Answered step by step

Verified Expert Solution

Question

1 Approved Answer

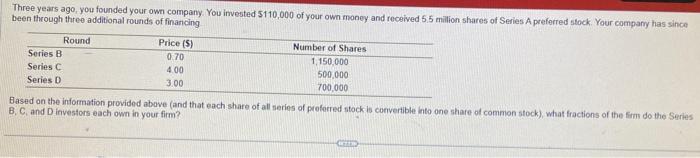

Three years ago, you founded your own company. You invested $110,000 of your own money and received 5.5 million shares of Series A preferred stock.

Three years ago, you founded your own company. You invested $110,000 of your own money and received 5.5 million shares of Series A preferred stock. Your company has since

been through three additional rounds of financing.

Round

Series B

Price (S)

0 70

Number of Shares

1 150.000

Series C

4.00

500.000

Series D

3 00

700,000

Based on the information provided above and that each share of all series of preferred stock is convertible into one share of common stock), what fractions of the firm do the Series

B, C, and D investors each own in your firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started