Question: QUESTION 2 - (15 MARKS) Taryn would like to open a new business as an interior designer, to funds her ambition she sold some

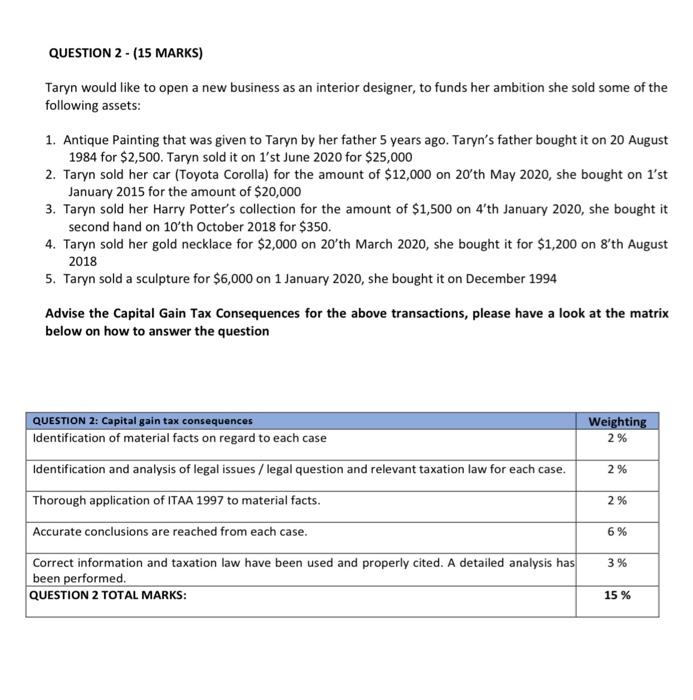

QUESTION 2 - (15 MARKS) Taryn would like to open a new business as an interior designer, to funds her ambition she sold some of the following assets: 1. Antique Painting that was given to Taryn by her father 5 years ago. Taryn's father bought it on 20 August 1984 for $2,500. Taryn sold it on 1'st June 2020 for $25,000 2. Taryn sold her car (Toyota Corolla) for the amount of $12,000 on 20'th May 2020, she bought on 1'st January 2015 for the amount of $20,000 3. Taryn sold her Harry Potter's collection for the amount of $1,500 on 4'th January 2020, she bought it second hand on 10'th October 2018 for $350. 4. Taryn sold her gold necklace for $2,000 on 20'th March 2020, she bought it for $1,200 on 8'th August 2018 5. Taryn sold a sculpture for $6,000 on 1 January 2020, she bought it on December 1994 Advise the Capital Gain Tax Consequences for the above transactions, please have a look at the matrix below on how to answer the question QUESTION 2: Capital gain tax consequences Identification of material facts on regard to each case Weighting 2% identification and analysis of legal issues / legal question and relevant taxation law for each case. 2% Thorough application of ITAA 1997 to material facts. 2% Accurate conclusions are reached from each case. 6% Correct information and taxation law have been used and properly cited. A detailed analysis has been performed. QUESTION 2 TOTAL MARKS: 3% 15 %

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Solution It is assumed that Taryn is an Australian resident at the time of the following Capital Gain Tax events 1 Antique Painting that was given to Taryn by her father 5 years ago Taryns father boug... View full answer

Get step-by-step solutions from verified subject matter experts