Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate

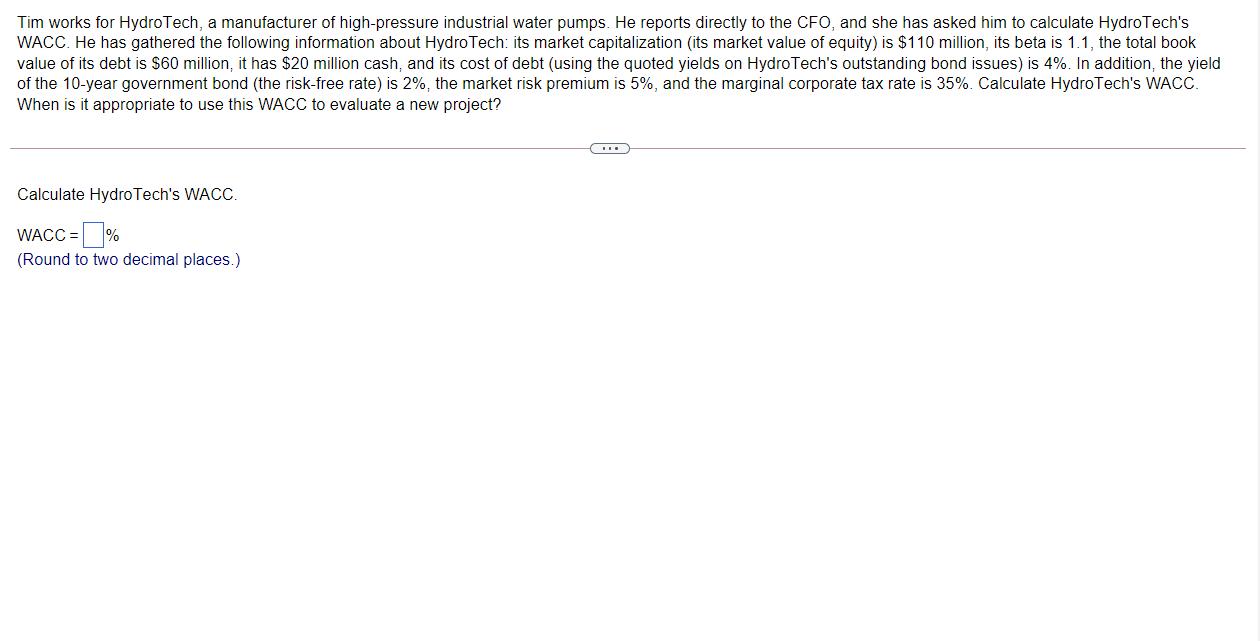

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following information about Hydro Tech: its market capitalization (its market value of equity) is $110 million, its beta is 1.1, the total book value of its debt is $60 million, it has $20 million cash, and its cost of debt (using the quoted yields on Hydro Tech's outstanding bond issues) is 4%. In addition, the yield of the 10-year government bond (the risk-free rate) is 2%, the market risk premium is 5%, and the marginal corporate tax rate is 35%. Calculate HydroTech's WACC. When is it appropriate to use this WACC to evaluate a new project? Calculate HydroTech's WACC. WACC = =% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate HydroTechs Weighted Average Cost of Capital WACC we need to use the following formula WACC E V R e D V R d 1 T c textWACC left fracEV tim...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started