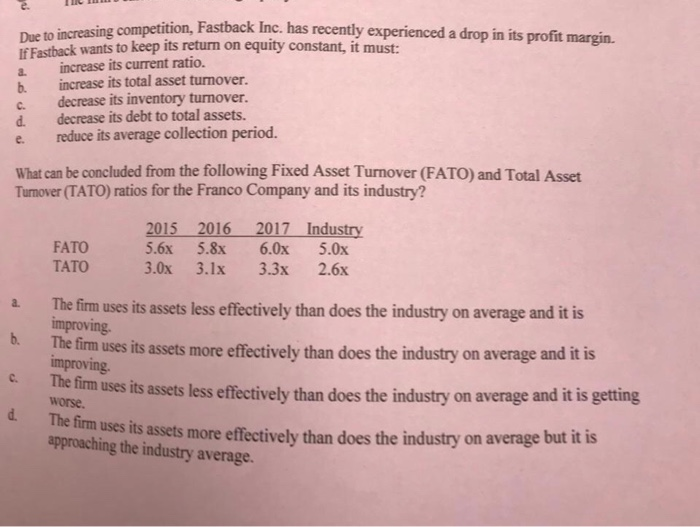

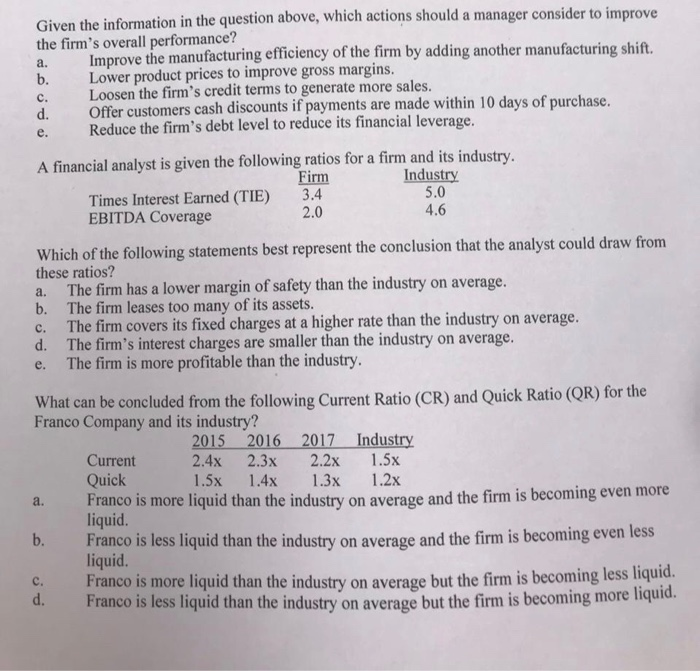

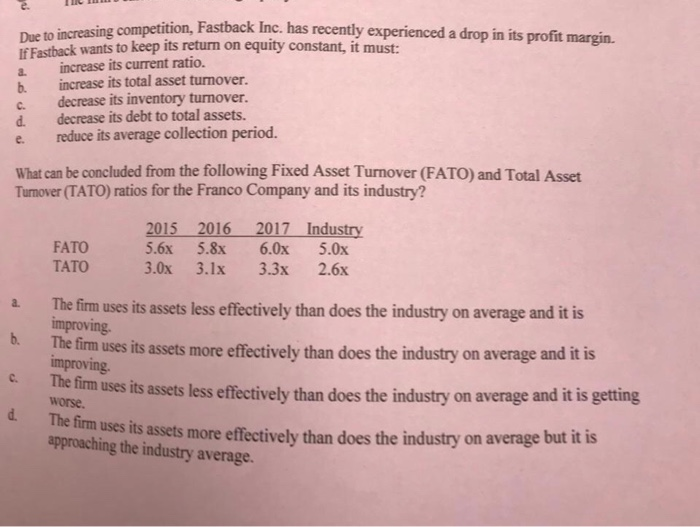

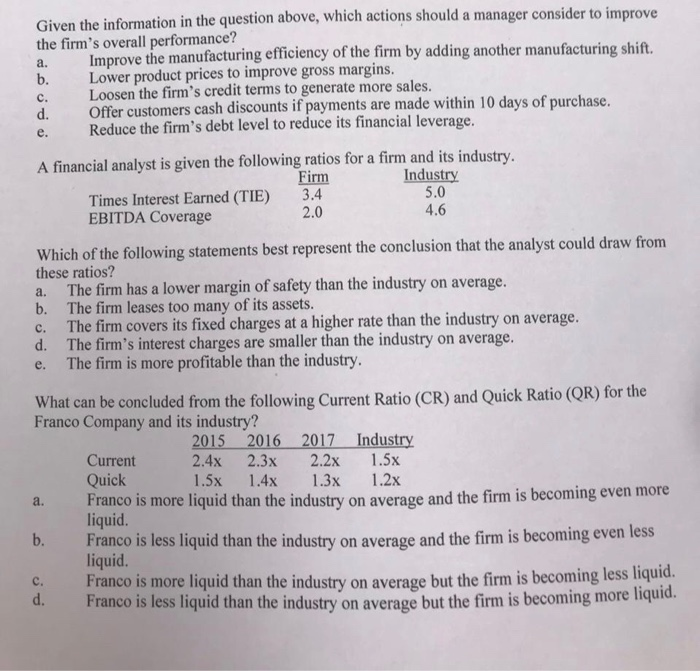

TIC Due to increasing competition, Fastback Inc e competition, Fastback Inc. has recently experienced a drop in its profit margin. If Fastback wants to keep its return on equity constant, it must: increase its current ratio. increase its total asset turnover. decrease its inventory turnover. decrease its debt to total assets. reduce its average collection period. What can be concluded from the following Fixed Asset Turnover (FATO) and Total Asset Turnover (TATO) ratios for the Franco Company and its industry? FATO TATO 2015 5.6x 3.0x 2016 5.8x 3.1x 2017 6.0x 3.3x Industry 5.0x 2.6x a. b. The firm uses its assets less effectively than does the industry on average and it is improving. The firm uses its assets more effectively than does the industry on average and it is improving. ne hirm uses its assets less effectively than does the industry on average and it is getting worse. s assets more effectively than does the industry on average but it is The firm uses its assets more effectively than approaching the industry average. Given the information in the question above, which actions should a manager consider to improve the firm's overall performance? Improve the manufacturing efficiency of the firm by adding another manufacturing shift. Lower product prices to improve gross margins. Loosen the firm's credit terms to generate more sales. Offer customers cash discounts if payments are made within 10 days of purchase. Reduce the firm's debt level to reduce its financial leverage. A financial analyst is given the following ratios for a firm and its industry. Firm Industry Times Interest Earned (TIE) 3.4 5.0 EBITDA Coverage 2.0 4.6 Which of the following statements best represent the conclusion that the analyst could draw from these ratios? a. The firm has a lower margin of safety than the industry on average. b. The firm leases too many of its assets. c. The firm covers its fixed charges at a higher rate than the industry on average. d. The firm's interest charges are smaller than the industry on average. e. The firm is more profitable than the industry. What can be concluded from the following Current Ratio (CR) and Quick Ratio (QR) for the Franco Company and its industry? 2015 2016 2017 Industry Current 2.4x 2.3x 2.2x 1.5x Quick 1.5x 1.4x 1.3x 1.2x Franco is more liquid than the industry on average and the firm is becoming even more liquid Franco is less liquid than the industry on average and the firm is becoming even less liquid. Franco is more liquid than the industry on average but the firm is becoming less liquid. Franco is less liquid than the industry on average but the firm is becoming more liquid