Answered step by step

Verified Expert Solution

Question

1 Approved Answer

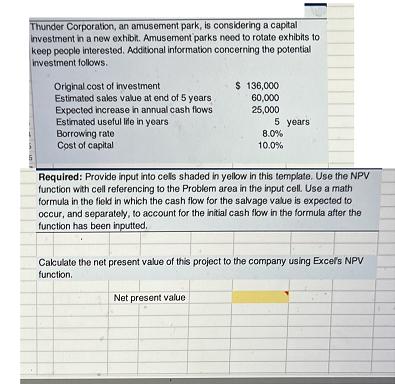

Thunder Corporation, an amusement park, is considering a capital Investment in a new exhibt. Amusement parks need to rotate exhibits to keep people interested.

Thunder Corporation, an amusement park, is considering a capital Investment in a new exhibt. Amusement parks need to rotate exhibits to keep people interested. Additional information concerning the potential investment follows. Original cost of investment Estimated sales value at end of 5 years Expected increase in annual cash flows Estimated useful life in years Borrowing rate Cost of capital $ 136,000 60,000 25,000 5 years 8.0% 10.0% Required: Provide input into cells shaded in yellow in this template. Use the NPV function with cell referencing to the Problem area in the input cell. Use a math formula in the fiekd in which the cash flow for the salvage value is expected to occur, and separately, to account for the initial cash flow in the formula after the function has been inputted. Cakulate the net present value of this project to the company using Excels NPV function. Net present value

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started