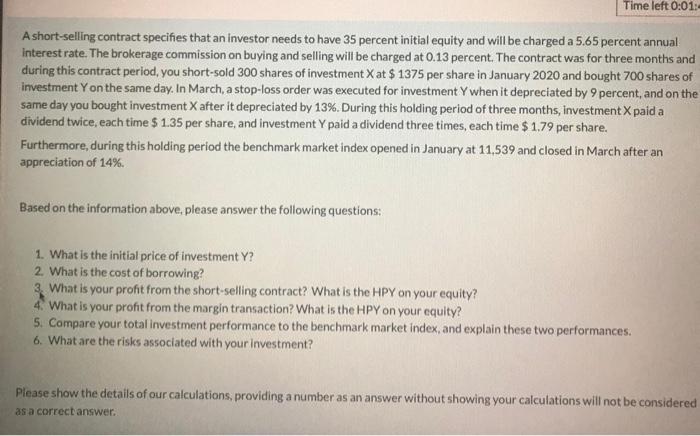

Time left 0:01: A short-selling contract specifies that an investor needs to have 35 percent initial equity and will be charged a 5.65 percent annual interest rate. The brokerage commission on buying and selling will be charged at 0.13 percent. The contract was for three months and during this contract period, you short-sold 300 shares of investment X at $ 1375 per share in January 2020 and bought 700 shares of investment Yon the same day. In March, a stop-loss order was executed for investment Y when it depreciated by 9 percent, and on the same day you bought investment X after it depreciated by 13%. During this holding period of three months, Investment X paid a dividend twice, each time $ 1.35 per share, and investment Y paid a dividend three times, each time $ 1.79 per share. Furthermore, during this holding period the benchmark market index opened in January at 11,539 and closed in March after an appreciation of 14% Based on the information above, please answer the following questions: 1. What is the initial price of investment Y? 2. What is the cost of borrowing? 3. What is your profit from the short-selling contract? What is the HPY on your equity? 4. What is your profit from the margin transaction? What is the HPY on your equity? 5. Compare your total investment performance to the benchmark market index, and explain these two performances. 6. What are the risks associated with your investment? Please show the details of our calculations, providing a number as an answer without showing your calculations will not be considered as a correct answer. Time left 0:01: A short-selling contract specifies that an investor needs to have 35 percent initial equity and will be charged a 5.65 percent annual interest rate. The brokerage commission on buying and selling will be charged at 0.13 percent. The contract was for three months and during this contract period, you short-sold 300 shares of investment X at $ 1375 per share in January 2020 and bought 700 shares of investment Yon the same day. In March, a stop-loss order was executed for investment Y when it depreciated by 9 percent, and on the same day you bought investment X after it depreciated by 13%. During this holding period of three months, Investment X paid a dividend twice, each time $ 1.35 per share, and investment Y paid a dividend three times, each time $ 1.79 per share. Furthermore, during this holding period the benchmark market index opened in January at 11,539 and closed in March after an appreciation of 14% Based on the information above, please answer the following questions: 1. What is the initial price of investment Y? 2. What is the cost of borrowing? 3. What is your profit from the short-selling contract? What is the HPY on your equity? 4. What is your profit from the margin transaction? What is the HPY on your equity? 5. Compare your total investment performance to the benchmark market index, and explain these two performances. 6. What are the risks associated with your investment? Please show the details of our calculations, providing a number as an answer without showing your calculations will not be considered as a correct