Question

Tim Hortons is a financial advisor specializing in commercial real estate investing. He is meeting with Gordon Bowker, a new client who is looking to

Tim Hortons is a financial advisor specializing in commercial real estate investing. He is meeting with Gordon Bowker, a new client who is looking to diversify his investment portfolio by adding real estate investments. Bowker has heard about various investment vehicles related to real estate from his friends and is seeking a more in- depth understanding of these investments from Hortons.

Hortons begins the meeting by advising Bowker of the many options that are available when investing in real estate, including:

Option 1 Direct ownership in real estate

Option 2 Publicly traded real estate investment trusts (REITs)

Option 3 Publicly traded real estate operating companies (REOCs)

Option 4 Publicly- traded residential mortgage- backed securities (RMBSs)

Hortons next asks Bowker about his investment preferences. Bowker responds by telling Hortons that he prefers to invest in equity securities that are highly liquid, provide high income, and are not subject to double taxation.

Bowker asks Hortons how the economic performance of REITs and REOCs is evaluated, and how their shares are valued. Hortons advises Bowker there are multiple measures of economic performance for REITs and REOCs, including:

Measure 1 Net operating income (NOI)

Measure 2 Funds from operations (FFO)

Measure 3 Adjusted funds from operations (AFFO)

In response, Bowker asks Hortons: "Which of the three measures is the best measure of a REIT's current economic return to shareholders?"

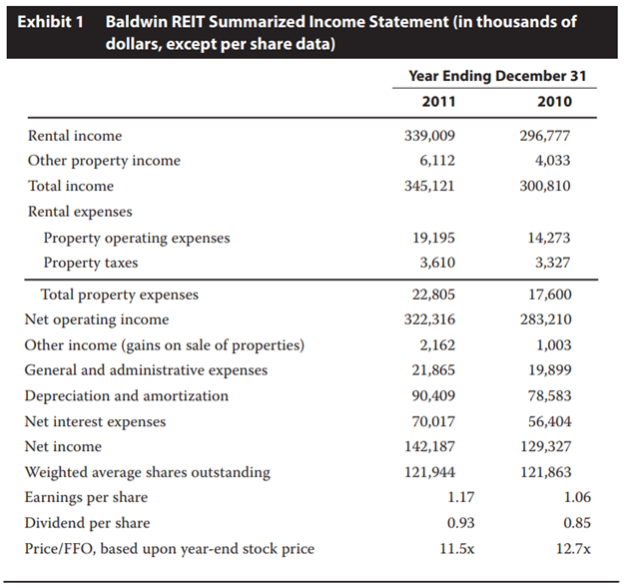

To help Bowker's understanding of valuation, Hortons presents Bowker with data on Baldwin, a health care REIT that primarily invests in independent and assisted senior housing communities in large cities across the United States. Select financial data on Baldwin for the past two years are provided in Exhibit 1.

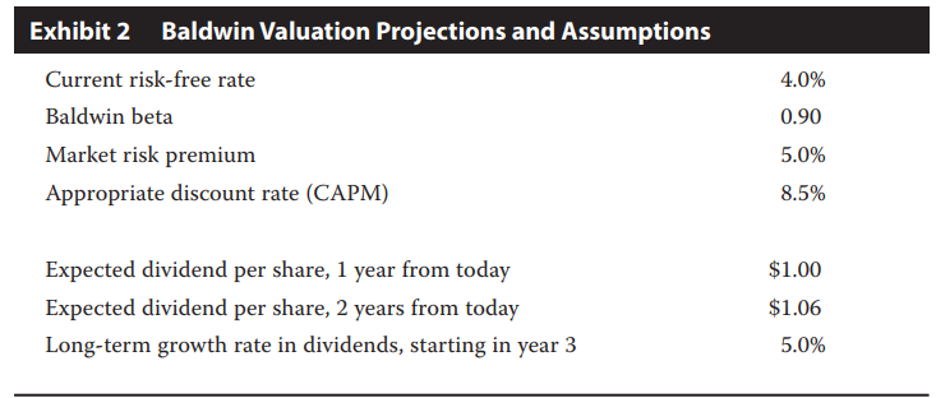

Before the meeting, Hortons had put together some valuation assumptions for Baldwin in anticipation of discussing valuation with Bowker. Hortons explains the process of valuing a REIT share using discounted cash flow analysis, and proceeds to estimate the value of Baldwin on a per share basis using a two- step dividend discount model using the data provided in Exhibit 2.

Exhibit 1 Baldwin REIT Summarized Income Statement (in thousands of dollars, except per share data) Rental income Other property income Total income Rental expenses Property operating expenses Property taxes Total property expenses Net operating income Other income (gains on sale of properties) General and administrative expenses Depreciation and amortization Net interest expenses Net income Weighted average shares outstanding Earnings per share Dividend per share Price/FFO, based upon year-end stock price Year Ending December 31 2011 2010 296,777 4,033 300,810 339,009 6,112 345,121 19,195 3,610 22,805 322,316 2,162 21,865 90,409 70,017 142,187 121,944 1.17 0.93 11.5x 14,273 3,327 17,600 283,210 1,003 19,899 78,583 56,404 129,327 121,863 1.06 0.85 12.7x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided 1 Which of the three measures is the best measure of a REITs curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started