Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three Cases of Inventory and Purchase Errors made in 2019 Case 1. Ending inventory overstated, but purchases were recorded correctly. Case 2. Ending inventory correctly

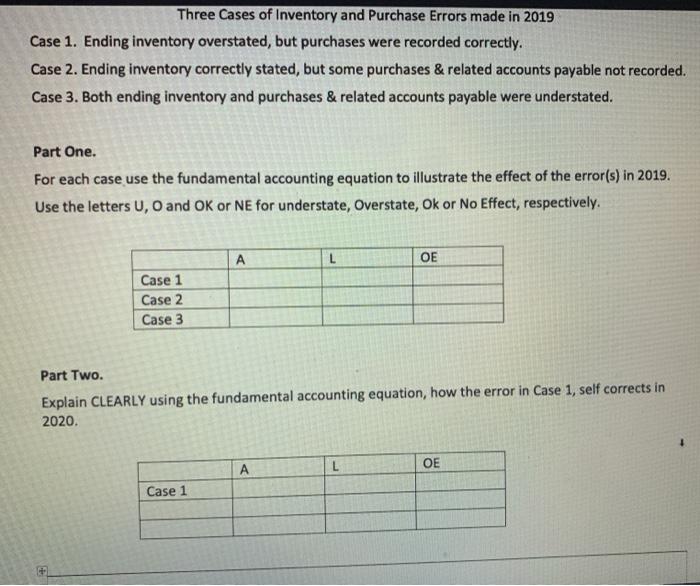

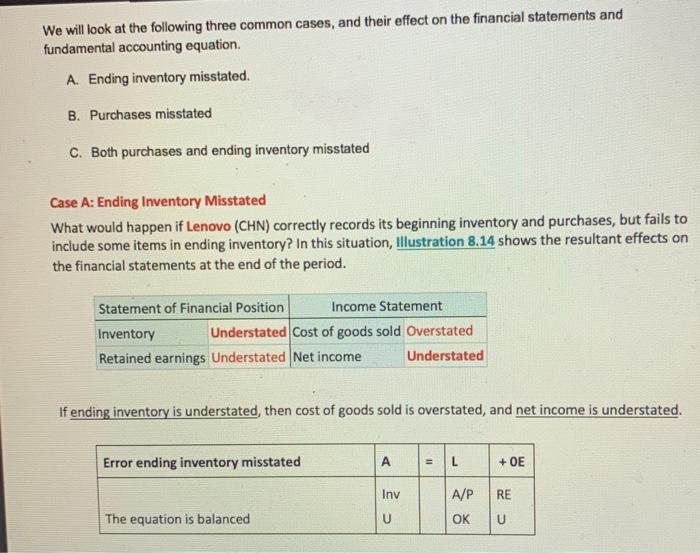

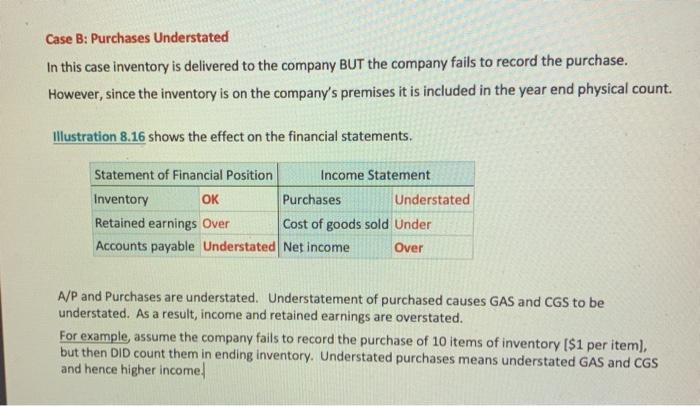

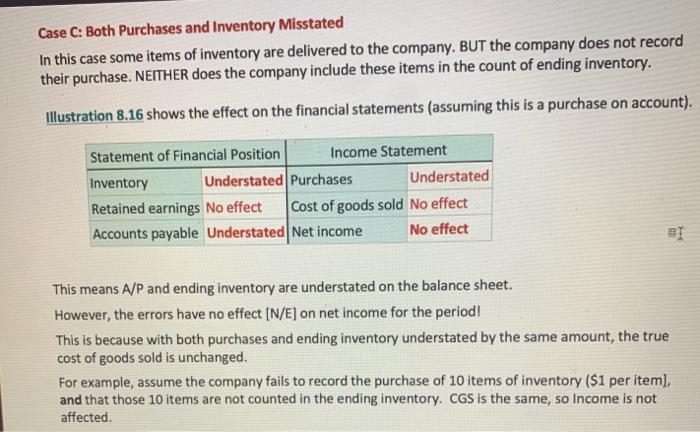

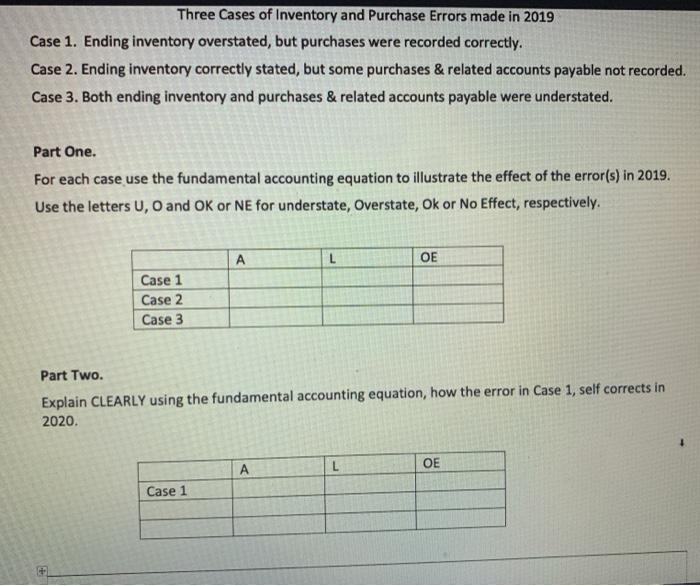

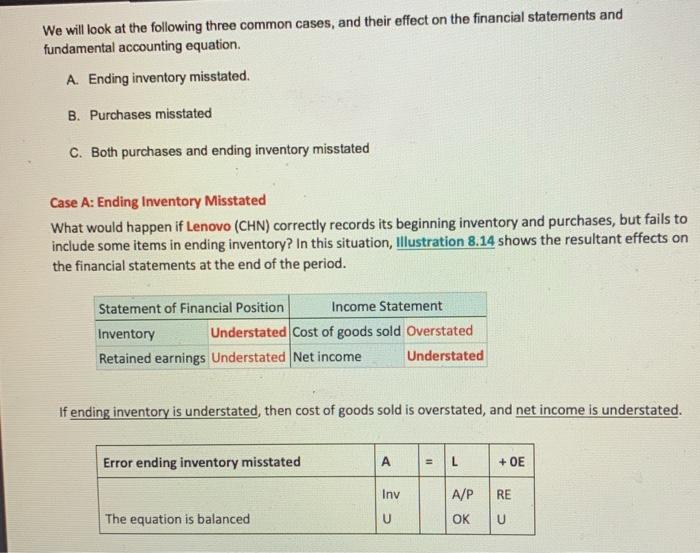

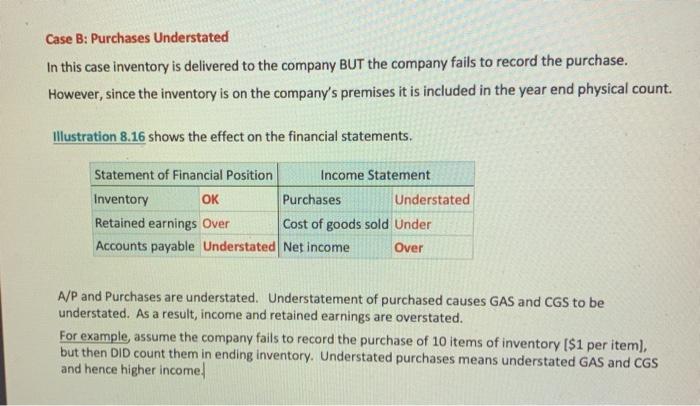

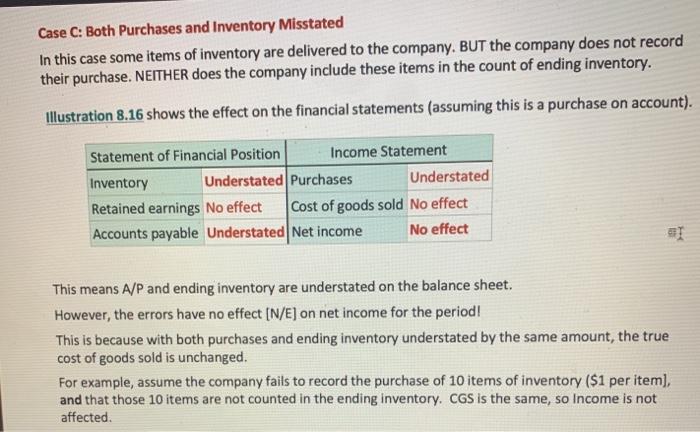

Three Cases of Inventory and Purchase Errors made in 2019 Case 1. Ending inventory overstated, but purchases were recorded correctly. Case 2. Ending inventory correctly stated, but some purchases & related accounts payable not recorded. Case 3. Both ending inventory and purchases & related accounts payable were understated. Part One. For each case use the fundamental accounting equation to illustrate the effect of the error(s) in 2019. Use the letters U, O and OK or NE for understate, Overstate, Ok or No Effect, respectively. A L OE Case 1 Case 2 Case 3 Part Two. Explain CLEARLY using the fundamental accounting equation, how the error in Case 1, self corrects in 2020. A L OE Case 1 We will look at the following three common cases, and their effect on the financial statements and fundamental accounting equation. A. Ending inventory misstated. B. Purchases misstated C. Both purchases and ending inventory misstated Case A: Ending Inventory Misstated What would happen if Lenovo (CHN) correctly records its beginning inventory and purchases, but fails to include some items in ending inventory? In this situation, Illustration 8.14 shows the resultant effects on the financial statements at the end of the period. Statement of Financial Position Income Statement Inventory Understated Cost of goods sold Overstated Understated Retained earnings Understated Net income If ending inventory is understated, then cost of goods sold is overstated, and net income is understated. Error ending inventory misstated The equation is balanced A = L + OE Inv A/P RE U C OK U Case B: Purchases Understated In this case inventory is delivered to the company BUT the company fails to record the purchase. However, since the inventory is on the company's premises it is included in the year end physical count. Illustration 8.16 shows the effect on the financial statements. Statement of Financial Position Inventory OK Retained earnings Over Income Statement Purchases Understated Cost of goods sold Under Over Accounts payable Understated Net income A/P and Purchases are understated. Understatement of purchased causes GAS and CGS to be understated. As a result, income and retained earnings are overstated. For example, assume the company fails to record the purchase of 10 items of inventory [$1 per item], but then DID count them in ending inventory. Understated purchases means understated GAS and CGS and hence higher income Case C: Both Purchases and Inventory Misstated In this case some items of inventory are delivered to the company. BUT the company does not record their purchase. NEITHER does the company include these items in the count of ending inventory. Illustration 8.16 shows the effect on the financial statements (assuming this is a purchase on account). Statement of Financial Position Inventory Income Statement Understated Purchases Understated Retained earnings No effect Cost of goods sold No effect Accounts payable Understated Net income No effect #I This means A/P and ending inventory are understated on the balance sheet. However, the errors have no effect [N/E] on net income for the period! This is because with both purchases and ending inventory understated by the same amount, the true cost of goods sold is unchanged. For example, assume the company fails to record the purchase of 10 items of inventory ($1 per item], and that those 10 items are not counted in the ending inventory. CGS is the same, so Income is not affected

Three Cases of Inventory and Purchase Errors made in 2019 Case 1. Ending inventory overstated, but purchases were recorded correctly. Case 2. Ending inventory correctly stated, but some purchases & related accounts payable not recorded. Case 3. Both ending inventory and purchases & related accounts payable were understated. Part One. For each case use the fundamental accounting equation to illustrate the effect of the error(s) in 2019. Use the letters U, O and OK or NE for understate, Overstate, Ok or No Effect, respectively. A L OE Case 1 Case 2 Case 3 Part Two. Explain CLEARLY using the fundamental accounting equation, how the error in Case 1, self corrects in 2020. A L OE Case 1 We will look at the following three common cases, and their effect on the financial statements and fundamental accounting equation. A. Ending inventory misstated. B. Purchases misstated C. Both purchases and ending inventory misstated Case A: Ending Inventory Misstated What would happen if Lenovo (CHN) correctly records its beginning inventory and purchases, but fails to include some items in ending inventory? In this situation, Illustration 8.14 shows the resultant effects on the financial statements at the end of the period. Statement of Financial Position Income Statement Inventory Understated Cost of goods sold Overstated Understated Retained earnings Understated Net income If ending inventory is understated, then cost of goods sold is overstated, and net income is understated. Error ending inventory misstated The equation is balanced A = L + OE Inv A/P RE U C OK U Case B: Purchases Understated In this case inventory is delivered to the company BUT the company fails to record the purchase. However, since the inventory is on the company's premises it is included in the year end physical count. Illustration 8.16 shows the effect on the financial statements. Statement of Financial Position Inventory OK Retained earnings Over Income Statement Purchases Understated Cost of goods sold Under Over Accounts payable Understated Net income A/P and Purchases are understated. Understatement of purchased causes GAS and CGS to be understated. As a result, income and retained earnings are overstated. For example, assume the company fails to record the purchase of 10 items of inventory [$1 per item], but then DID count them in ending inventory. Understated purchases means understated GAS and CGS and hence higher income Case C: Both Purchases and Inventory Misstated In this case some items of inventory are delivered to the company. BUT the company does not record their purchase. NEITHER does the company include these items in the count of ending inventory. Illustration 8.16 shows the effect on the financial statements (assuming this is a purchase on account). Statement of Financial Position Inventory Income Statement Understated Purchases Understated Retained earnings No effect Cost of goods sold No effect Accounts payable Understated Net income No effect #I This means A/P and ending inventory are understated on the balance sheet. However, the errors have no effect [N/E] on net income for the period! This is because with both purchases and ending inventory understated by the same amount, the true cost of goods sold is unchanged. For example, assume the company fails to record the purchase of 10 items of inventory ($1 per item], and that those 10 items are not counted in the ending inventory. CGS is the same, so Income is not affected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started