Question

Tiger Insurance Company, Inc., a life insurance company located in the United States, maintains a stock and bond portfolio and also invests in all four

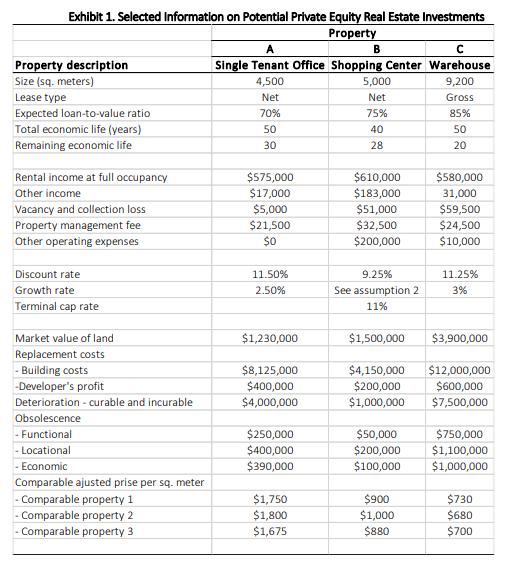

Tiger Insurance Company, Inc., a life insurance company located in the United States, maintains a stock and bond portfolio and also invests in all four quadrants of the real estate market; private equity, public equity, private debt, and public debt. Each of the four real estate quadrants has a manager assigned to it. Tiger intendsto increase its allocation to real estate. The Chief Investment Officer (CIO) has scheduled a meeting with the four real estate managers to discuss the allocation to real estate and to each real estate quadrant. Julia Conley, who manages the private equity quadrant, believes her quadrant offers the greatest potential and has identified three investment properties to consider for acquisition. Selected information for the three properties is presented in Exhibit 1.

To prepare for the upcoming meeting, Conley has asked her research analyst, John Reese, for a valuation of each of these properties under the income, cost and sales comparison approaches using the information provided in Exhibit 1, and the following two assumptions: Assumption 1: The holding period for each property is expected to be five years. Assumption 2: Property B is expected to have the same net operating income for the holding period due to existing leases, and a one-time 25% increase in year 6 due to lease rollovers. No further growth is assumed thereafter.

In reviewing Exhibit 1, Conley notes the disproportionate estimated obsolescence charges for Property C relative to the other properties and asks Reese to verify the reasonableness of these estimates. Epstein also reminds Reese that they will need to conduct proper due diligence. In that regard, Conley indicates that she is concerned whether a covered parking lot that was added to Property A is partially located on adjoining properties. Conley would like for Reese to identify an expert and present documentation to address her concerns regarding the parking lot. In addition to discussing the new allocation, the CIO informs Conley that he wants to discuss the appropriate real estate index for the private equity real estate quadrant at the upcoming meeting. The CIO believes that the current index may result in over-allocating resources to the private equity real estate quadrant.

Questions:

1. Find the value of Property C using the direct capitalization method.

2. Based upon Assumptions 1 and 2, find the value of Property B using the discounted cash flow method, assuming a five-year holding period.

3. Find the value of Property A using the cost approach.

4. Find the value of Property B using the sales comparison approach.

5. What justification could Conley present for directing the increased allocation to her quadrant, instead of other quadrants?

6. Which of the properties in Exhibit 1 exposes the owner to the greatest risk related to operating expenses? Explain.

7. Which property in Exhibit 1 is most likely to be affected by import and export activity? Explain.

8. Which property in Exhibit 1 would most likely require the greatest amount of active management? Explain

Exhibit 1. Selected Information on Potential Private Equity Real Estate Investments Property Property description Size (sq. meters) Lease type Expected loan-to-value ratio Total economic life (years) Remaining economic life Rental income at full occupancy Other income Vacancy and collection loss Property management fee Other operating expenses Discount rate Growth rate Terminal cap rate Market value of land Replacement costs - Building costs -Developer's profit Deterioration - curable and incurable Obsolescence -Functional - Locational - Economic Comparable ajusted prise per sq. meter - Comparable property 1 Comparable property 2 Comparable property 3 A C Single Tenant Office Shopping Center Warehouse 4,500 Net 70% 50 30 $575,000 $17,000 $5,000 $21,500 $0 11.50% 2.50% $1,230,000 $8,125,000 $400,000 $4,000,000 $250,000 $400,000 $390,000 $1,750 $1,800 $1,675 B 5,000 Net 75% 40 28 $610,000 $183,000 $51,000 $32,500 $200,000 9.25% See assumption 2 11% 9,200 Gross 85% 50 20 $580,000 31,000 $59,500 $24,500 $10,000 $900 $1,000 $880 11.25% 3% $1,500,000 $3,900,000 $4,150,000 $12,000,000 $200,000 $600,000 $1,000,000 $7,500,000 $50,000 $750,000 $200,000 $1,100,000 $100,000 $1,000,000 $730 $680 $700

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 The value of Property C using the direct capitalization method can be found by dividing the propertys net operating income by its capitalization rate The capitalization rate is the percentage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started