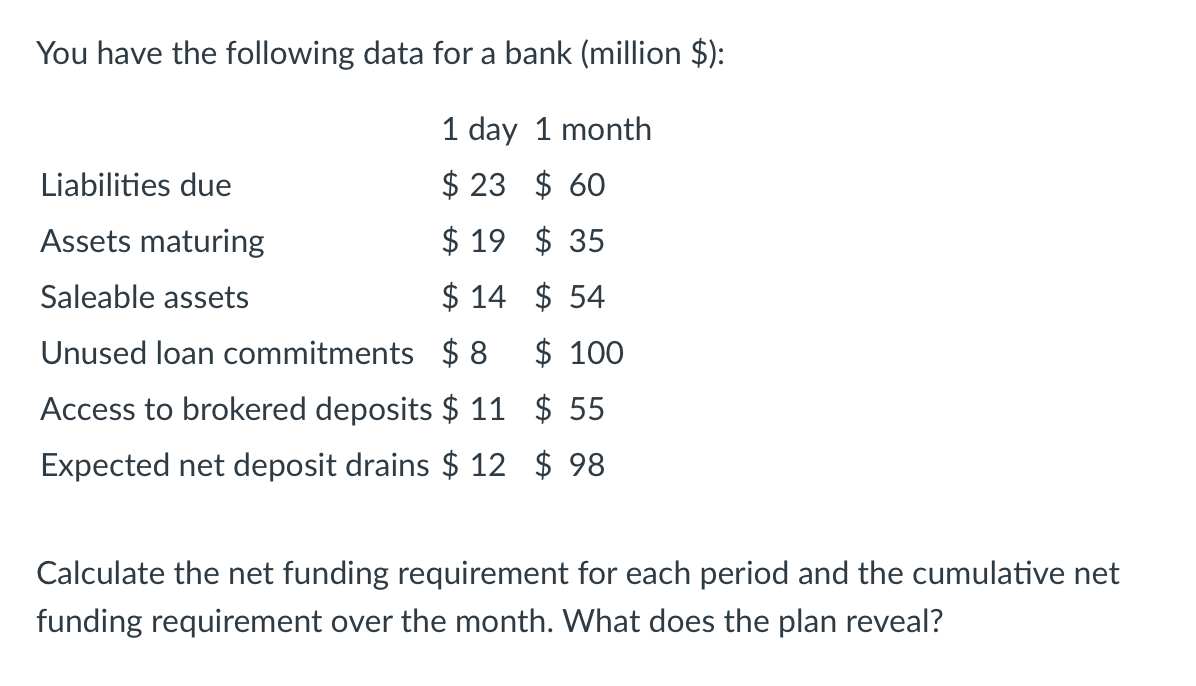

You have the following data for a bank (million $): 1 day 1 month Liabilities due $23 $60 Assets maturing $19 $35 Saleable assets

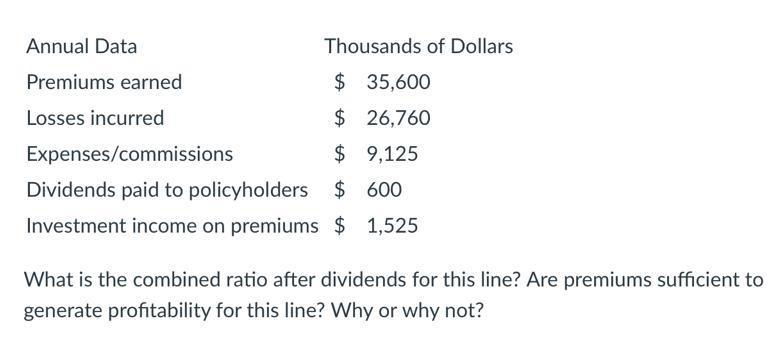

You have the following data for a bank (million $): 1 day 1 month Liabilities due $23 $60 Assets maturing $19 $35 Saleable assets $14 $54 Unused loan commitments $8 $100 Access to brokered deposits $ 11 $ 55 Expected net deposit drains $ 12 $98 Calculate the net funding requirement for each period and the cumulative net funding requirement over the month. What does the plan reveal? Thousands of Dollars $ 35,600 $ 26,760 Annual Data Premiums earned Losses incurred Expenses/commissions $9,125 Dividends paid to policyholders $ 600 Investment income on premiums $ 1,525 What is the combined ratio after dividends for this line? Are premiums sufficient to generate profitability for this line? Why or why not?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the Insurance Line Combined Ratio after Dividends Calculate the combined ratio without dividends Combined ratio Losses incurred Expensescomm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started