Answered step by step

Verified Expert Solution

Question

1 Approved Answer

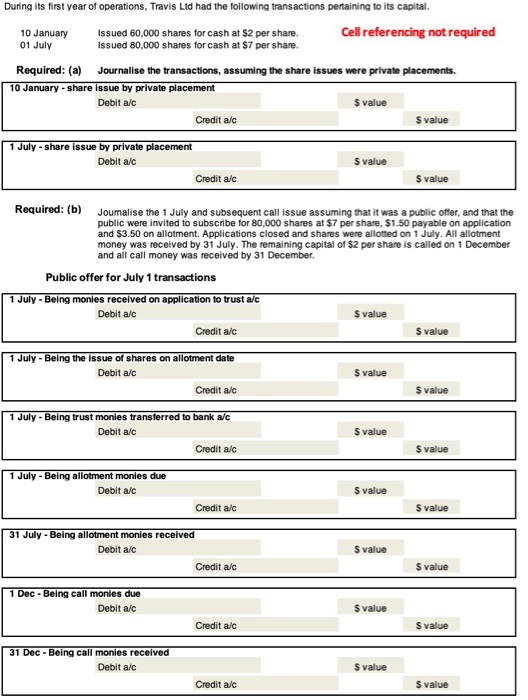

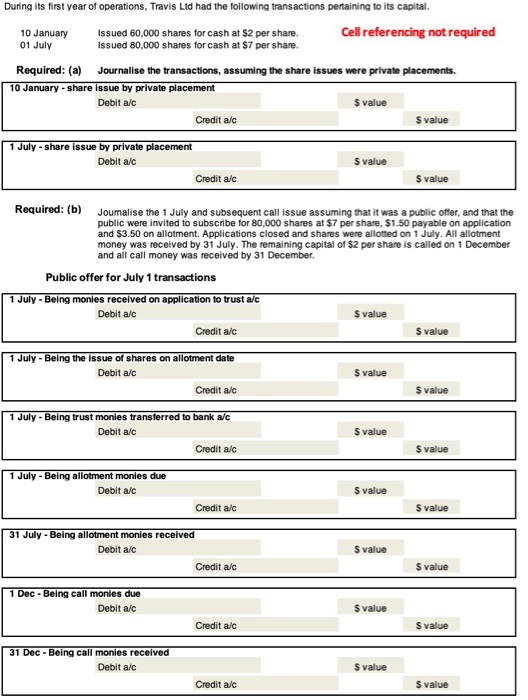

Thx! During its first year of operations, Travis Ltd had the following transactions pertaining to its capital. Cell referencing not required Issued 60,000 shares for

Thx!

During its first year of operations, Travis Ltd had the following transactions pertaining to its capital. Cell referencing not required Issued 60,000 shares for cash at $2 per share. Issued 80,000 shares for cash at $7 per share. 01 July Required: (a) Journalise the transactions, assuming the share issues were private placements. 10 share i by private placement Debit a/c S value Credit a/c $ value 1 July - share issue by private placement Debit a/c S value Credit a/c S value Required: (b) Joumalise the 1 July and subsequent call issue assuming that it was a public offler, and that the public were invited to subscribe for 80,000 shares at $7 per share, $1.50 payable on application and $3.50 on allotment. Applications closed and shares were allotted on 1 July. All allotment money was received by 31 July. The remaining capital of $2 per share is called on 1 December and all call money was received by 31 December. Public offer for July 1 transactions monies received on application to trust a/c Debit a/c $ value Credit a/ S value the issue of shares on allotment date Debit a/c S value Credit a/c S value trust monies transterred to bank Debit a/c S value Credit a/c S value Being allotment monies due Debit akc S value Credit a/c S value 31 July Being allotment monies received Debit a/c S value Credit a/c S value Being call monies due Debit a S value Credit a/c S value 31 Being call monies received Debit a/c S value Credit ac S value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started