Answered step by step

Verified Expert Solution

Question

1 Approved Answer

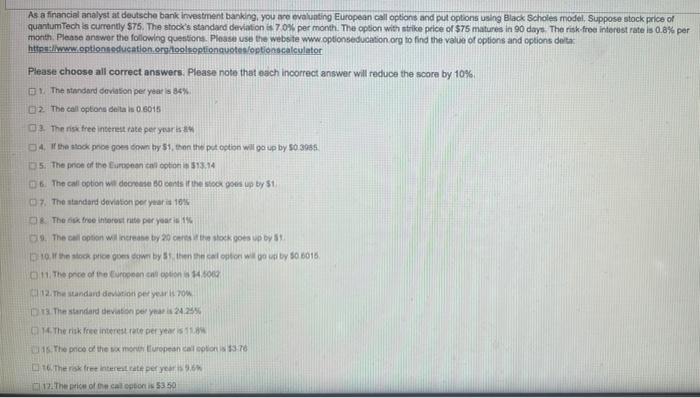

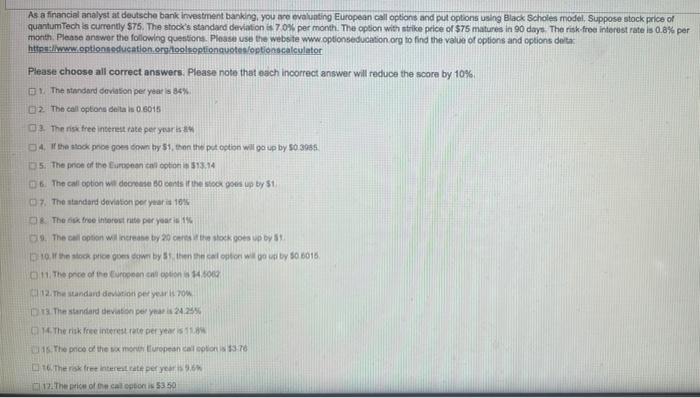

THUMBS UP IF YOU ANSWER QUICKLY & CORRECTLY AND SHOW WORK As a financial analyst at deutsche Bank Investment banking, you are evaluating European Gall

THUMBS UP IF YOU ANSWER QUICKLY & CORRECTLY AND SHOW WORK

As a financial analyst at deutsche Bank Investment banking, you are evaluating European Gall options and put options using Black Scholes model. Suppose stock price of quantum Tech is currently S75. The stock's standard deviation 70% per month. The option with strike price of $75 matures in 90 days. The risk-free interest rate is 0.8% per month. Please answer the following questions. Please use the website www.optionseducation org to find the value of options and options delta https://www.options education.org/ool optionquotes optionscalculator Please choose all correct answers. Please note that each incorrect answer will reduce the score by 10% The standard deviation per year is 84% 2. The call option detais 0 6015 03. The risk free interest rate per years 4 the stock price goes down by 51, then the pot option will go up by 50 3955 5. The price of the European calotion 593.14 6. The call option in decrease on the six ou up by 51 7. The standard deviation per year 10% The free interest rate per year 1% C. The call option will increase by 20 the stock goes up by 10. If the stock price gom by 5 then the call option will you by 50 6015 11. The price of the European calotion 146000 12. The standard deviation per years now 13. The standard deviation per year is 24.29% The risk free interest rate per year 118 1. The price of the money repean callcolo 1378 The risk free interest rate per year 12. The price of a cal option is 5350 As a financial analyst at deutsche Bank Investment banking, you are evaluating European Gall options and put options using Black Scholes model. Suppose stock price of quantum Tech is currently S75. The stock's standard deviation 70% per month. The option with strike price of $75 matures in 90 days. The risk-free interest rate is 0.8% per month. Please answer the following questions. Please use the website www.optionseducation org to find the value of options and options delta https://www.options education.org/ool optionquotes optionscalculator Please choose all correct answers. Please note that each incorrect answer will reduce the score by 10% The standard deviation per year is 84% 2. The call option detais 0 6015 03. The risk free interest rate per years 4 the stock price goes down by 51, then the pot option will go up by 50 3955 5. The price of the European calotion 593.14 6. The call option in decrease on the six ou up by 51 7. The standard deviation per year 10% The free interest rate per year 1% C. The call option will increase by 20 the stock goes up by 10. If the stock price gom by 5 then the call option will you by 50 6015 11. The price of the European calotion 146000 12. The standard deviation per years now 13. The standard deviation per year is 24.29% The risk free interest rate per year 118 1. The price of the money repean callcolo 1378 The risk free interest rate per year 12. The price of a cal option is 5350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started