Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time value of money concepts are one of the key building blocks to understanding corporate financial management. TVOM also has many applications to personal finance.

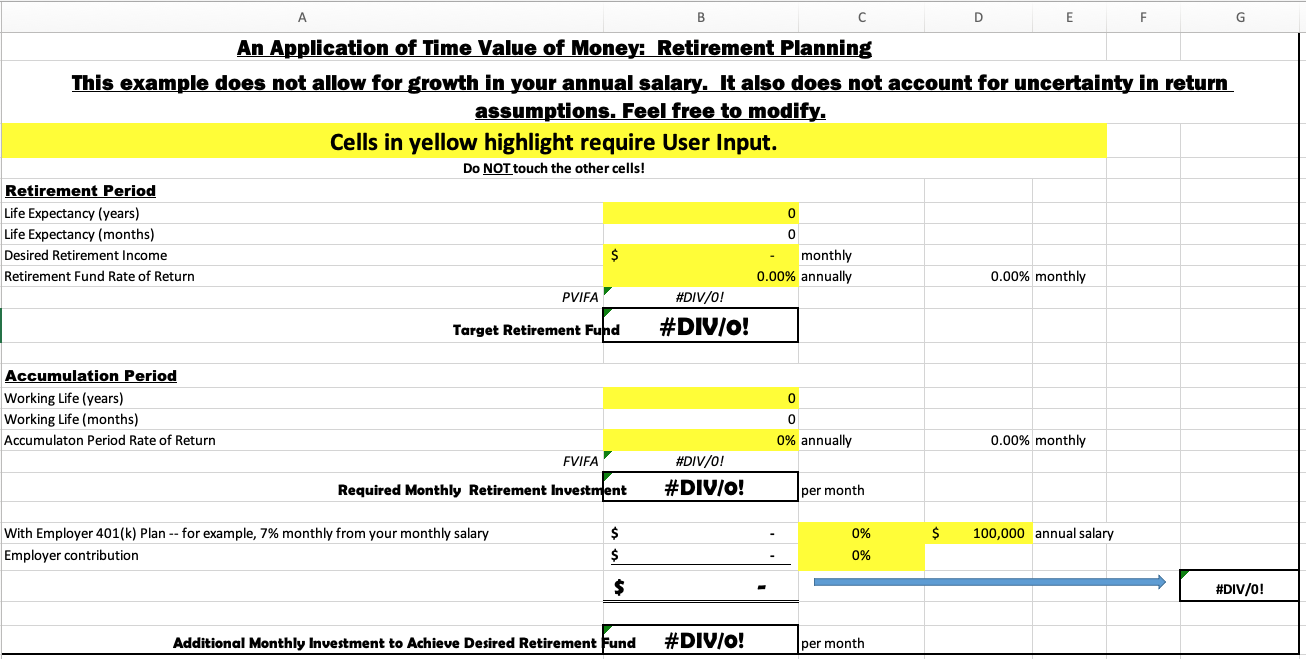

Time value of money concepts are one of the key building blocks to understanding corporate financial management. TVOM also has many applications to personal finance. One is retirement planning. Use the Excel template in the schedule for this week.

Time value of money concepts are one of the key building blocks to understanding corporate financial management. TVOM also has many applications to personal finance. One is retirement planning. Use the Excel template in the schedule for this week.

Initial Post

Your initial post may address the following questions:

- Expected length of retirement period (life expectancy in years)

- Desired monthly retirement during your retirement

- What rate of return might you earn on your retirement funds?

- How many years do you plan to work?

- What rate of return do you expect to earn on your investments toward your retirement fund?

- Will the combination of your and employer contributions allow you to achieve your target retirement fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started