Question: Tim and Jill Taylor are retiring this year! Tim has worked for a utility company since his co-op job in college and has participated in

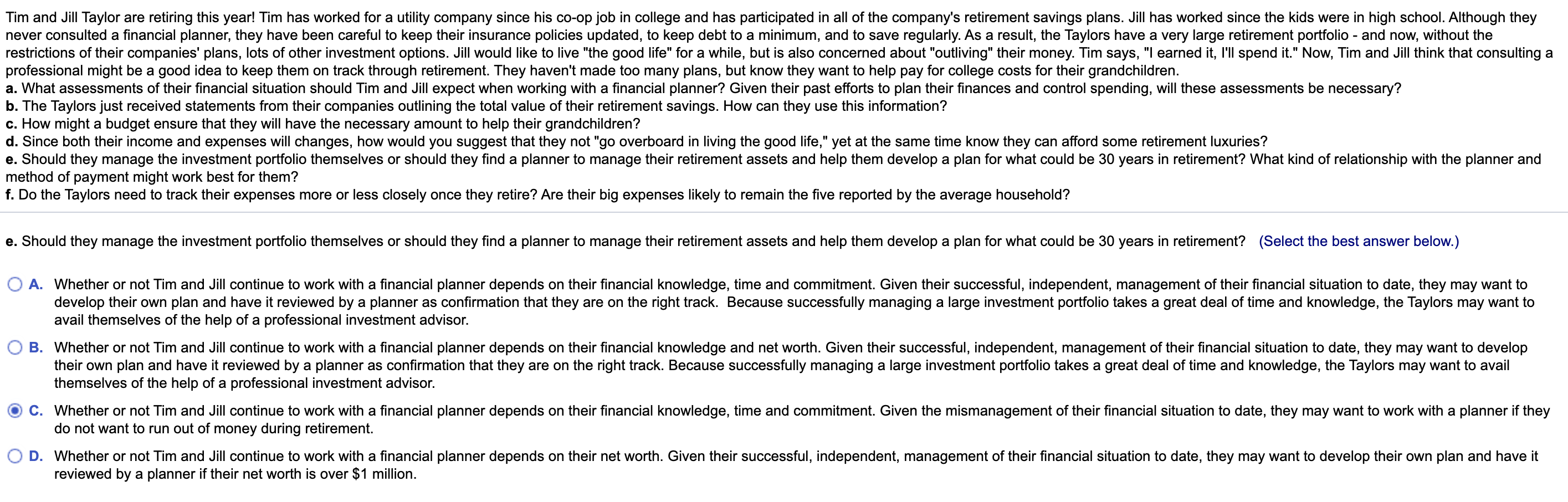

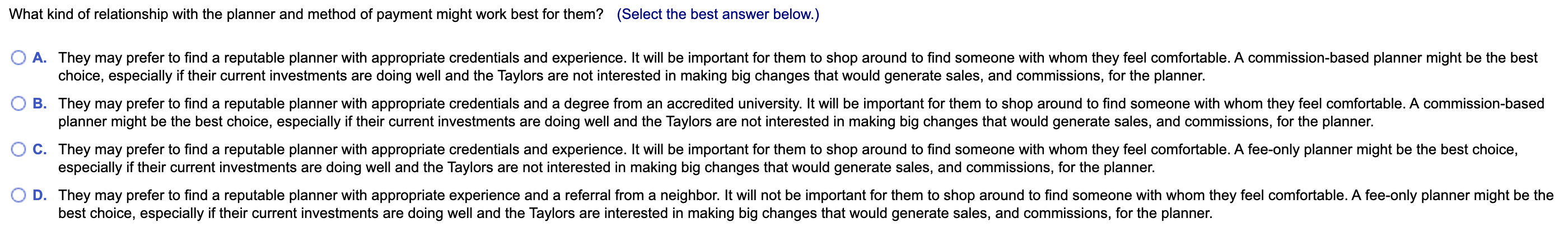

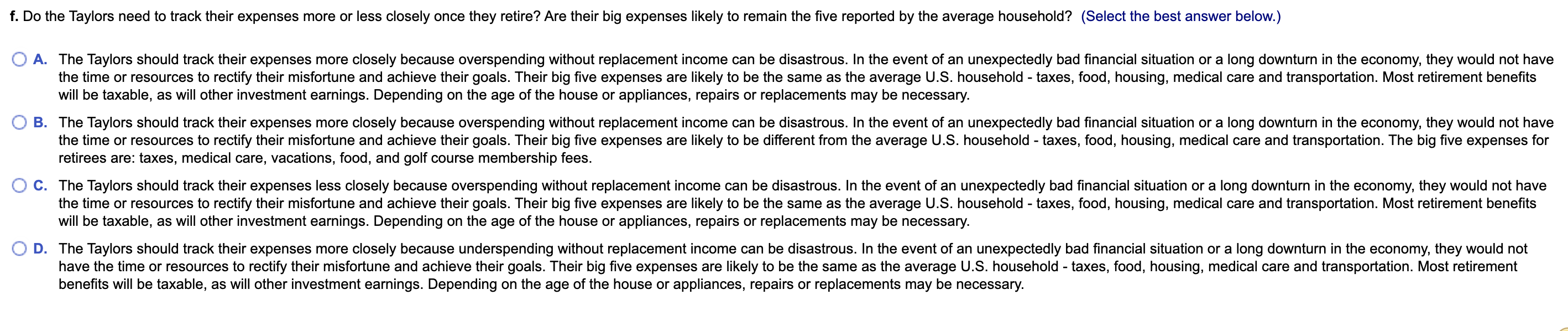

Tim and Jill Taylor are retiring this year! Tim has worked for a utility company since his co-op job in college and has participated in all of the company's retirement savings plans. Jill has worked since the kids were in high school. Although they never consulted a financial planner, they have been careful to keep their insurance policies updated, to keep debt to a minimum, and to save regularly. As a result, the Taylors have a very large retirement portfolio - and now, without the restrictions of their companies' plans, lots of other investment options. Jill would like to live "the good life" for a while, but is also concerned about "outliving" their money. Tim says, "I earned it, I'll spend it." Now, Tim and Jill think that consulting a professional might be a good idea to keep them on track through retirement. They haven't made too many plans, but know they want to help pay for college costs for their grandchildren. a. What assessments of their financial situation should Tim and Jill expect when working with a financial planner? Given their past efforts to plan their finances and control spending, will these assessments be necessary? b. The Taylors just received statements from their companies outlining the total value of their retirement savings. How can they use this information? c. How might a budget ensure that they will have the necessary amount to help their grandchildren? d. Since both their income and expenses will changes, how would you suggest that they not "go overboard in living the good life," yet at the same time know they can afford some retirement luxuries? e. Should they manage the investment portfolio themselves or should they find a planner to manage their retirement assets and help them develop a plan for what could be 30 years in retirement? What kind of relationship with the planner and method of payment might work best for them? f. Do the Taylors need to track their expenses more or less closely once they retire? Are their big expenses likely to remain the five reported by the average household? e. Should they manage the investment portfolio themselves or should they find a planner to manage their retirement assets and help them develop a plan for what could be 30 years in retirement? (Select the best answer below.) A. Whether or not Tim and Jill continue to work with a financial planner depends on their financial knowledge, time and commitment. Given their successful, independent, management of their financial situation to date, they may want to develop their own plan and have it reviewed by a planner as confirmation that they are on the right track. Because successfully managing a large investment portfolio takes a great deal of time and knowledge, the Taylors may want to avail themselves of the help of a professional investment advisor. B. Whether or not Tim and Jill continue to work with a financial planner depends on their financial knowledge and net worth. Given their successful, independent, management of their financial situation to date, they may want to develop their own plan and have it reviewed by a planner as confirmation that they are on the right track. Because successfully managing a large investment portfolio takes a great deal of time and knowledge, the Taylors may want to avail themselves of the help of a professional investment advisor. C. Whether or not Tim and Jill continue to work with a financial planner depends on their financial knowledge, time and commitment. Given the mismanagement of their financial situation to date, they may want to work with a planner if they do not want to run out of money during retirement. D. Whether or not Tim and Jill continue to work with a financial planner depends on their net worth. Given their successful, independent, management of their financial situation to date, they may want to develop their own plan and have it reviewed by a planner if their net worth is over $1 million. What kind of relationship with the planner and method of payment might work best for them? (Select the best answer below.) O A. They may prefer to find a reputable planner with appropriate credentials and experience. It will be important for them to shop around to find someone with whom they feel comfortable. A commission-based planner might be the best choice, especially if their current investments are doing well and the Taylors are not interested in making big changes that would generate sales, and commissions, for the planner. B. They may prefer to find a reputable planner with appropriate credentials and a degree from an accredited university. It will be important for them to shop around to find someone with whom they feel comfortable. A commission-based planner might be the best choice, especially if their current investments are doing well and the Taylors are not interested in making big changes that would generate sales, and commissions, for the planner. O C. They may prefer to find a reputable planner with appropriate credentials and experience. It will be important for them to shop around to find someone with whom they feel comfortable. A fee-only planner might be the best choice, especially if their current investments are doing well and the Taylors are not interested in making big changes that would generate sales, and commissions, for the planner. D. They may prefer to find a reputable planner with appropriate experience and a referral from a neighbor. It will not be important for them to shop around to find someone with whom they feel comfortable. A fee-only planner might be the best choice, especially if their current investments are doing well and the Taylors are interested in making big changes that would generate sales, and commissions, for the planner. f. Do the Taylors need to track their expenses more or less closely once they retire? Are their big expenses likely to remain the five reported by the average household? (Select the best answer below.) O A. The Taylors should track their expenses more closely because overspending without replacement income can be disastrous. In the event of an unexpectedly bad financial situation or a long downturn in the economy, they would not have the time or resources to rectify their misfortune and achieve their goals. Their big five expenses are likely to be the same as the average U.S. household - taxes, food, housing, medical care and transportation. Most retirement benefits will be taxable, as will other investment earnings. Depending on the age of the house or appliances, repairs or replacements may be necessary. OB. The Taylors should track their expenses more closely because overspending without replacement income can be disastrous. In the event of an unexpectedly bad financial situation or a long downturn in the economy, they would not have the time or resources to rectify their misfortune and achieve their goals. Their big five expenses are likely to be different from the average U.S. household - taxes, food, housing, medical care and transportation. The big five expenses for retirees are: taxes, medical care, vacations, food, and golf course membership fees. C. The Taylors should track their expenses less closely because overspending without replacement income can be disastrous. In the event of an unexpectedly bad financial situation or a long downturn in the economy, they would not have the time or resources to rectify their misfortune and achieve their goals. Their big five expenses are likely to be the same as the average U.S. household - taxes, food, housing, medical care and transportation. Most retirement benefits will be taxable, as will other investment earnings. Depending on the age of the house or appliances, repairs or replacements may be necessary. D. The Taylors should track their expenses more closely because underspending without replacement income can be disastrous. In the event of an unexpectedly bad financial situation or a long downturn in the economy, they would not have the time or resources to rectify their misfortune and achieve their goals. Their big five expenses are likely to be the same as the average U.S. household - taxes, food, housing, medical care and transportation. Most retirement benefits will be taxable, as will other investment earnings. Depending on the age of the house or appliances, repairs or replacements may be necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts