Question

Throughout the problems, all interest rates yields are based on the semiannual compounding convention. All coupon bonds pay coupons twice per year with the

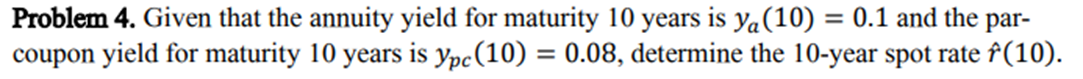

Throughout the problems, all interest rates yields are based on the semiannual compounding convention. All coupon bonds pay coupons twice per year with the first payment to be made 6 months from today. All interest rates and yields should be assumed to be strictly positive. = 0.1 and the par- Problem 4. Given that the annuity yield for maturity 10 years is ya (10) coupon yield for maturity 10 years is ypc (10) = 0.08, determine the 10-year spot rate (10).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem Given the annuity yield ya10 of 10 and the parcoupon yield ypc10 of 8 for a 10year bond with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App