Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TIAA Inc. is considering a capital expansion project. The initial investment of undertaking this project is $343,008. This expansion project will last for five

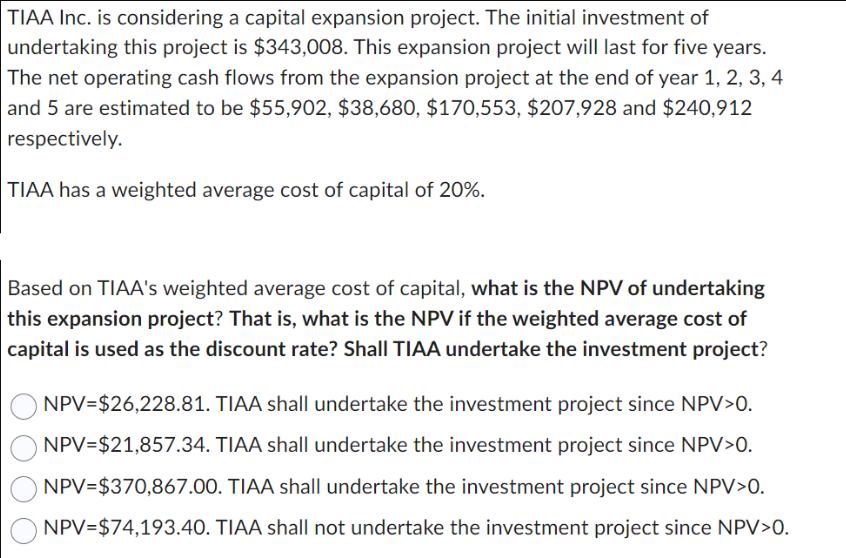

TIAA Inc. is considering a capital expansion project. The initial investment of undertaking this project is $343,008. This expansion project will last for five years. The net operating cash flows from the expansion project at the end of year 1, 2, 3, 4 and 5 are estimated to be $55,902, $38,680, $170,553, $207,928 and $240,912 respectively. TIAA has a weighted average cost of capital of 20%. Based on TIAA's weighted average cost of capital, what is the NPV of undertaking this expansion project? That is, what is the NPV if the weighted average cost of capital is used as the discount rate? Shall TIAA undertake the investment project? NPV=$26,228.81. TIAA shall undertake the investment project since NPV>0. NPV=$21,857.34. TIAA shall undertake the investment project since NPV>0. NPV=$370,867.00. TIAA shall undertake the investment project since NPV>0. NPV=$74,193.40. TIAA shall not undertake the investment project since NPV>0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To find the NPV Net Present Value of the investment we will discount the future cash flows back to the present value using the formula for NPV NPV Cash Flow at time t 1 rt Initial Investment Where Cash Flow at time t is the net operating cash flow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started