Question

Three years ago in January, Sheila borrowed $20,000 from her employer to buy an automobile. The original arrangement called for her to pay 7%

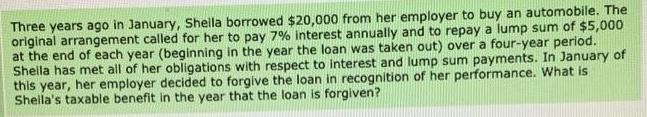

Three years ago in January, Sheila borrowed $20,000 from her employer to buy an automobile. The original arrangement called for her to pay 7% interest annually and to repay a lump sum of $5,000 at the end of each year (beginning in the year the loan was taken out) over a four-year period. Shella has met all of her obligations with respect to interest and lump sum payments. In January of this year, her employer decided to forgive the loan in recognition of her performance. What is Shella's taxable benefit in the year that the loan is forgiven?

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Sheilas taxable benefit in the year that the loan is forgiven is equal to the amount of the loan tha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Canadian Income Taxation 2022/2023

Authors: William Buckwold, Joan Kitunen, Matthew Roman

25th Edition

1260881202, 978-1260881202

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App