Question

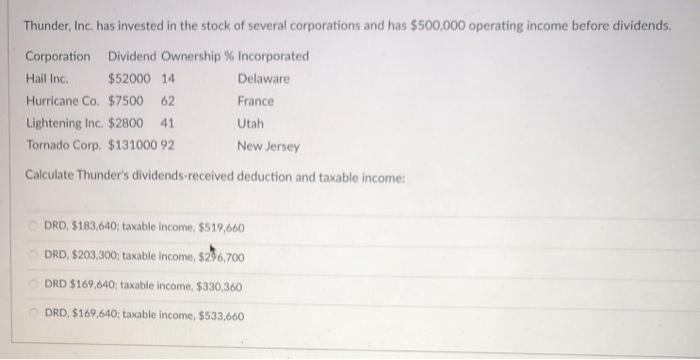

Thunder, Inc. has invested in the stock of several corporations and has $500,000 operating income before dividends. Corporation Dividend Ownership % Incorporated Hail Inc.

Thunder, Inc. has invested in the stock of several corporations and has $500,000 operating income before dividends. Corporation Dividend Ownership % Incorporated Hail Inc. $52000 14 Delaware Hurricane Co. $7500 62 France Lightening Inc. $2800 41 Utah Tornado Corp. $131000 92 New Jersey Calculate Thunder's dividends-received deduction and taxable income: DRD, $183,640; taxable income, $519,660 DRD, $203,300; taxable income, $296,700 DRD $169,640; taxable income, $330,360 DRD, $169,640; taxable income, $533,660

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

is the 1007 x13000 First calculate the 100 of dividend received deduction DRD The allowable de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Auditing and Other Assurance Services

Authors: Ray Whittington, Kurt Pany

19th edition

978-0077804770, 78025613, 77804775, 978-0078025617

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App