Answered step by step

Verified Expert Solution

Question

1 Approved Answer

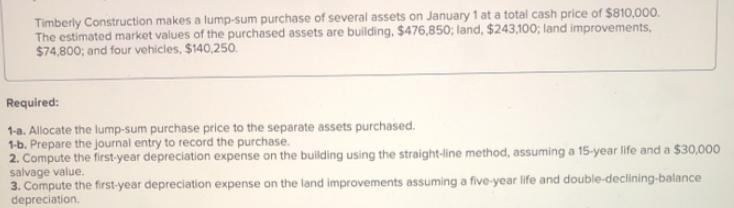

Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of

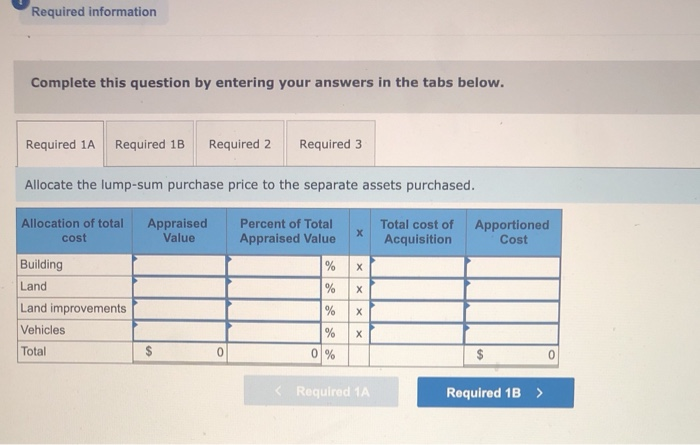

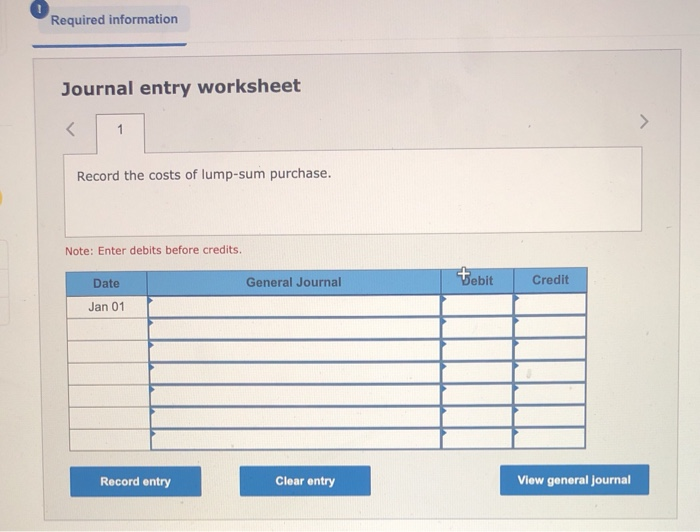

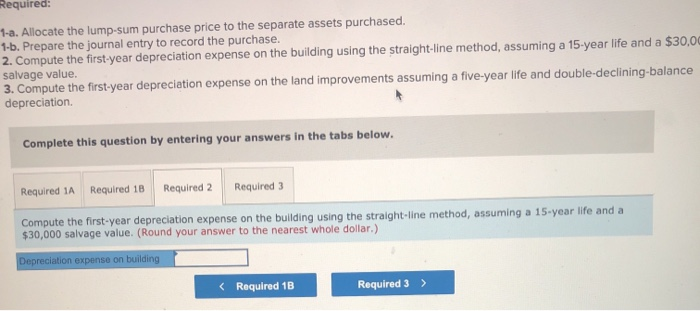

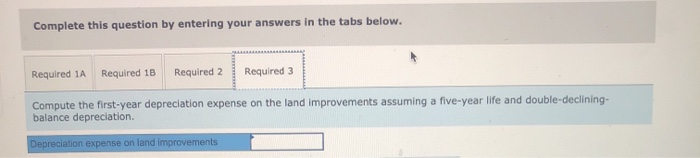

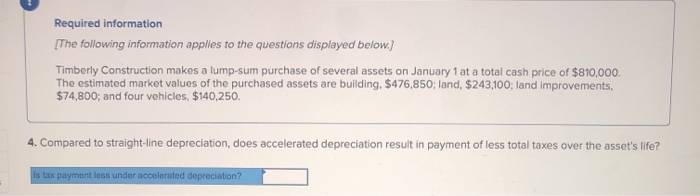

Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $476,850; land, $243,100; land improvements, $74,800; and four vehicles, $140,250. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Required information Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Allocate the lump-sum purchase price to the separate assets purchased. Allocation of total cost Building Land Land improvements Vehicles Total Appraised Value $ 0 Percent of Total Appraised Value X % X % X % % 0% X X < Required 1A Total cost of Apportioned Acquisition Cost $ Required 1B > Required information Journal entry worksheet < 1 Record the costs of lump-sum purchase. Note: Enter debits before credits. Date Jan 01 Record entry General Journal Clear entry bebit Credit View general journal Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,00 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building < Required 1B Required 3 > Complete this question by entering your answers in the tabs below. Required 3 Required 1A Required 1B Required 2 Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining- balance depreciation. Depreciation expense on land improvements Required information [The following information applies to the questions displayed below.] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $476,850; land, $243,100; land improvements, $74,800; and four vehicles, $140,250. 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset's life? is tax payment less under accelerated depreciation?

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1a To allocate the lumpsum purchase price to the separate assets purchased we can use the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started