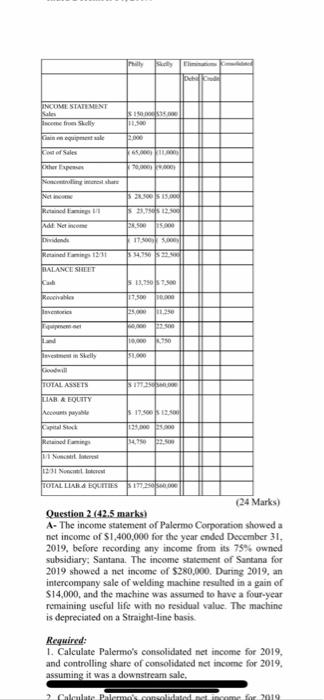

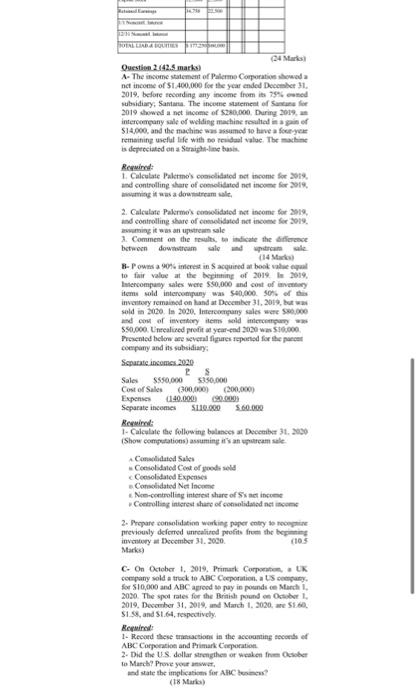

Tilly 1 INOUSEE STATEMENT SI 11.00 K. 20 entire interesthas 2000 15.000 Retained 2012 Ad New PS 17 Didende Reading 1201 BALANCE SHEET 51.250.00 Rech 12.30 Land 1.750 levels S. TOTAL ASSEIN 17.250 TIAR A EQUITY Acopy s 17.500.00 13.00 Rama 114.50 2.5 1 1231 Not TOTAL LIAR TIS S172,250.00 (24 Marks) Question 2 (42.5 marks A- The income statement of Palermo Corporation showed a nct income of $1,400,000 for the year ended December 31. 2019, before recording any income from its 75% owned subsidiary: Santana. The income statement of Santana for 2019 showed a net income of $280,000. During 2019, an intercompany sale of welding machine resulted in a gain of $14,000, and the machine was assumed to have a four-year remaining useful life with no residual value. The machine is depreciated on a Straight-line basis Required: 1. Calculate Palermo's consolidated net income for 2019, and controlling share of consolidated net income for 2019, assuming it was a downstream sale. Calculate Palemmascared for 2019 TOTAL LIABOUT THE 4 Mars Osestion 2 42.5 marks A- The income statement of Palermo Corporation showed net income of $1.400.000 for the year ended December 31. 2019. before recording any income from its 79% cened subsidiary, Santare. The income statement of Stone 2019 showed a net income of $280,000. During 2009 intercompany sale of welding machine resulted in an of $14,000, and the machine was assumed to have a four year remaining useful life with no residual value. The machine is deprecated on a Straight-line basis Reywined: 1. Calculate Palermo's consolidated net income for 2019 and controlling share of consolidated net income for 2018 wwwing it was a downstream at 2. Calculate Palermo colidated net income for 2019, and controlling share of comidatod niet income for 2019 wing it was an upstren sale Comment on the results to indicate the difference between downstrum und we (14 Mar -Pows a 90% in acquired at book acqua to fair value at the beginning of 2019 2019, Intercomputy sales were $50,000 and cost of the items sold intercompany was $40,000. 50% of Inventory remained on hand at December 31, 2019, but was sold in 2020. In 2020. Intercompany sales wees and cost of inventory items sold interce 550.000. Unrealed profit at year-end 2000 was 550.000 Presented below are several flores reported for the part company and its subsidiary: Separate incomes.2020 LS Sales S550.000 $350.000 Cost of Sales (200,000) 200.000 Expenses 40.000 90.000 Separate income 10.000 5.60.000 Reinet 1- Calculate the following balances at December 31, 2030 (Show computations, assuming it's an upstram sale Comalidated Sales Consolidated Cost of goods sold Consolidated Expenses Comolidated Net Income Ne-controlling interest share of Sx et income Controlling interest share of comelidated set income 2. Prepare consolidation working paper try to reorgie previously deferred unrealed profits from the began in December 31, 2000 Marks) c. On October 1, 2019. Primark Corp.UK company sold a track to ABC Corporation, a S. for 510,000 and ABC agreed to pay in poundice Marchi 2020. The spot rates for the British pound on October 1, 2019. December 31, 2019, and March 1, 2020 e 160 SIS, and $164respectively Reginal 1. Record these transactions in the accounting records of ABC Corporation and Primark Corporation 2. Did the US dollar strengthen or weaken from October to March? Prove your answer und state the implications for ABC bus? (18 Mario) Tilly 1 INOUSEE STATEMENT SI 11.00 K. 20 entire interesthas 2000 15.000 Retained 2012 Ad New PS 17 Didende Reading 1201 BALANCE SHEET 51.250.00 Rech 12.30 Land 1.750 levels S. TOTAL ASSEIN 17.250 TIAR A EQUITY Acopy s 17.500.00 13.00 Rama 114.50 2.5 1 1231 Not TOTAL LIAR TIS S172,250.00 (24 Marks) Question 2 (42.5 marks A- The income statement of Palermo Corporation showed a nct income of $1,400,000 for the year ended December 31. 2019, before recording any income from its 75% owned subsidiary: Santana. The income statement of Santana for 2019 showed a net income of $280,000. During 2019, an intercompany sale of welding machine resulted in a gain of $14,000, and the machine was assumed to have a four-year remaining useful life with no residual value. The machine is depreciated on a Straight-line basis Required: 1. Calculate Palermo's consolidated net income for 2019, and controlling share of consolidated net income for 2019, assuming it was a downstream sale. Calculate Palemmascared for 2019 TOTAL LIABOUT THE 4 Mars Osestion 2 42.5 marks A- The income statement of Palermo Corporation showed net income of $1.400.000 for the year ended December 31. 2019. before recording any income from its 79% cened subsidiary, Santare. The income statement of Stone 2019 showed a net income of $280,000. During 2009 intercompany sale of welding machine resulted in an of $14,000, and the machine was assumed to have a four year remaining useful life with no residual value. The machine is deprecated on a Straight-line basis Reywined: 1. Calculate Palermo's consolidated net income for 2019 and controlling share of consolidated net income for 2018 wwwing it was a downstream at 2. Calculate Palermo colidated net income for 2019, and controlling share of comidatod niet income for 2019 wing it was an upstren sale Comment on the results to indicate the difference between downstrum und we (14 Mar -Pows a 90% in acquired at book acqua to fair value at the beginning of 2019 2019, Intercomputy sales were $50,000 and cost of the items sold intercompany was $40,000. 50% of Inventory remained on hand at December 31, 2019, but was sold in 2020. In 2020. Intercompany sales wees and cost of inventory items sold interce 550.000. Unrealed profit at year-end 2000 was 550.000 Presented below are several flores reported for the part company and its subsidiary: Separate incomes.2020 LS Sales S550.000 $350.000 Cost of Sales (200,000) 200.000 Expenses 40.000 90.000 Separate income 10.000 5.60.000 Reinet 1- Calculate the following balances at December 31, 2030 (Show computations, assuming it's an upstram sale Comalidated Sales Consolidated Cost of goods sold Consolidated Expenses Comolidated Net Income Ne-controlling interest share of Sx et income Controlling interest share of comelidated set income 2. Prepare consolidation working paper try to reorgie previously deferred unrealed profits from the began in December 31, 2000 Marks) c. On October 1, 2019. Primark Corp.UK company sold a track to ABC Corporation, a S. for 510,000 and ABC agreed to pay in poundice Marchi 2020. The spot rates for the British pound on October 1, 2019. December 31, 2019, and March 1, 2020 e 160 SIS, and $164respectively Reginal 1. Record these transactions in the accounting records of ABC Corporation and Primark Corporation 2. Did the US dollar strengthen or weaken from October to March? Prove your answer und state the implications for ABC bus? (18 Mario)