Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time Value Money 4) Assume an investment is for sale at $100,000 and has the following income stream each year (Year 5 includes rent and

Time Value Money

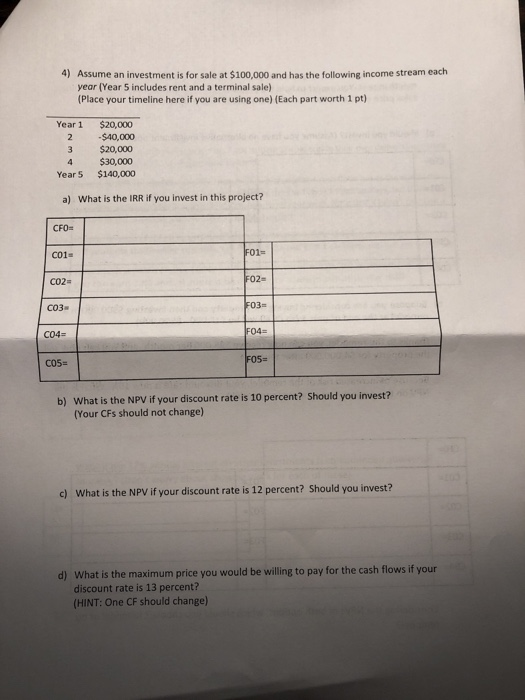

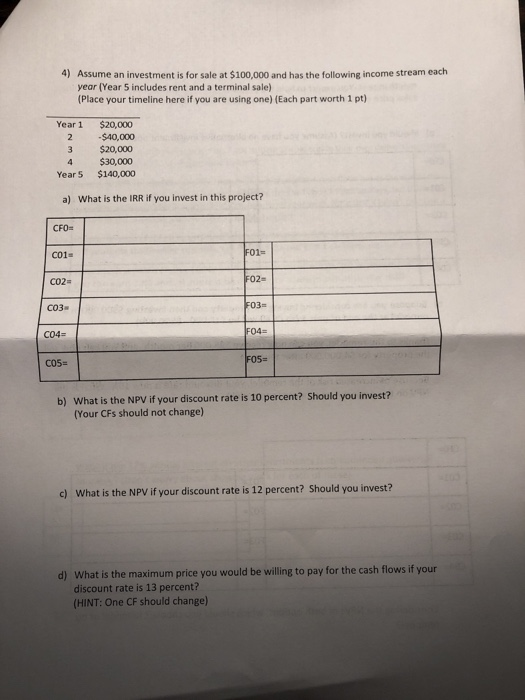

4) Assume an investment is for sale at $100,000 and has the following income stream each year (Year 5 includes rent and a terminal sale) (Place your timeline here if you are using one) (Each part worth 1 pt) $20,000 Year 1 -$40,000 2. $20,000 3 $30,000 $140,000 4 Year 5 a) What is the IRR if you invest in this project? CFO FO1 c01 FO2 CO2 F03 CO3 FO4 CO4= FOS= CO5 b) What is the NPV if your discount rate is 10 percent? Should you invest? (Your CFs should not change) What is the NPV if your discount rate is 12 percent? Should you invest? c) d) What is the maximum price you would be willing to pay for the cash flows if your discount rate is 13 percent? (HINT: One CF should change)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started