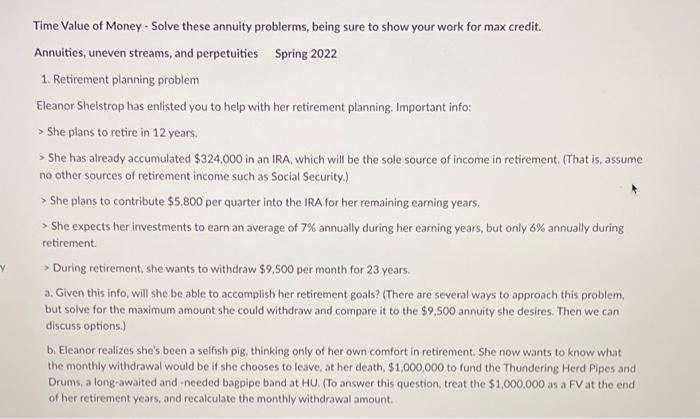

Time Value of Money - Solve these annuity problerms, being sure to show your work for max credit. Annuities, uneven streams, and perpetuities Spring 2022 1. Retirement planning problem Eleanor Shelstrop has enlisted you to help with her retirement planning. Important info: > She plans to retire in 12 years. > She has already accumulated $324.00 in an IRA, which will be the sole source of income in retirement. (That is, assume no other sources of retirement income such as Social Security.) > She plans to contribute $5,800 per quarter into the IRA for her remaining earning years. > She expects her investments to earn an average of 7% annually during her earning years, but only 6% annually during retirement > During retirement, she wants to withdraw $9,500 per month for 23 years a. Given this info. will she be able to accomplish her retirement goals? (There are several ways to approach this problem, but solve for the maximum amount she could withdraw and compare it to the $9,500 annuity she desires. Then we can discuss options.) b. Eleanor realizes she's been a selfish pig, thinking only of her own comfort in retirement. She now wants to know what the monthly withdrawal would be if she chooses to leave, at her death $1,000,000 to fund the Thundering Herd Pipes and Drums, a long-awaited and needed bagpipe band at HU. (To answer this question, treat the $1,000,000 as a FV at the end of her retirement years, and recalculate the monthly withdrawal amount y Time Value of Money - Solve these annuity problerms, being sure to show your work for max credit. Annuities, uneven streams, and perpetuities Spring 2022 1. Retirement planning problem Eleanor Shelstrop has enlisted you to help with her retirement planning. Important info: > She plans to retire in 12 years. > She has already accumulated $324.00 in an IRA, which will be the sole source of income in retirement. (That is, assume no other sources of retirement income such as Social Security.) > She plans to contribute $5,800 per quarter into the IRA for her remaining earning years. > She expects her investments to earn an average of 7% annually during her earning years, but only 6% annually during retirement > During retirement, she wants to withdraw $9,500 per month for 23 years a. Given this info. will she be able to accomplish her retirement goals? (There are several ways to approach this problem, but solve for the maximum amount she could withdraw and compare it to the $9,500 annuity she desires. Then we can discuss options.) b. Eleanor realizes she's been a selfish pig, thinking only of her own comfort in retirement. She now wants to know what the monthly withdrawal would be if she chooses to leave, at her death $1,000,000 to fund the Thundering Herd Pipes and Drums, a long-awaited and needed bagpipe band at HU. (To answer this question, treat the $1,000,000 as a FV at the end of her retirement years, and recalculate the monthly withdrawal amount y