Answered step by step

Verified Expert Solution

Question

1 Approved Answer

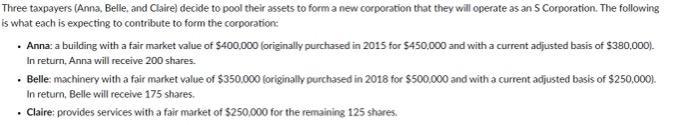

Three taxpayers (Anna, Belle, and Claire) decide to pool their assets to form a new corporation that they will operate as an 5 Corporation.

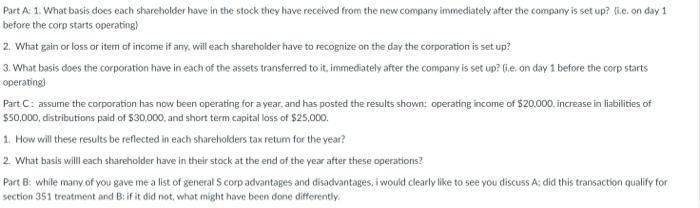

Three taxpayers (Anna, Belle, and Claire) decide to pool their assets to form a new corporation that they will operate as an 5 Corporation. The following is what each is expecting to contribute to form the corporation: Anna: a building with a fair market value of $400,000 (originally purchased in 2015 for $450,000 and with a current adjusted basis of $380,000). In return, Anna will receive 200 shares. Belle: machinery with a fair market value of $350.000 (originally purchased in 2018 for $500,000 and with a current adjusted basis of $250,000). In return, Belle will receive 175 shares. Claire: provides services with a fair market of $250,000 for the remaining 125 shares. Part A: 1. What basis does each shareholder have in the stock they have received from the new company immediately after the company is set up? (ie. on day 1 before the corp starts operating) 2. What gain or loss or item of income if any, will each shareholder have to recognize on the day the corporation is set up? 3. What basis does the corporation have in each of the assets transferred to it, immediately after the company is set up? (.e. on day 1 before the corp starts operating) Part C: assume the corporation has now been operating for a year, and has posted the results shown: operating income of $20.000, increase in liabilities of $50,000, distributions paid of $30,000, and short term capital loss of $25,000. 1. How will these results be reflected in each shareholders tax return for the year? 2. What basis will each shareholder have in their stock at the end of the year after these operations? Part B: while many of you gave me a list of general S corp advantages and disadvantages, i would clearly like to see you discuss A: did this transaction qualify for section 351 treatment and B: if it did not, what might have been done differently.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part A 1 Each shareholder will have a basis in the stock they have received from the new company of the amount they have contributed For Anna this wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started