Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time left Write a java program to compute the total tax owed by an individual. You should ask the user to give you his/her

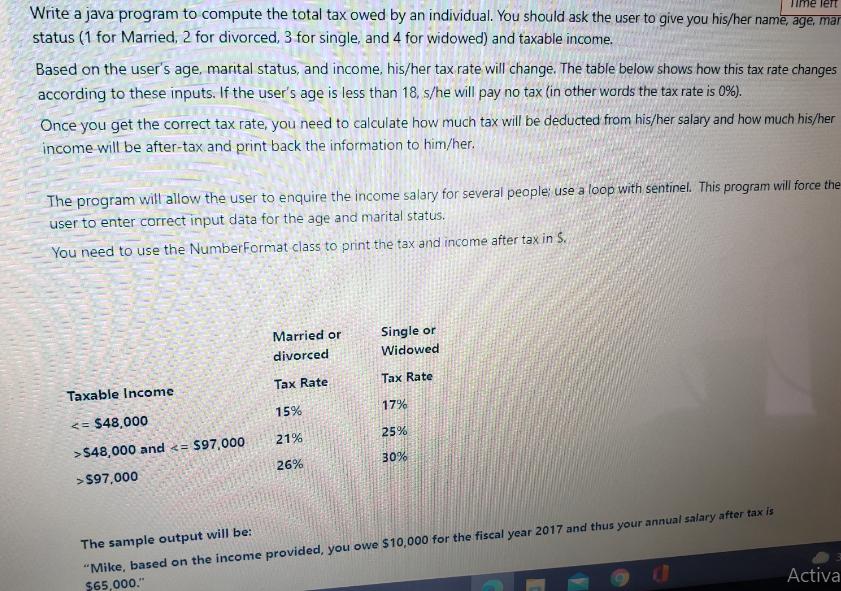

Time left Write a java program to compute the total tax owed by an individual. You should ask the user to give you his/her name, age, mar status (1 for Married, 2 for divorced, 3 for single, and 4 for widowed) and taxable income. Based on the user's age, marital status, and income, his/her tax rate will change. The table below shows how this tax rate changes according to these inputs. If the user's age is less than 18, s/he will pay no tax (in other words the tax rate is 0%). Once you get the correct tax rate, you need to calculate how much tax will be deducted from his/her salary and how much his/her income will be after-tax and print back the information to him/her. The program will allow the user to enquire the income salary for several people: use a loop with sentinel. This program will force the user to enter correct input data for the age and marital status. You need to use the NumberFormat class to print the tax and income after tax in S. Married or divorced Single or Widowed Taxable Income Tax Rate Tax Rate $48,000 and $97,000 26% 30% The sample output will be: "Mike, based on the income provided, you owe $10,000 for the fiscal year 2017 and thus your annual salary after tax is $65,000." Activa

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Heres a Java program that calculates the total tax owed by an individual based on their age marital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started