Answered step by step

Verified Expert Solution

Question

1 Approved Answer

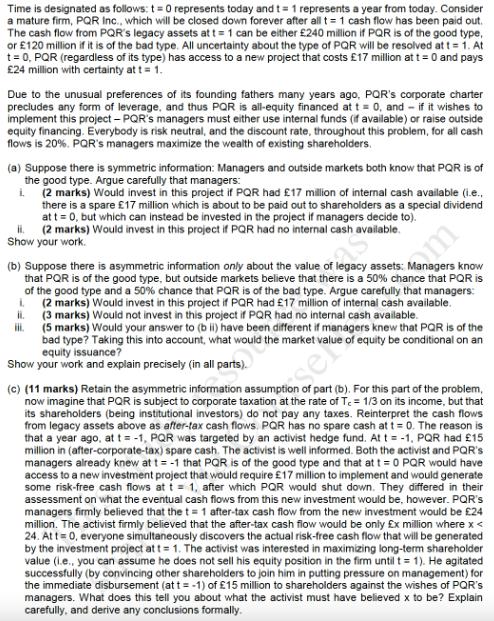

Time is designated as follows: t = 0 represents today and t= 1 represents a year from today. Consider a mature firm, PQR Inc.,

Time is designated as follows: t = 0 represents today and t= 1 represents a year from today. Consider a mature firm, PQR Inc., which will be closed down forever after all t= 1 cash flow has been paid out. The cash flow from PQR's legacy assets at t = 1 can be either 240 million if PQR is of the good type, or 120 million if it is of the bad type. All uncertainty about the type of PQR will be resolved at t= 1. At t = 0, PQR (regardless of its type) has access to a new project that costs 17 million at t= 0 and pays 24 million with certainty at t = 1. Due to the unusual preferences of its founding fathers many years ago, PQR's corporate charter precludes any form of leverage, and thus PQR is all-equity financed at t = 0, and if it wishes to implement this project - PQR's managers must either use internal funds (if available) or raise outside equity financing. Everybody is risk neutral, and the discount rate, throughout this problem, for all cash flows is 20%. PQR's managers maximize the wealth of existing shareholders. (a) Suppose there is symmetric information: Managers and outside markets both know that PQR is of the good type. Argue carefully that managers: i. (2 marks) Would invest in this project if PQR had 17 million of internal cash available (i.e.. there is a spare 17 million which is about to be paid out to shareholders as a special dividend at t = 0, but which can instead be invested in the project if managers decide to). H. (2 marks) Would invest in this project if PQR had no internal cash available. Show your work. (b) Suppose there is asymmetric information only about the value of legacy assets: Managers know that PQR is of the good type, but outside markets believe that there is a 50% chance that PQR is of the good type and a 50% chance that PQR is of the bad type. Argue carefully that managers: (2 marks) Would invest in this project if PQR had 17 million of internal cash available. (3 marks) Would not invest in this project if PQR had no internal cash available. 1. ii. iii. (5 marks) Would your answer to (b ii) have been different if managers knew that PQR is of the bad type? Taking this into account, what would the market value of equity be conditional on an equity issuance? Show your work and explain precisely (in all parts). HS (c) (11 marks) Retain the asymmetric information assumption of part (b). For this part of the problem, now imagine that PQR is subject to corporate taxation at the rate of Tc = 1/3 on its income, but that its shareholders (being institutional investors) do not pay any taxes. Reinterpret the cash flows from legacy assets above as after-tax cash flows. PQR has no spare cash at t = 0. The reason is that a year ago, at t= -1, PQR was targeted by an activist hedge fund. At t = -1, PQR had 15 million in (after-corporate-tax) spare cash. The activist is well informed. Both the activist and PQR's managers already knew at t = -1 that PQR is of the good type and that at t = 0 PQR would have access to a new investment project that would require 17 million to implement and would generate some risk-free cash flows at t= 1, after which PQR would shut down. They differed in their assessment on what the eventual cash flows from this new investment would be, however. PQR's managers firmly believed that the t = 1 after-tax cash flow from the new investment would be 24 million. The activist firmly believed that the after-tax cash flow would be only x million where x < 24. At t=0, everyone simultaneously discovers the actual risk-free cash flow that will be generated by the investment project at t= 1. The activist was interested in maximizing long-term shareholder value (i.e., you can assume he does not sell his equity position in the firm until t = 1). He agitated successfully (by convincing other shareholders to join him in putting pressure on management) for the immediate disbursement (at t = -1) of 15 million to shareholders against the wishes of PQR's managers. What does this tell you about what the activist must have believed x to be? Explain carefully, and derive any conclusions formally.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a If there is symmetric information and both managers and outside markets know that PQR is of the good type given that the project costs 17 million an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started