Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tikon Manufacturing began Operations on January 1 2018. The following fixed assets have been acquired over the years. The below cost and related expenditure

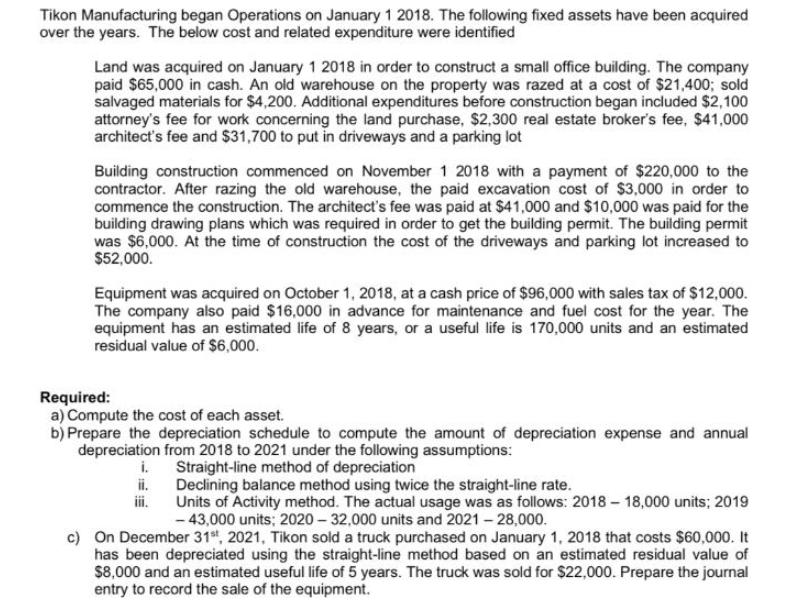

Tikon Manufacturing began Operations on January 1 2018. The following fixed assets have been acquired over the years. The below cost and related expenditure were identified Land was acquired on January 1 2018 in order to construct a small office building. The company paid $65,000 in cash. An old warehouse on the property was razed at a cost of $21,400; sold salvaged materials for $4,200. Additional expenditures before construction began included $2,100 attorney's fee for work concerning the land purchase, $2,300 real estate broker's fee, $41,000 architect's fee and $31,700 to put in driveways and a parking lot Building construction commenced on November 1 2018 with a payment of $220,000 to the contractor. After razing the old warehouse, the paid excavation cost of $3,000 in order to commence the construction. The architect's fee was paid at $41,000 and $10,000 was paid for the building drawing plans which was required in order to get the building permit. The building permit was $6,000. At the time of construction the cost of the driveways and parking lot increased to $52,000. Equipment was acquired on October 1, 2018, at a cash price of $96,000 with sales tax of $12,000. The company also paid $16,000 in advance for maintenance and fuel cost for the year. The equipment has an estimated life of 8 years, or a useful life is 170,000 units and an estimated residual value of $6,000. Required: a) Compute the cost of each asset. b) Prepare the depreciation schedule to compute the amount of depreciation expense and annual depreciation from 2018 to 2021 under the following assumptions: Straight-line method of depreciation Declining balance method using twice the straight-line rate. Units of Activity method. The actual usage was as follows: 2018 - 18,000 units; 2019 - 43,000 units; 2020 32.000 units and 2021 - 28,000. i. c) On December 31", 2021, Tikon sold a truck purchased on January 1, 2018 that costs $60,000. It has been depreciated using the straight-line method based on an estimated residual value of $8,000 and an estimated useful life of 5 years. The truck was sold for $22,000. Prepare the journal entry to record the sale of the equipment.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution This is in reference to IAS 16 An item of property plant and equipment should initially be recorded at cost IAS 1615 Cost includes all costs necessary to bring the asset to working condition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started