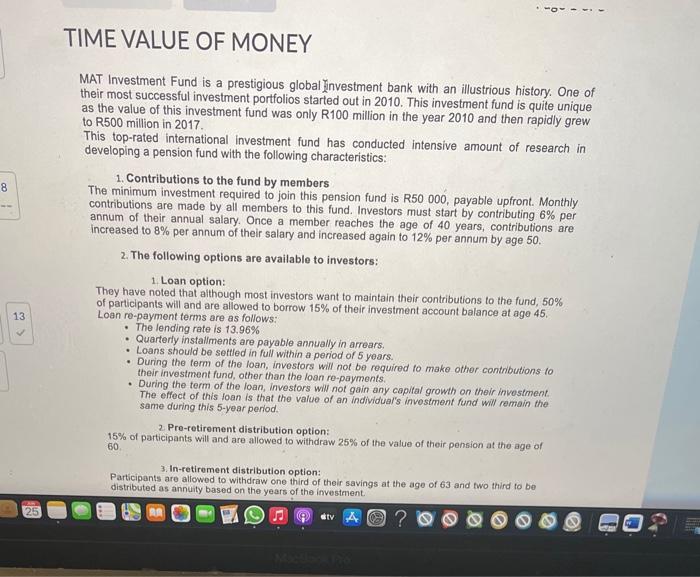

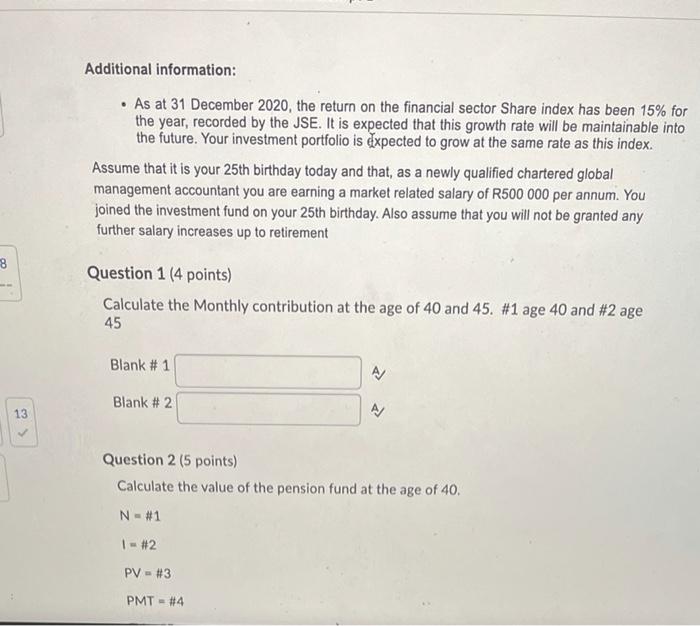

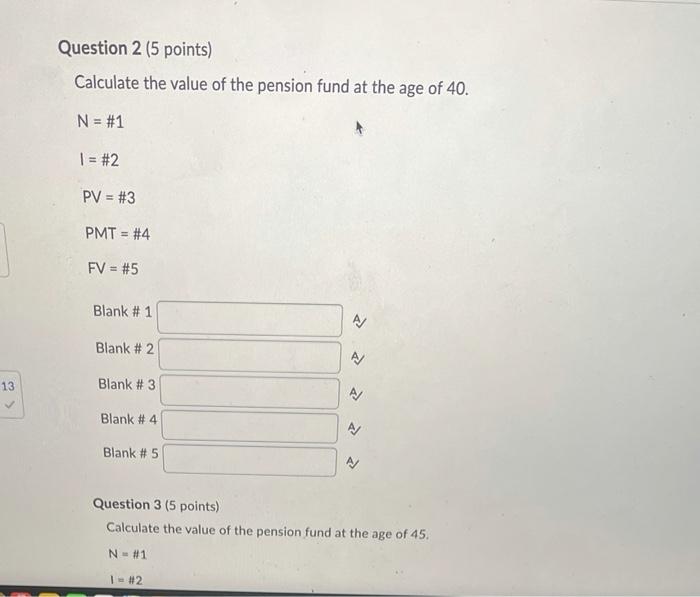

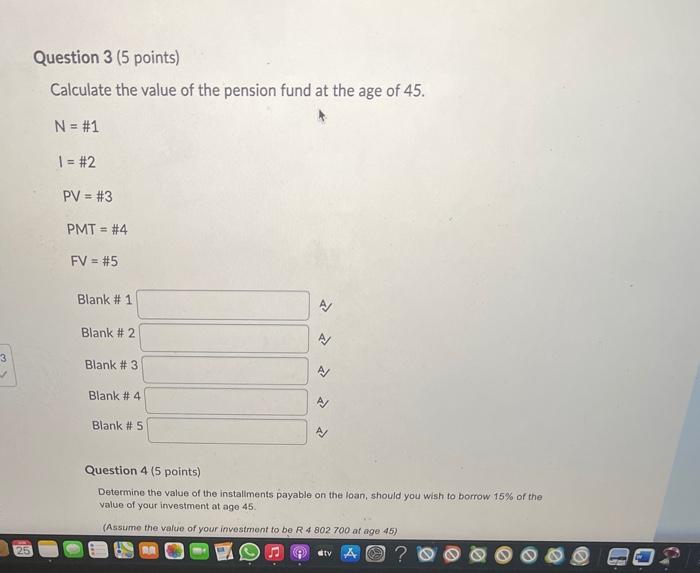

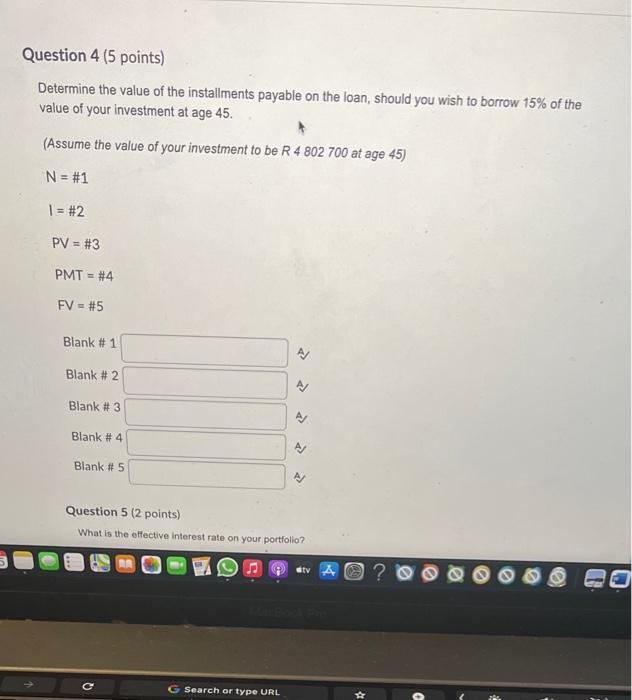

TIME VALUE OF MONEY 8 MAT Investment Fund is a prestigious global investment bank with an illustrious history. One of their most successful investment portfolios started out in 2010. This investment fund is quite unique as the value of this investment fund was only R100 million in the year 2010 and then rapidly grew to R500 million in 2017 This top-rated international investment fund has conducted intensive amount of research in developing a pension fund with the following characteristics: 1. Contributions to the fund by members The minimum investment required to join this pension fund is R50 000, payable upfront. Monthly contributions are made by all members to this fund. Investors must start by contributing 6% per annum of their annual salary. Once a member reaches the age of 40 years, contributions are increased to 8% per annum of their salary and increased again to 12% per annum by age 50. 2. The following options are available to investors: 1. Loan option: They have noted that although most investors want to maintain their contributions to the fund, 50% of participants will and are allowed to borrow 15% of their investment account balance at age 45. Loan re-payment terms are as follows: The lending rate is 13.96% Quarterly installments are payable annually in arrears. Loans should be settled in full within a period of 5 years. . During the term of the loan, investors will not be required to make other contributions to their investment fund, other than the loan re-payments. . During the term of the loan, investors will not gain any capital growth on their investment The effect of this loan is that the value of an individual's investment fund will remain the same during this 5-year period. 2. Pre-retirement distribution option: 15% of participants will and are allowed to withdraw 25% of the value of their pension at the age of 13 60 3. In-retirement distribution option: Participants are allowed to withdraw one third of their savings at the age of 63 and two third to be distributed as annuity based on the years of the investment 25 sty Additional information: As at 31 December 2020, the return on the financial sector Share index has been 15% for the year, recorded by the JSE. It is expected that this growth rate will be maintainable into the future. Your investment portfolio is expected to grow at the same rate as this index. Assume that it is your 25th birthday today and that, as a newly qualified chartered global management accountant you are earning a market related salary of R500 000 per annum. You joined the investment fund on your 25th birthday. Also assume that you will not be granted any further salary increases up to retirement 8 Question 1 (4 points) Calculate the Monthly contribution at the age of 40 and 45. #1 age 40 and #2 age 45 Blank # 1 A/ Blank # 2 13 A Question 2 (5 points) Calculate the value of the pension fund at the age of 40, N- #1 1 - #2 PV - #3 PMT - #4 Question 2 (5 points) Calculate the value of the pension fund at the age of 40. N = #1 1 = #2 PV = #3 PMT = #4 FV = #5 Blank #1 Blank # 2 13 Blank #3 Blank #4 Blank # 5 N Question 3 (5 points) Calculate the value of the pension fund at the age of 45. N- #1 1 #2 Question 3 (5 points) Calculate the value of the pension fund at the age of 45. N = #1 I = #2 PV = #3 PMT = #4 FV = #5 Blank # 1 Blank # 2 A/ 3 Blank # 3 Blank #4 DJ Blank #5 Question 4 (5 points) Determine the value of the installments payable on the loan, should you wish to borrow 15% of the value of your investment at age 45 (Assume the value of your investment to be R 4 802 700 at age 45) 25 DO atv 0. Question 4 (5 points) Determine the value of the installments payable on the loan, should you wish to borrow 15% of the value of your investment at age 45. (Assume the value of your investment to be R 4 802 700 at age 45) N = #1 1 = #2 PV = #3 PMT = #4 EV = #5 Blank # 1 Blank #2 Blank # 3 Blank #4 Blank # 5 Question 5 (2 points) What is the effective interest rate on your portfolio? etv A G Search or type URL Question 5 (2 points) What is the effective interest rate on your portfolio? AJ TIME VALUE OF MONEY 8 MAT Investment Fund is a prestigious global investment bank with an illustrious history. One of their most successful investment portfolios started out in 2010. This investment fund is quite unique as the value of this investment fund was only R100 million in the year 2010 and then rapidly grew to R500 million in 2017 This top-rated international investment fund has conducted intensive amount of research in developing a pension fund with the following characteristics: 1. Contributions to the fund by members The minimum investment required to join this pension fund is R50 000, payable upfront. Monthly contributions are made by all members to this fund. Investors must start by contributing 6% per annum of their annual salary. Once a member reaches the age of 40 years, contributions are increased to 8% per annum of their salary and increased again to 12% per annum by age 50. 2. The following options are available to investors: 1. Loan option: They have noted that although most investors want to maintain their contributions to the fund, 50% of participants will and are allowed to borrow 15% of their investment account balance at age 45. Loan re-payment terms are as follows: The lending rate is 13.96% Quarterly installments are payable annually in arrears. Loans should be settled in full within a period of 5 years. . During the term of the loan, investors will not be required to make other contributions to their investment fund, other than the loan re-payments. . During the term of the loan, investors will not gain any capital growth on their investment The effect of this loan is that the value of an individual's investment fund will remain the same during this 5-year period. 2. Pre-retirement distribution option: 15% of participants will and are allowed to withdraw 25% of the value of their pension at the age of 13 60 3. In-retirement distribution option: Participants are allowed to withdraw one third of their savings at the age of 63 and two third to be distributed as annuity based on the years of the investment 25 sty Additional information: As at 31 December 2020, the return on the financial sector Share index has been 15% for the year, recorded by the JSE. It is expected that this growth rate will be maintainable into the future. Your investment portfolio is expected to grow at the same rate as this index. Assume that it is your 25th birthday today and that, as a newly qualified chartered global management accountant you are earning a market related salary of R500 000 per annum. You joined the investment fund on your 25th birthday. Also assume that you will not be granted any further salary increases up to retirement 8 Question 1 (4 points) Calculate the Monthly contribution at the age of 40 and 45. #1 age 40 and #2 age 45 Blank # 1 A/ Blank # 2 13 A Question 2 (5 points) Calculate the value of the pension fund at the age of 40, N- #1 1 - #2 PV - #3 PMT - #4 Question 2 (5 points) Calculate the value of the pension fund at the age of 40. N = #1 1 = #2 PV = #3 PMT = #4 FV = #5 Blank #1 Blank # 2 13 Blank #3 Blank #4 Blank # 5 N Question 3 (5 points) Calculate the value of the pension fund at the age of 45. N- #1 1 #2 Question 3 (5 points) Calculate the value of the pension fund at the age of 45. N = #1 I = #2 PV = #3 PMT = #4 FV = #5 Blank # 1 Blank # 2 A/ 3 Blank # 3 Blank #4 DJ Blank #5 Question 4 (5 points) Determine the value of the installments payable on the loan, should you wish to borrow 15% of the value of your investment at age 45 (Assume the value of your investment to be R 4 802 700 at age 45) 25 DO atv 0. Question 4 (5 points) Determine the value of the installments payable on the loan, should you wish to borrow 15% of the value of your investment at age 45. (Assume the value of your investment to be R 4 802 700 at age 45) N = #1 1 = #2 PV = #3 PMT = #4 EV = #5 Blank # 1 Blank #2 Blank # 3 Blank #4 Blank # 5 Question 5 (2 points) What is the effective interest rate on your portfolio? etv A G Search or type URL Question 5 (2 points) What is the effective interest rate on your portfolio? AJ