Answered step by step

Verified Expert Solution

Question

1 Approved Answer

time sensitive plz answer as fast as u can In January 2022, Jack Reynolds, who works for an Alberta company was awarded his first bonus

time sensitive plz answer as fast as u can

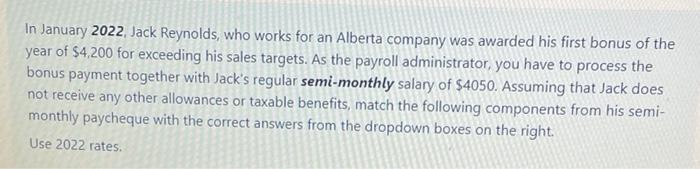

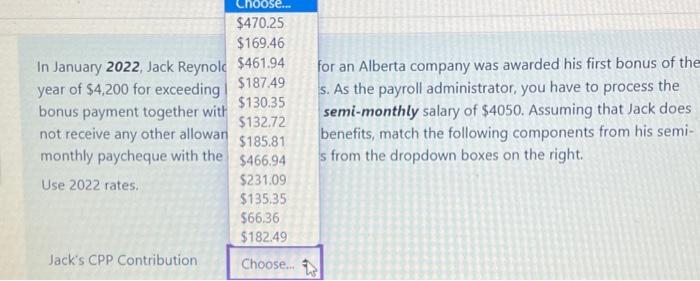

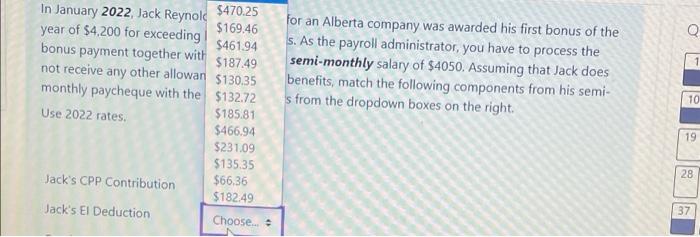

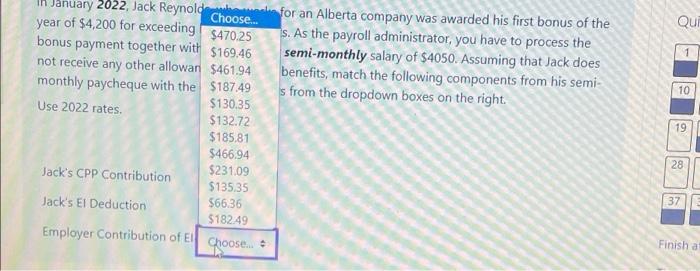

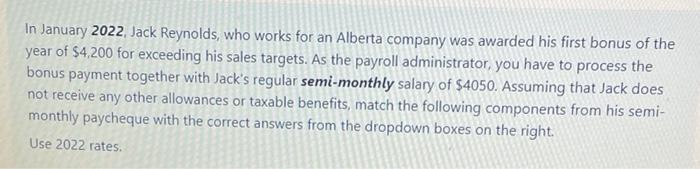

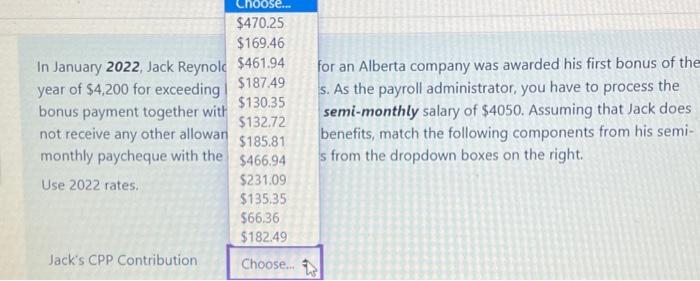

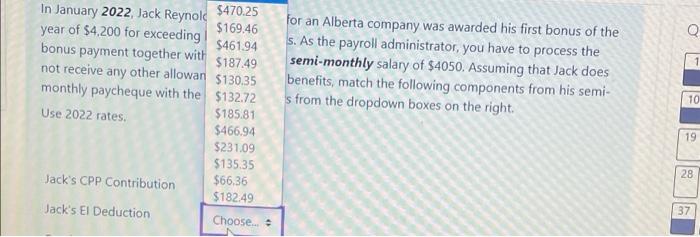

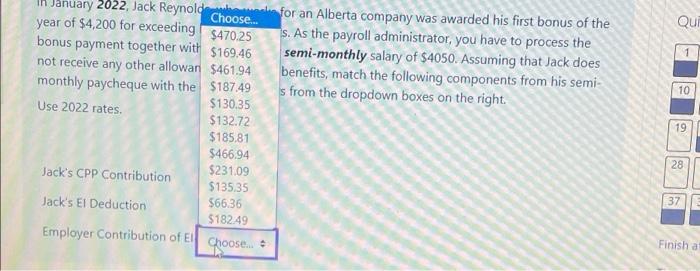

In January 2022, Jack Reynolds, who works for an Alberta company was awarded his first bonus of the year of $4,200 for exceeding his sales targets. As the payroll administrator, you have to process the bonus payment together with Jack's regular semi-monthly salary of $4050. Assuming that Jack does not receive any other allowances or taxable benefits, match the following components from his semi- monthly paycheque with the correct answers from the dropdown boxes on the right. Use 2022 rates. Choose $470.25 $169.46 In January 2022, Jack Reynole $461.94 $187.49 year of $4,200 for exceeding $130.35 bonus payment together with $132.72 not receive any other allowan $185.81 monthly paycheque with the $466.94 Use 2022 rates. $231.09 $135.35 $66.36 $182.49 Jack's CPP Contribution for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right Choose... Q for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right 1 In January 2022, Jack Reynol $470.25 year of $4,200 for exceeding $169.46 $46194 bonus payment together with $187.49 not receive any other allowan $130.35 monthly paycheque with the $132.72 Use 2022 rates, $185.81 $466.94 $231.09 $135.35 Jack's CPP Contribution $66.36 $182.49 Jack's El Deduction Choose 10 19 28 37 Qui for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right 10 January 2022, Jack Reynold Choose... year of $4,200 for exceeding $470.25 bonus payment together with $169.46 not receive any other allowan 5461.94 monthly paycheque with the $187.49 Use 2022 rates $130,35 $132.72 $185,81 $466.94 $231.09 Jack's CPP Contribution $135.35 Jack's El Deduction $66.36 $182.49 Employer Contribution of El 19 28 37 Choose . Finish a In January 2022, Jack Reynolds, who works for an Alberta company was awarded his first bonus of the year of $4,200 for exceeding his sales targets. As the payroll administrator, you have to process the bonus payment together with Jack's regular semi-monthly salary of $4050. Assuming that Jack does not receive any other allowances or taxable benefits, match the following components from his semi- monthly paycheque with the correct answers from the dropdown boxes on the right. Use 2022 rates. Choose $470.25 $169.46 In January 2022, Jack Reynole $461.94 $187.49 year of $4,200 for exceeding $130.35 bonus payment together with $132.72 not receive any other allowan $185.81 monthly paycheque with the $466.94 Use 2022 rates. $231.09 $135.35 $66.36 $182.49 Jack's CPP Contribution for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right Choose... Q for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right 1 In January 2022, Jack Reynol $470.25 year of $4,200 for exceeding $169.46 $46194 bonus payment together with $187.49 not receive any other allowan $130.35 monthly paycheque with the $132.72 Use 2022 rates, $185.81 $466.94 $231.09 $135.35 Jack's CPP Contribution $66.36 $182.49 Jack's El Deduction Choose 10 19 28 37 Qui for an Alberta company was awarded his first bonus of the s. As the payroll administrator, you have to process the semi-monthly salary of $4050. Assuming that Jack does benefits, match the following components from his semi- s from the dropdown boxes on the right 10 January 2022, Jack Reynold Choose... year of $4,200 for exceeding $470.25 bonus payment together with $169.46 not receive any other allowan 5461.94 monthly paycheque with the $187.49 Use 2022 rates $130,35 $132.72 $185,81 $466.94 $231.09 Jack's CPP Contribution $135.35 Jack's El Deduction $66.36 $182.49 Employer Contribution of El 19 28 37 Choose . Finish a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started