Answered step by step

Verified Expert Solution

Question

1 Approved Answer

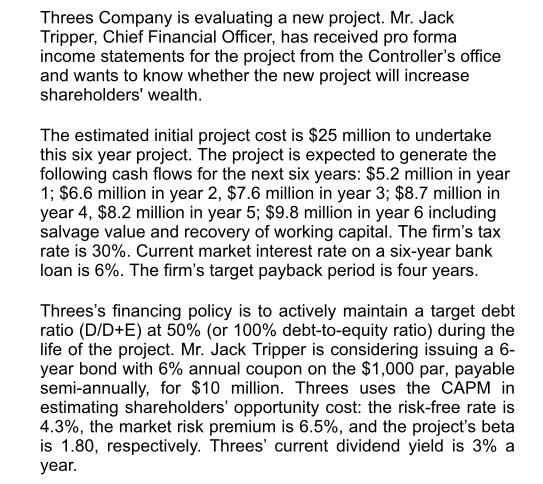

Threes Company is evaluating a new project. Mr. Jack Tripper, Chief Financial Officer, has received pro forma income statements for the project from the

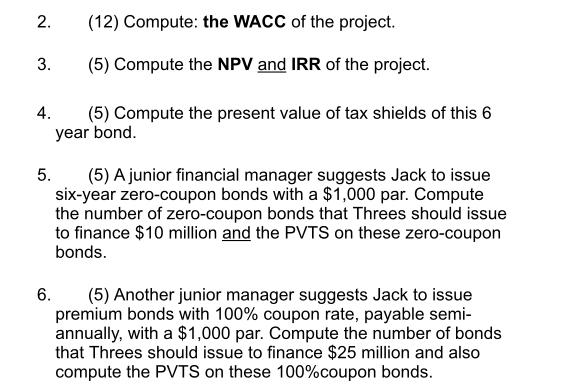

Threes Company is evaluating a new project. Mr. Jack Tripper, Chief Financial Officer, has received pro forma income statements for the project from the Controller's office and wants to know whether the new project will increase shareholders' wealth. The estimated initial project cost is $25 million to undertake this six year project. The project is expected to generate the following cash flows for the next six years: $5.2 million in year 1; $6.6 million in year 2, $7.6 million in year 3; $8.7 million in year 4, $8.2 million in year 5; $9.8 million in year 6 including salvage value and recovery of working capital. The firm's tax rate is 30%. Current market interest rate on a six-year bank loan is 6%. The firm's target payback period is four years. Threes's financing policy is to actively maintain a target debt ratio (D/D+E) at 50% (or 100% debt-to-equity ratio) during the life of the project. Mr. Jack Tripper is considering issuing a 6- year bond with 6% annual coupon on the $1,000 par, payable semi-annually, for $10 million. Threes uses the CAPM in estimating shareholders' opportunity cost: the risk-free rate is 4.3%, the market risk premium is 6.5%, and the project's beta is 1.80, respectively. Threes' current dividend yield is 3% a year. 2. 3. (12) Compute: the WACC of the project. (5) Compute the NPV and IRR of the project. 4. (5) Compute the present value of tax shields of this 6 year bond. 5. (5) A junior financial manager suggests Jack to issue six-year zero-coupon bonds with a $1,000 par. Compute the number of zero-coupon bonds that Threes should issue to finance $10 million and the PVTS on these zero-coupon bonds. 6. (5) Another junior manager suggests Jack to issue premium bonds with 100% coupon rate, payable semi- annually, with a $1,000 par. Compute the number of bonds that Threes should issue to finance $25 million and also compute the PVTS on these 100%coupon bonds.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the WACC of the project Cost of Equity Rf Rm Rf 43 1865 1194 Cost of Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started