Answered step by step

Verified Expert Solution

Question

1 Approved Answer

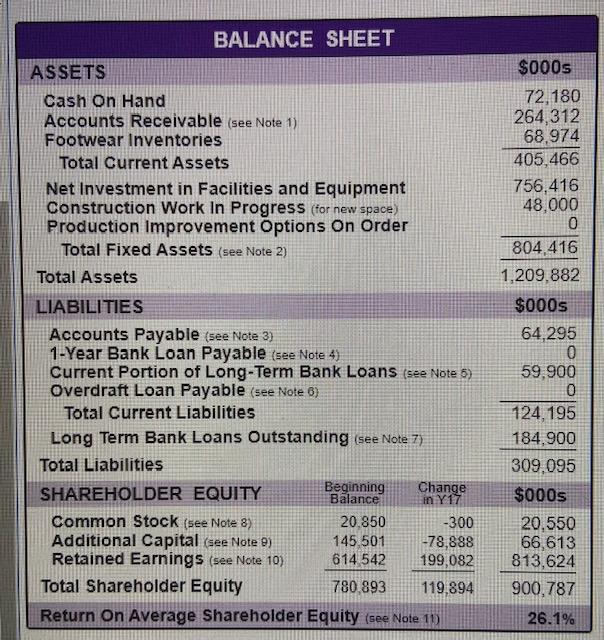

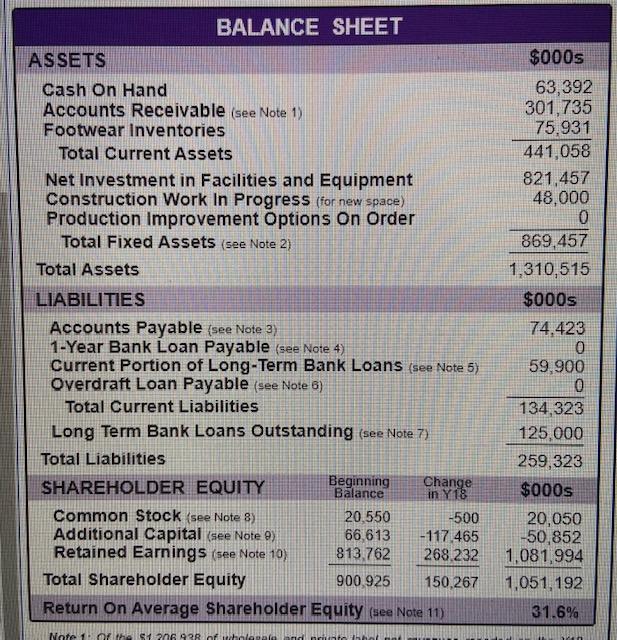

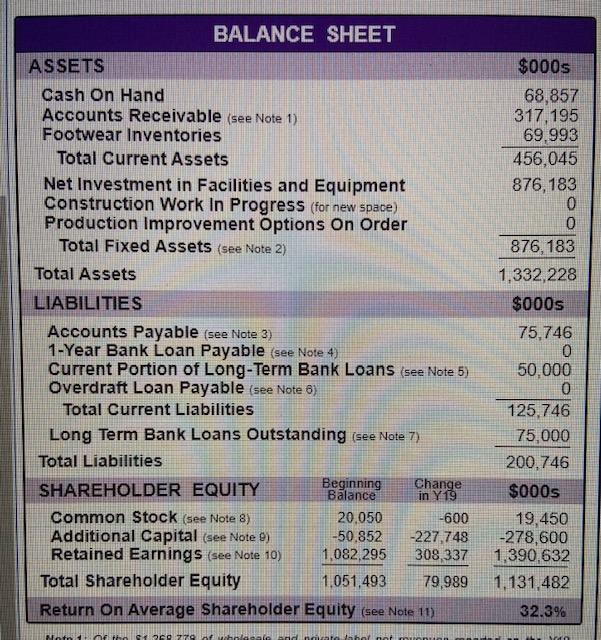

Three-year analysis of liquidity ratios (1) 2017 (2) 2018 (3)2019 BALANCE SHEET ASSETS Cash On Hand Accounts Receivable (see Note 1) Footwear Inventories Total Current

Three-year analysis of liquidity ratios (1) 2017 (2) 2018 (3)2019

BALANCE SHEET ASSETS Cash On Hand Accounts Receivable (see Note 1) Footwear Inventories Total Current Assets Net Investment in Facilities and Equipment Construction Work In Progress for new space) Production Improvement Options On Order Total Fixed Assets (see Note 2) Total Assets LIABILITIES Accounts Payable (see Note 3) 1-Year Bank Loan Payable (see Note 4) Current Portion of Long-Term Bank Loans (see Note 5) Overdraft Loan Payable (see Note 6) Total Current Liabilities Long Term Bank Loans Outstanding (see Note 7) Total Liabilities SHAREHOLDER EQUITY Beginning Change in Y 17 Common Stock (see Note 8) 20.850 -300 Additional Capital (see Note) 145,501 -78,888 Retained Earnings (see Note 10) 614 542 199,082 Total Shareholder Equity 780.893 119.894 Return On Average Shareholder Equity (see Note 10 $000s 72,180 264,312 68,974 405,466 756,416 48,000 0 804 416 1,209.882 $000s 64,295 0 59.900 0 124,195 184,900 309,095 $000s 20.550 66,613 813,624 900,787 Balance 26.1% BALANCE SHEET ASSETS Cash On Hand Accounts Receivable (see Note 1) Footwear Inventories Total Current Assets Net Investment in Facilities and Equipment Construction Work In Progress (for new space) Production Improvement Options On Order Total Fixed Assets (see Note 2) Total Assets LIABILITIES Accounts Payable (see Note 3) 1-Year Bank Loan Payable (see Note 4) Current Portion of Long-Term Bank Loans (see Note 5) Overdraft Loan Payable (see Note 6) Total Current Liabilities Long Term Bank Loans Outstanding (see Note 7) Total Liabilities Beginning Change SHAREHOLDER EQUITY in Y18 Common Stock (see Note 8) 20.550 -500 Additional Capital (see Note > 66 613 -117.465 Retained Earnings (see Note 10) 813,762 268.232 Total Shareholder Equity 900 925 150.267 Return On Average Shareholder Equity (see Note 11) $000s 63,392 301,735 75,931 441,058 821.457 48,000 0 869,457 1,310,515 $000s 74.423 0 59,900 0 134,323 125,000 259,323 $000s 20,050 -50,852 1,081,994 1,051,192 31.6% Balance Note 1or the St 206 ABR of wholesale and into the $000s 68,857 317,195 69,993 456,045 876,183 0 0 876,183 1,332,228 $000s BALANCE SHEET ASSETS Cash On Hand Accounts Receivable (see Note 1) Footwear Inventories Total Current Assets Net Investment in Facilities and Equipment Construction Work In Progress (for new space) Production Improvement Options On Order Total Fixed Assets (see Note 2) Total Assets LIABILITIES Accounts Payable (see Note 3) 1-Year Bank Loan Payable (see Note 4 Current Portion of Long-Term Bank Loans (see Note 5) Overdraft Loan Payable (see Note 6) Total Current Liabilities Long Term Bank Loans Outstanding (se Note 7) Total Liabilities SHAREHOLDER EQUITY Beginning Change Balance in Y 19 Common Stock (see Note 8) 20.050 -600 Additional Capital (see Note ) -50.852 -227,748 Retained Earnings (see Note 10) 1.082,295 308,337 Total Shareholder Equity 1.051,493 79,989 Return On Average Shareholder Equity (see Note 11) 75,746 0 50,000 0 125.746 75,000 200.746 $000s 19,450 -278,600 1,390,632 1.131.482 32.3% O 7779 hannah

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started