Three mutually exclusive projects, Project A, Project B, and Project C, are being considered for investment...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

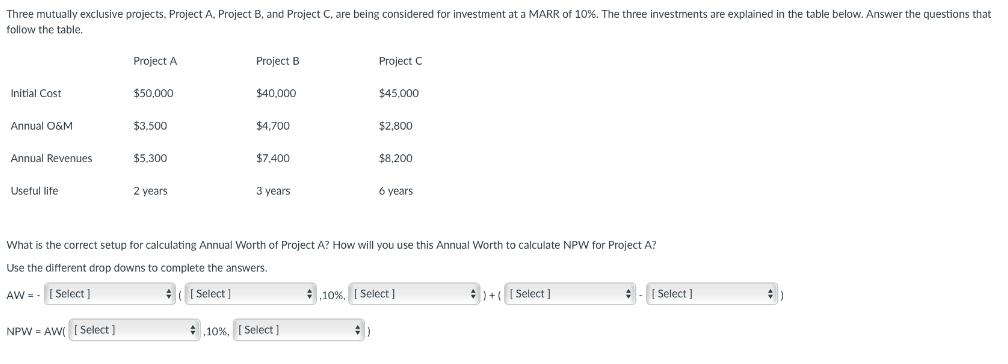

Three mutually exclusive projects, Project A, Project B, and Project C, are being considered for investment at a MARR of 10%. The three investments are explained in the table below. Answer the questions that follow the table. Initial Cost Annual O&M Annual Revenues Useful life Project A NPW AW [Select] $50,000 $3,500 $5,300 2 years Project B $40,000 $4,700 $7,400 3 years Project C 10%, [Select] $45,000 $2,800 $8,200 What is the correct setup for calculating Annual Worth of Project A? How will you use this Annual Worth to calculate NPW for Project A? Use the different drop downs to complete the answers. AW=- [Select] ([Select] 6 years # 10%, [Select] +)+([Select] + [Select] #) Three mutually exclusive projects, Project A, Project B, and Project C, are being considered for investment at a MARR of 10%. The three investments are explained in the table below. Answer the questions that follow the table. Initial Cost Annual O&M Annual Revenues Useful life Project A NPW AW [Select] $50,000 $3,500 $5,300 2 years Project B $40,000 $4,700 $7,400 3 years Project C 10%, [Select] $45,000 $2,800 $8,200 What is the correct setup for calculating Annual Worth of Project A? How will you use this Annual Worth to calculate NPW for Project A? Use the different drop downs to complete the answers. AW=- [Select] ([Select] 6 years # 10%, [Select] +)+([Select] + [Select] #)

Expert Answer:

Related Book For

Engineering Economy

ISBN: 978-0132554909

15th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Posted Date:

Students also viewed these accounting questions

-

Three mutually exclusive alternatives are being considered for the production equipment at a tissue paper factory. The estimated cash flows for each alternative are given here. (All costs are in...

-

Three mutually exclusive projects are being considered for a new park. The life of the park is expected to be 100 years and the sponsoring agency's MARR is 10% per year. Annual benefits to the public...

-

Three different point-of-purchase displays are being considered for lottery ticket sales at a chain of convenience stores. Two different locations within the store are also being considered. Eighteen...

-

A reaction for which H = + 98.8 kJ and S = + 141.5 J/K is ________ (spontaneous or nonspontaneous) at low temperatures and ________ (spontaneous or nonspontaneous) at high temperatures.

-

Daniel Barenboim sells and erects shell houses, that is, frame structures that are completely finished on the outside but are unfinished on the inside except for flooring, partition studding, and...

-

SY&I is a partnership owned by T. Shitang, D. Yamamoto, and J. Ishikawa, who share profits and losses in the ratio of 2:3:5. The adjusted trial balance of the partnership (in condensed form) at...

-

A business started trading on 1 January 19X6. During the two years ended 31 December 19X6 and 19X7 the following debts were written off to the Bad Debts Account on the dates stated: On 31 December...

-

On December 1 of the current year, the following accounts and their balances appear in the ledger of Latte Corp., a coffee processor: Preferred 2% Stock, $50 par (250,000 shares authorized, 80,000...

-

Question 3 (10 marks) Directors have a duty to prevent their company incurring debts when the company is insolvent or would become insolvent.as set out in S 588G of the Corporations Law. Explain...

-

David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant, specializing in retail management and...

-

A project requires an initial investment of $150 000 and has an expected life of five years. The required rate of return on the project is 12 percent per annum. The projects estimated cash flows each...

-

1. Why are employee referrals an effective means of recruitment? 2. Describe the principles one should follow to write a effective help-wanted ad. 3. If the unstructured interview is so bad, why is...

-

Joseph's investment manager offers him an interest rate of 10.00% compounded monthly on his investments. How much more money would he have to deposit at the end of every month for his fund to...

-

You believe this is due to very bad visibility exiting the lot into the street, which could likely be solved by the placement of two convex mirrors costing approximately $100 each. Proposed...

-

What types of group influence exist? Why must a marketing manager be aware of these separate types of group influence? Describe the factors that affect the diffusion rate for an innovation. How can...

-

Your cover letter must be customized for the job posting you have selected for your resume - which means that you need to select and use keywords from the job posting.(sales Associate For Home Depot)...

-

using the approaches to ethical decision making ( Utilitarian Approach, Rights Approach, Virtue Approach, Fairness Approach, Common Good Approach, Care Ethics). What is the best approach to handle a...

-

Consider a closed, rigid tank with a volume of 0.8L, filled with cold water initially at 27C. The tank is filled such that there are no voids (air pockets) within. The initial pressure within the...

-

A new machine is purchased to be part of a manufacturing process in order to increase efficiency and the rate of production. The machine costs $500,000 and the estimated savings from using the...

-

Doris Wade purchased a condominium for $50,000 in 1987. Her down payment was $20,000. She financed the remaining amount as a $30,000, 30-year mortgage at 7%, compounded monthly. Her monthly payments...

-

In Problem 12-2, perform an analysis to determine how sensitive the choice of a four-lane bridge built now versus a four-lane bridge that is constructed in two stages is to the interest rate. Will an...

-

Evaluate the following expressions at the given point. Use your calculator or your computer (such as Maple). Then use series expansions to find an approximation of the value of the expression to as...

-

How would you factor in the absence of liquidity into your valuation?

-

An analyst who looks at real estate decides to apply the capital asset pricing model to estimate the risk (beta) for real estate. He regresses returns on a real estate index (based on appraised...

Study smarter with the SolutionInn App