Answered step by step

Verified Expert Solution

Question

1 Approved Answer

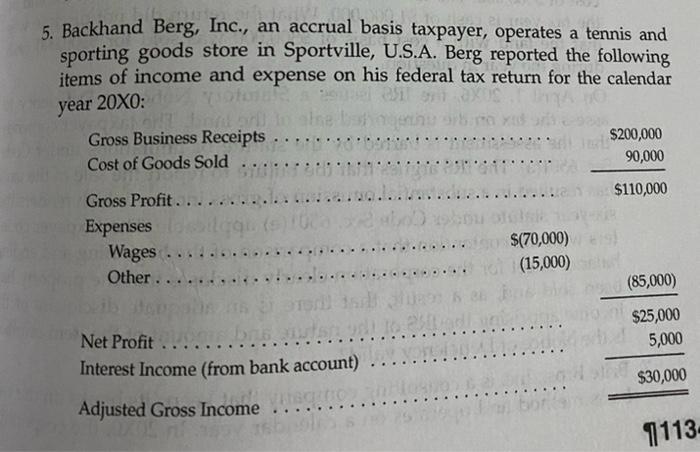

Thu 5. Backhand Berg, Inc., an accrual basis taxpayer, operates a tennis and sporting goods store in Sportville, U.S.A. Berg reported the following items

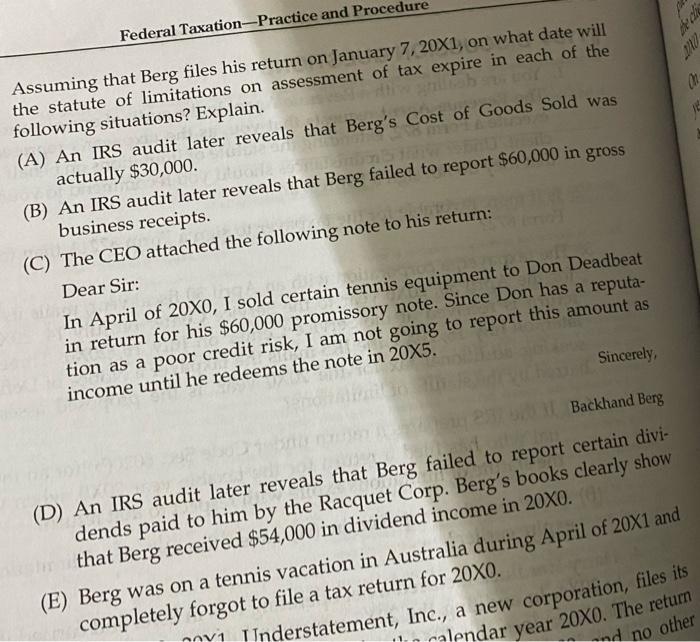

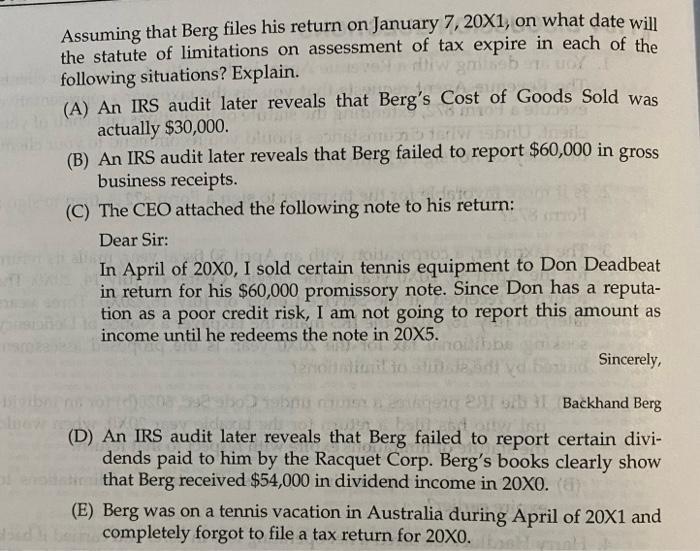

Thu 5. Backhand Berg, Inc., an accrual basis taxpayer, operates a tennis and sporting goods store in Sportville, U.S.A. Berg reported the following items of income and expense on his federal tax return for the calendar year 20X0: ysoforate. viol Lort bont Gross Business Receipts .. Cost of Goods Sold Gross Profit..... Expenses Wages..... Other. .. lagi (s)10ca od #60 gen Tell tarta Net Profit Or brs autan Interest Income (from bank account) Adjusted Gross Income Vigno xid 251-ad $200,000 90,000 $110,000 $(70,000)) (15,000) (85,000) $25,000 5,000 $30,000 1113- Federal Taxation-Practice and Procedure Assuming that Berg files his return on January 7, 20X1, on what date will the statute of limitations on assessment of tax expire in each of the following situations? Explain. (A) An IRS audit later reveals that Berg's Cost of Goods Sold was actually $30,000. (B) An IRS audit later reveals that Berg failed to report $60,000 in gross business receipts. (C) The CEO attached the following note to his return: Dear Sir: 2001 In April of 20XO, I sold certain tennis equipment to Don Deadbeat in return for his $60,000 promissory note. Since Don has a reputa- tion as a poor credit risk, I am not going to report this amount as income until he redeems the note in 20X5. Sincerely, Backhand Berg (D) An IRS audit later reveals that Berg failed to report certain divi- dends paid to him by the Racquet Corp. Berg's books clearly show ghthat Berg received $54,000 in dividend income in 20X0. (1 DONO (E) Berg was on a tennis vacation in Australia during April of 20X1 and completely forgot to file a tax return for 20X0. Inderstatement, Inc., a new corporation, files its calendar year 20X0. The return nd no other 00 Assuming that Berg files his return on January 7, 20X1, on what date will the statute of limitations on assessment of tax expire in each of the amilasb following situations? Explain. BOX (A) An IRS audit later reveals that Berg's Cost of Goods Sold was actually $30,000. (B) An IRS audit later reveals that Berg failed to report $60,000 in gross business receipts. (C) The CEO attached the following note to his return: oll Dear Sir: fil In April of 20X0, I sold certain tennis equipment to Don Deadbeat in return for his $60,000 promissory note. Since Don has a reputa- tion as a poor credit risk, I am not going to report this amount as income until he redeems the note in 20X5. bilibbe Sound Sincerely, Backhand Berg (D) An IRS audit later reveals that Berg failed to report certain divi- dends paid to him by the Racquet Corp. Berg's books clearly show that Berg received $54,000 in dividend income in 20X0. (a) (E) Berg was on a tennis vacation in Australia during April of 20X1 and completely forgot to file a tax return for 20X0. ooklyn

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer A An IRS audit later reveals that Bergs Cost of Goods Sold was actually 30000 The statute of limitations on assessment of tax would expire on J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started