Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tim Tenant signed a one-year lease agreement on November 1,2021 to occupy a new space for his business. Rent will be $1,700 per month, beginning

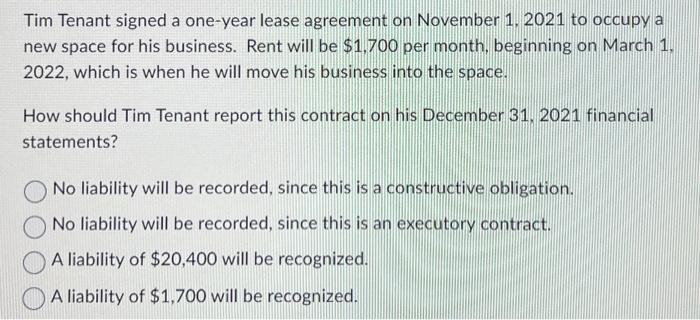

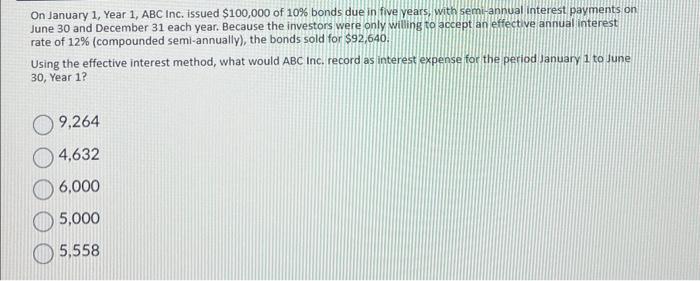

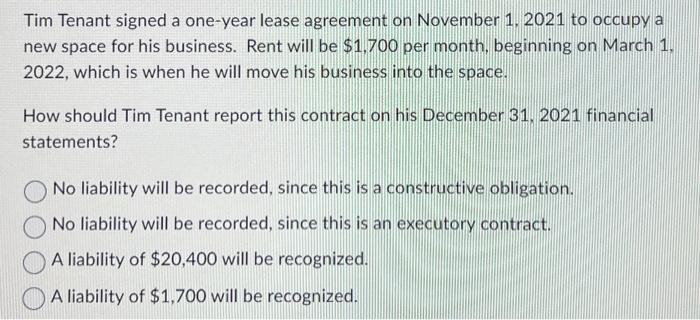

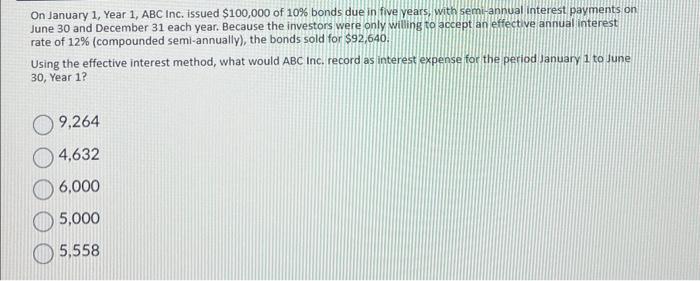

Tim Tenant signed a one-year lease agreement on November 1,2021 to occupy a new space for his business. Rent will be $1,700 per month, beginning on March 1 , 2022 , which is when he will move his business into the space. How should Tim Tenant report this contract on his December 31, 2021 financial statements? No liability will be recorded, since this is a constructive obligation. No liability will be recorded, since this is an executory contract. A liability of $20,400 will be recognized. A liability of $1,700 will be recognized. On January 1, Year 1, ABC Inc. issued $100,000 of 10% bonds due in five years, with sem-linnual interest payments on. June 30 and December 31 each year. Because the investors were only willing to accept an effective annual interest rate of 12% (compounded semi-annually), the bonds sold for $92,640. Using the effective interest method, what would ABC Inc. record as interest expense for the period January 1 to June 30 , Year 1 ? 9,264 4,632 6,000 5,000 5,558

Tim Tenant signed a one-year lease agreement on November 1,2021 to occupy a new space for his business. Rent will be $1,700 per month, beginning on March 1 , 2022 , which is when he will move his business into the space. How should Tim Tenant report this contract on his December 31, 2021 financial statements? No liability will be recorded, since this is a constructive obligation. No liability will be recorded, since this is an executory contract. A liability of $20,400 will be recognized. A liability of $1,700 will be recognized. On January 1, Year 1, ABC Inc. issued $100,000 of 10% bonds due in five years, with sem-linnual interest payments on. June 30 and December 31 each year. Because the investors were only willing to accept an effective annual interest rate of 12% (compounded semi-annually), the bonds sold for $92,640. Using the effective interest method, what would ABC Inc. record as interest expense for the period January 1 to June 30 , Year 1 ? 9,264 4,632 6,000 5,000 5,558

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started