Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Through the classifieds of the Miami Herald Rhonda Brennan found her first job after graduating from college. She was delighted when the offer came

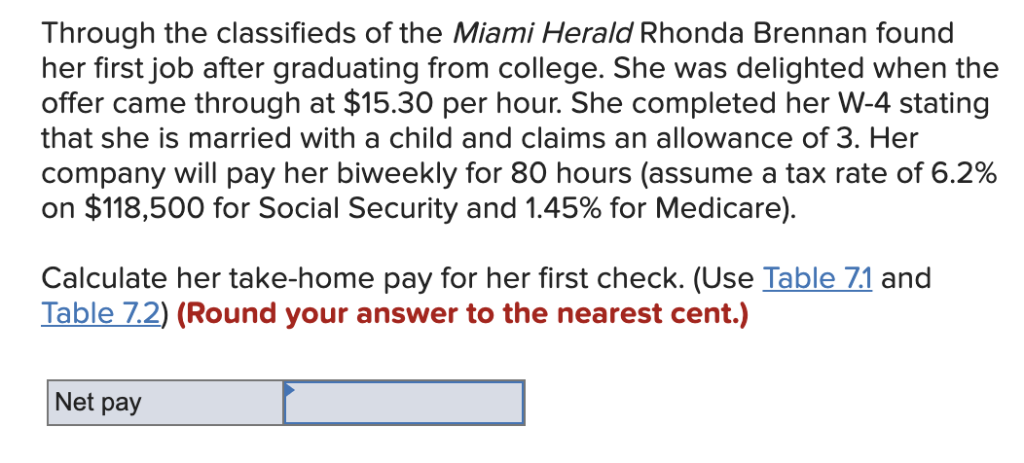

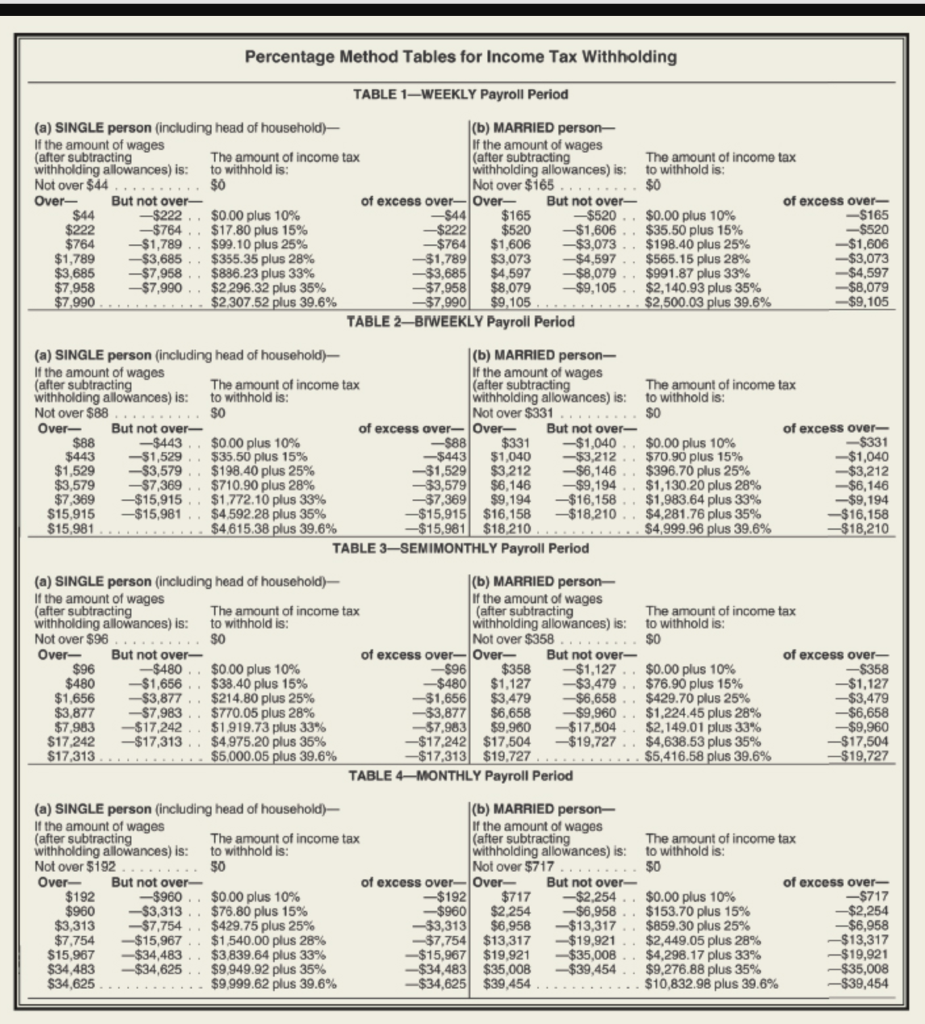

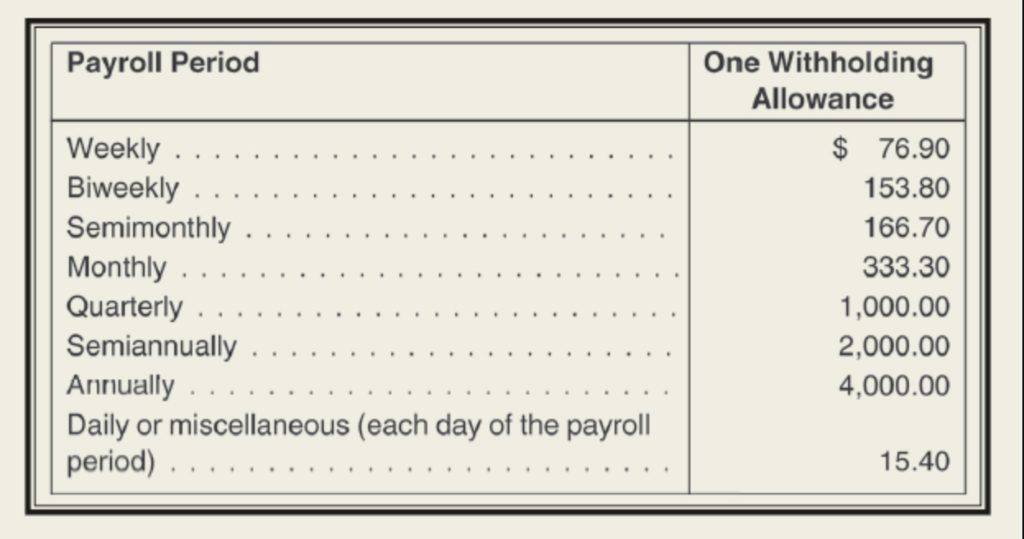

Through the classifieds of the Miami Herald Rhonda Brennan found her first job after graduating from college. She was delighted when the offer came through at $15.30 per hour. She completed her W-4 stating that she is married with a child and claims an allowance of 3. Her company will pay her biweekly for 80 hours (assume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare). Calculate her take-home pay for her first check. (Use Table 7.1 and Table 7.2) (Round your answer to the nearest cent.) Net pay (a) SINGLE person (including If the amount of wages (after subtracting withholding allowances) is: Not over $44......... Over- But not over- -$222 -$764.. $44 $222 $88 $443 $764 -$1,789 $99.10 plus 25% $1,789 -$3,685 $3,685 -$7,958 $7,958 -$7,990 $7,990 (a) SINGLE person (including If the amount of wages (after subtracting withholding allowances) is: Not over $88 Over- But not over- -$443 -$1,529 -$3,579 -$7,369 $1,529 $3,579 $7,369 -$15,915 -$15,981 $15.915 $15,981 head of household)- The amount of income tax to withhold is: $0 $96 $480 Percentage Method Tables for Income Tax Withholding TABLE 1-WEEKLY Payroll Period ... But not over- $0.00 plus 10% $17.80 plus 15% (a) SINGLE person (including If the amount of wages (after subtracting withholding allowances) is: Not over $96 Over- $355.35 plus 28% $886.23 plus 33% $2,296.32 plus 35% $2,307.52 plus 39.6% $0.00 plus 10% $35.50 plus 15% $198.40 plus 25% $710.90 plus 28% $1,772.10 plus 33% $4,592.28 plus 35% $4,615.38 plus 39.6% head of household)- The amount of income tax to withhold is: $0 head of household)- The amount of income tax to withhold is: $0 -$480 -$1,656 -$3,877. $0.00 plus 10% $38.40 plus 15% $214.80 plus 25% $1,656 $3.877 -$7,983 $770.05 plus 28% $7,983 -$17,242 $1,919.73 plus 33% $17,242 -$17,313 $17,313 $4.975.20 plus 35% $5,000.05 plus 39.6% (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $331 of excess over- Over- But not over- -$88 $331 -$1,040 -$443 $1,040 -$3,212 -$1,529 $3,212 -$6,146 -$3,579 $6,146 -$9,194 -$7,369 $9,194 -$16,158 -$15,915 $16,158 -$18,210 -$15,981 $18,210... TABLE 3-SEMIMONTHLY Payroll Period TABLE 2-BIWEEKLY (a) SINGLE person (including If the amount of wages (after subtracting withholding allowances) is: Not over $192 But not over- Over- $192 $960 $3,313 $7,754 -$15,967 $1,540.00 plus 28% -$960.. $0.00 plus 10% -$3,313.. $76.80 plus 15% -$7,754 $429.75 plus 25% $15,967 -$34,483 $3,839.64 plus 33% $9,949.92 plus 35% $34,483 -$34,625 $34,625 $9,999.62 plus 39.6% (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $165....... But not over- -$520 -$1,606.. -$3,073.. $198.40 plus 25% $565.15 plus 28% $991.87 plus 33% $165 of excess over-Over- -$44 -$222 $520 -$764 $1,606 -$1,789 $3,073 -$4,597 -$8,079 -$3,685 $4,597 -$7,958 $8,079 -$9,105 -$7,990 $9,105. head of household)- The amount of income tax to withhold is: 50 Payroll Period (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $358 of excess over-Over- But not over- -$96 $358 -$1,127.. -$480 $1,127 -$3,479 -$1,656 $3,479 -$6,658 -$3,877 $6,658 -$9,960 -$7,983 $9.960 -$17,504 -$17,242 $17,504 -$19,727 -$17,313 $19,727 TABLE 4-MONTHLY Payroll Period (b) MARRIED person- If the amount of wages (after subtracting The amount of income tax to withhold is: $0 $0.00 plus 10% $35.50 plus 15% of excess over-Over- -$192 $717 -$960 $2,254 -$3,313 $6,958 -$7,754 $13,317 -$19,921 -$15,967 $19,921 -$35,008 -$34,483 $35,008 -$39,454 -$34,625 $39,454 $2,140.93 plus 35% $2,500.03 plus 39.6% The amount of income tax to withhold is: $0 $0.00 plus 10% $70.90 plus 15% $396.70 plus 25% $1,130.20 plus 28% $1,983.64 plus 33% $4,281.76 plus 35% $4,999.96 plus 39.6% $0.00 plus 10% $76.90 plus 15% $429.70 plus 25% $1,224.45 plus 28% $2,149.01 plus 33% $4,638.53 plus 35% $5,416.58 plus 39.6% The amount of income tax to withhold is: $0 withholding allowances) is: to withhold is: Not over $717 of excess over- -$165 -$520 ... $0 But not over- -$2,254.. $0.00 plus 10% -$6,958 $153.70 plus 15% -$13,317.. $859.30 plus 25% The amount of income tax $2,449.05 plus 28% $4,298.17 plus 33% $9,276.88 plus 35% $10,832.98 plus 39.6% of excess over- -$331 -$1,040 -$3,212 -$6,146 -$9,194 -$1,606 -$3,073 -$4,597 -$8,079 -$9,105 -$16,158 -$18,210 of excess over- -$358 -$1,127 -$3,479 -$6,658 -$9,960 -$17,504 -$19,727 of excess over- -$717 -$2,254 -$6,958 -$13,317 -$19,921 -$35,008 -$39,454 Payroll Period Weekly Biweekly Semimonthly Monthly. Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period). . One Withholding Allowance $76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Net pay 108720 Workings Gross pay 1224 80153 Value of allowa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started