Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tilly's Tiles and Bathroom Fittings is an established company that has been in operation for a number of years. They have just reached the

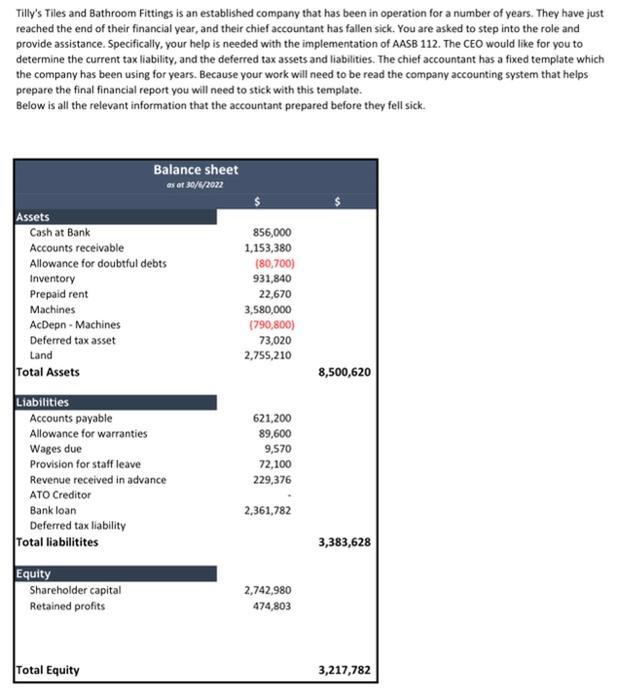

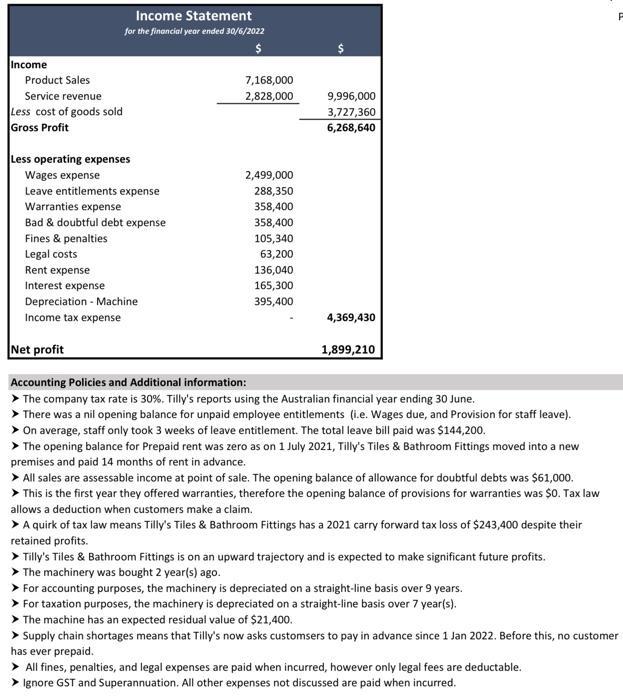

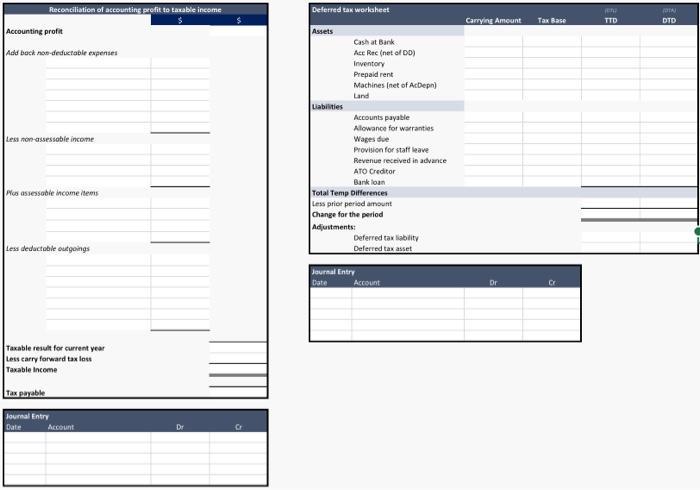

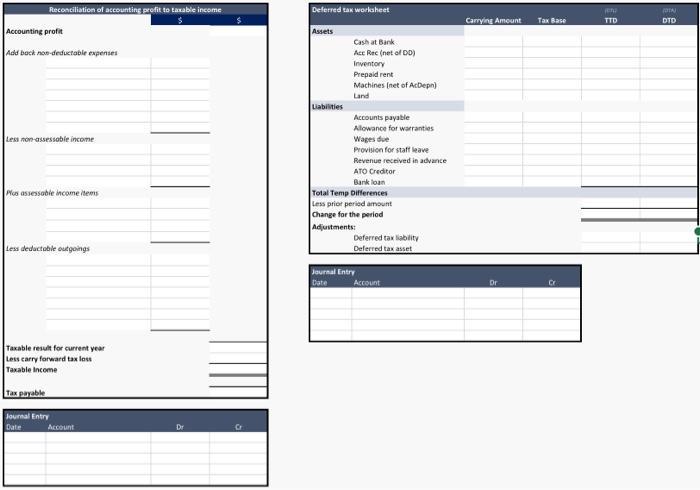

Tilly's Tiles and Bathroom Fittings is an established company that has been in operation for a number of years. They have just reached the end of their financial year, and their chief accountant has fallen sick. You are asked to step into the role and provide assistance. Specifically, your help is needed with the implementation of AASB 112. The CEO would like for you to determine the current tax liability, and the deferred tax assets and liabilities. The chief accountant has a fixed template which the company has been using for years. Because your work will need to be read the company accounting system that helps prepare the final financial report you will need to stick with this template. Below is all the relevant information that the accountant prepared before they fell sick. Assets Cash at Bank Accounts receivable Allowance for doubtful debts Inventory Prepaid rent Machines AcDepn - Machines Deferred tax asset Land Total Assets Liabilities Accounts payable Allowance for warranties Wages due Provision for staff leave Revenue received in advance ATO Creditor Bank loan Deferred tax liability Total liabilitites Equity Balance sheet as at 30/6/2022 Shareholder capital Retained profits Total Equity 856,000 1,153,380 (80,700) 931,840 22,670 3,580,000 (790,800) 73,020 2,755,210 621,200 89,600 9,570 72,100 229,376 2,361,782 2,742,980 474,803 8,500,620 3,383,628 3,217,782 Income Product Sales Service revenue Less cost of goods sold Gross Profit Income Statement for the financial year ended 30/6/2022 $ Less operating expenses Wages expense Leave entitlements expense Warranties expense Bad & doubtful debt expense Fines & penalties Legal costs Rent expense Interest expense Depreciation - Machine Income tax expense Net profit 7,168,000 2,828,000 2,499,000 288,350 358,400 358,400 105,340 63,200 136,040 165,300 395,400 9,996,000 3,727,360 6,268,640 4,369,430 1,899,210 Accounting Policies and Additional information: The company tax rate is 30%. Tilly's reports using the Australian financial year ending 30 June. > There was a nil opening balance for unpaid employee entitlements (i.e. Wages due, and Provision for staff leave). On average, staff only took 3 weeks of leave entitlement. The total leave bill paid was $144,200. > The opening balance for Prepaid rent was zero as on 1 July 2021, Tilly's Tiles & Bathroom Fittings moved into a new premises and paid 14 months of rent in advance. All sales are assessable income at point of sale. The opening balance of allowance for doubtful debts was $61,000. This is the first year they offered warranties, therefore the opening balance of provisions for warranties was $0. Tax law allows a deduction when customers make a claim. > A quirk of tax law means Tilly's Tiles & Bathroom Fittings has a 2021 carry forward tax loss of $243,400 despite their retained profits. > Tilly's Tiles & Bathroom Fittings is on an upward trajectory and is expected to make significant future profits. > The machinery was bought 2 year(s) ago. For accounting purposes, the machinery is depreciated on a straight-line basis over 9 years. For taxation purposes, the machinery is depreciated on a straight-line basis over 7 year(s). The machine has an expected residual value of $21,400. F Supply chain shortages means that Tilly's now asks customsers to pay in advance since 1 Jan 2022. Before this, no customer has ever prepaid. > All fines, penalties, and legal expenses are paid when incurred, however only legal fees are deductable. Ignore GST and Superannuation. All other expenses not discussed are paid when incurred. Reconciliation of accounting profit to taxable income Accounting profit Add back non-deductable expenses Less non-assessable income Plus assessable income items Less dedactable outgoings Taxable result for current year Less carry forward tax loss Taxable Income Tax payable Journal Entry Date Account Dr $ Deferred tax worksheet Assets Liabilities Cash at Bank Acc Rec (net of DD) Inventory Prepaid rent Machines (net of AcDepn) Land Accounts payable Allowance for warranties Wages due Provision for staff leave Revenue received in advance ATO Creditor Bank loan Total Temp Differences Less prior period amount Change for the period Adjustments: Deferred tax liability Deferred tax asset Journal Entry Date Account Carrying Amount Dr Tax Base TTD POTA DTD Reconciliation of accounting profit to taxable income Accounting profit Add back non-deductable expenses Less non-assessable income Plus assessable income items Less dedactable outgoings Taxable result for current year Less carry forward tax loss Taxable Income Tax payable Journal Entry Date Account Dr $ Deferred tax worksheet Assets Liabilities Cash at Bank Acc Rec (net of DD) Inventory Prepaid rent Machines (net of AcDepn) Land Accounts payable Allowance for warranties Wages due Provision for staff leave Revenue received in advance ATO Creditor Bank loan Total Temp Differences Less prior period amount Change for the period Adjustments: Deferred tax liability Deferred tax asset Journal Entry Date Account Carrying Amount Dr Tax Base TTD POTA DTD

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Date Account l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started