Question

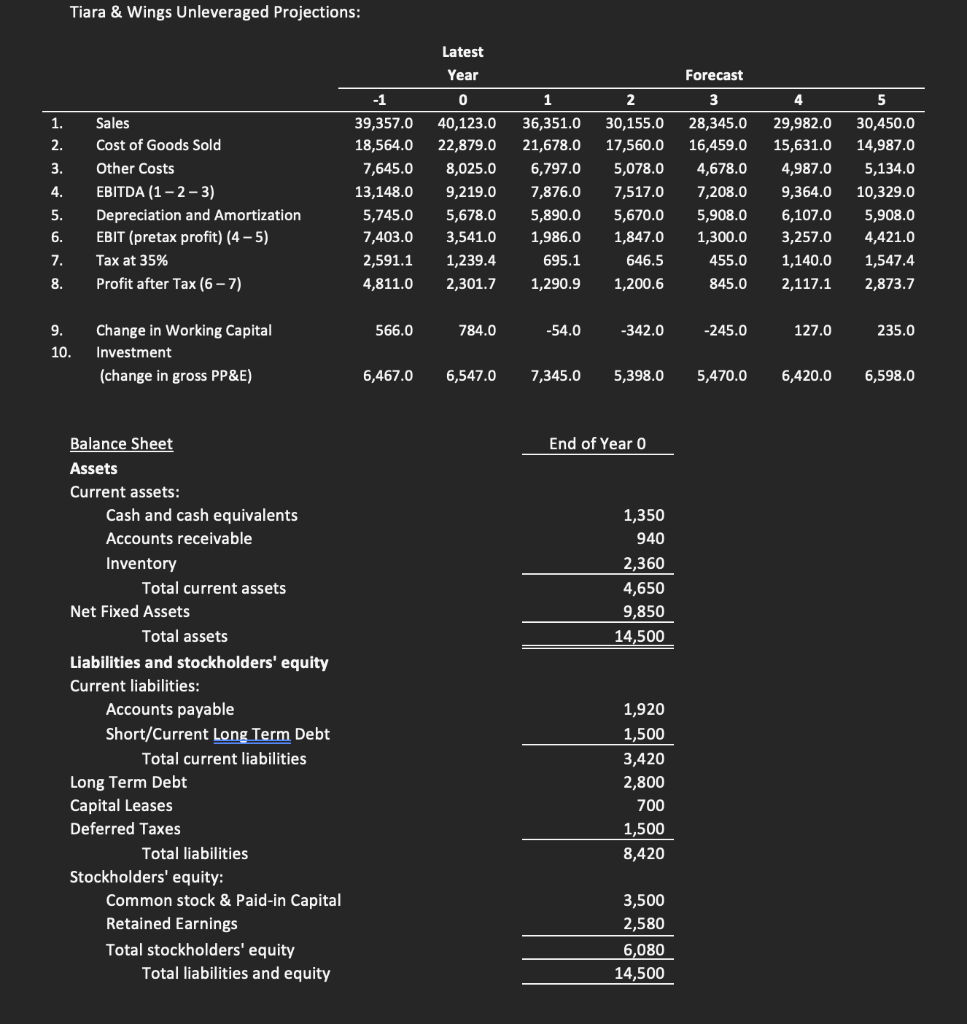

Tiara Wings Ltd is a firm that makes princess tiaras and chicken wings. The firm has projected its future growth in the table below. The

Tiara Wings Ltd is a firm that makes princess tiaras and chicken wings. The firm has projected its future growth in the table below. The firm has a required Return on Equity of 14.9%. The long-run growth rate after year 5 is 4%. The firms cost of debt is 5.55% and there are 865,000 shares of common stock outstanding that are trading at $16.77. The accounting statement is in thousands of dollars on the following pages. Assuming that the projections are correct and that there are no asset sales other than those at book value, compute the stock price per share using:

a) the WACC/FCF method

b) the Flow-to-Equity method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started