Answered step by step

Verified Expert Solution

Question

1 Approved Answer

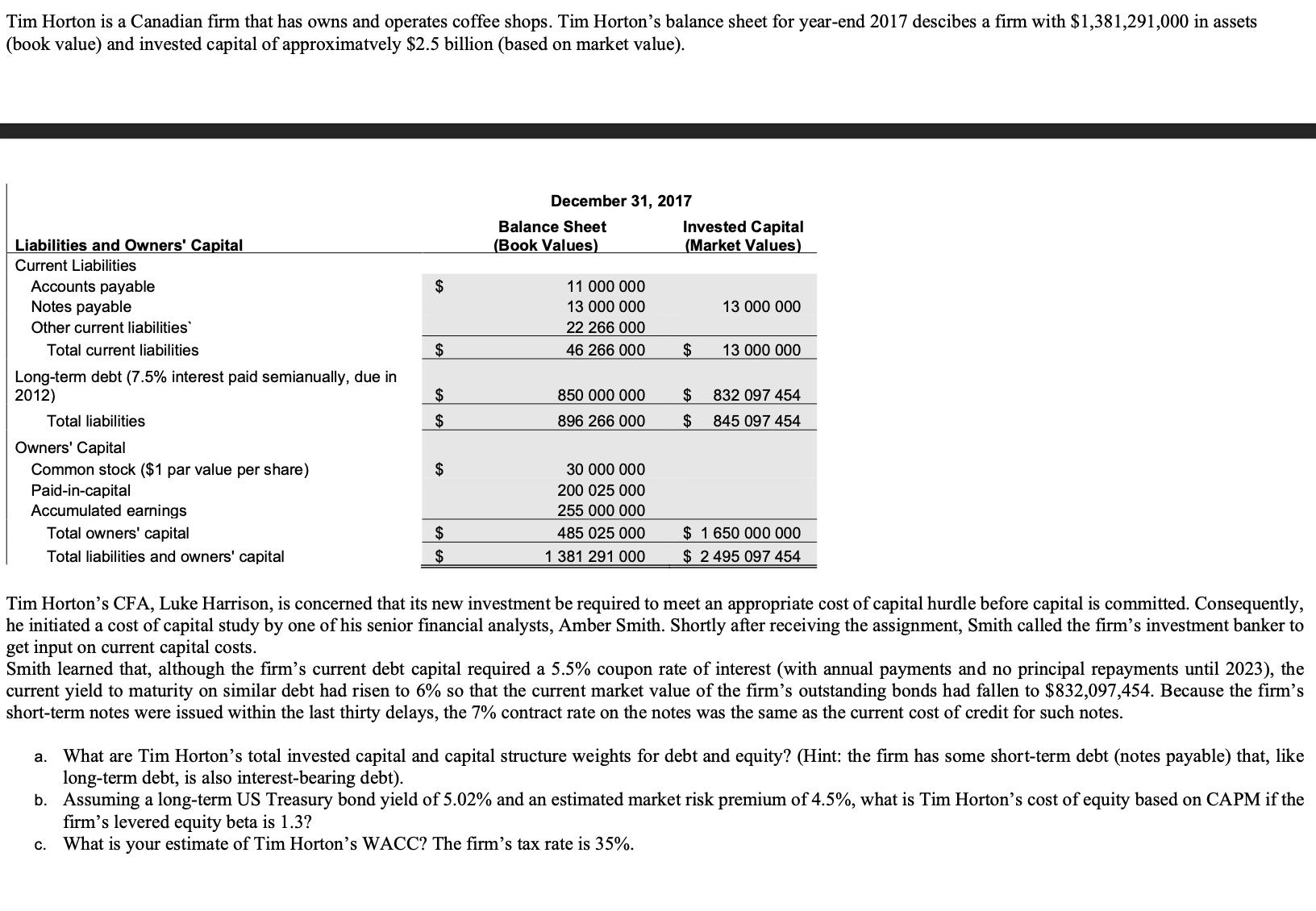

Tim Horton is a Canadian firm that has owns and operates coffee shops. Tim Horton's balance sheet for year-end 2017 descibes a firm with

Tim Horton is a Canadian firm that has owns and operates coffee shops. Tim Horton's balance sheet for year-end 2017 descibes a firm with $1,381,291,000 in assets (book value) and invested capital of approximatvely $2.5 billion (based on market value). Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt (7.5% interest paid semianually, due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital $ $ $ $ $ $ $ December 31, 2017 Balance Sheet (Book Values) 11 000 000 13 000 000 22 266 000 46 266 000 850 000 000 896 266 000 30 000 000 200 025 000 255 000 000 485 025 000 1 381 291 000 Invested Capital (Market Values) $ $ $ 13 000 000 13 000 000 832 097 454 845 097 454 $ 1 650 000 000 $2 495 097 454 Tim Horton's CFA, Luke Harrison, is concerned that its new investment be required to meet an appropriate cost of capital hurdle before capital is committed. Consequently, he initiated a cost of capital study by one of his senior financial analysts, Amber Smith. Shortly after receiving the assignment, Smith called the firm's investment banker to get input on current capital costs. Smith learned that, although the firm's current debt capital required a 5.5% coupon rate of interest (with annual payments and no principal repayments until 2023), the current yield to maturity on similar debt had risen to 6% so that the current market value of the firm's outstanding bonds had fallen to $832,097,454. Because the firm's short-term notes were issued within the last thirty delays, the 7% contract rate on the notes was the same as the current cost of credit for such notes. a. What are Tim Horton's total invested capital and capital structure weights for debt and equity? (Hint: the firm has some short-term debt (notes payable) that, like long-term debt, is also interest-bearing debt). b. Assuming a long-term US Treasury bond yield of 5.02% and an estimated market risk premium of 4.5%, what is Tim Horton's cost of equity based on CAPM if the firm's levered equity beta is 1.3? c. What is your estimate of Tim Horton's WACC? The firm's tax rate is 35%.

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Tim Hortons total invested capital and capital structure weights for debt and equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started