Answered step by step

Verified Expert Solution

Question

1 Approved Answer

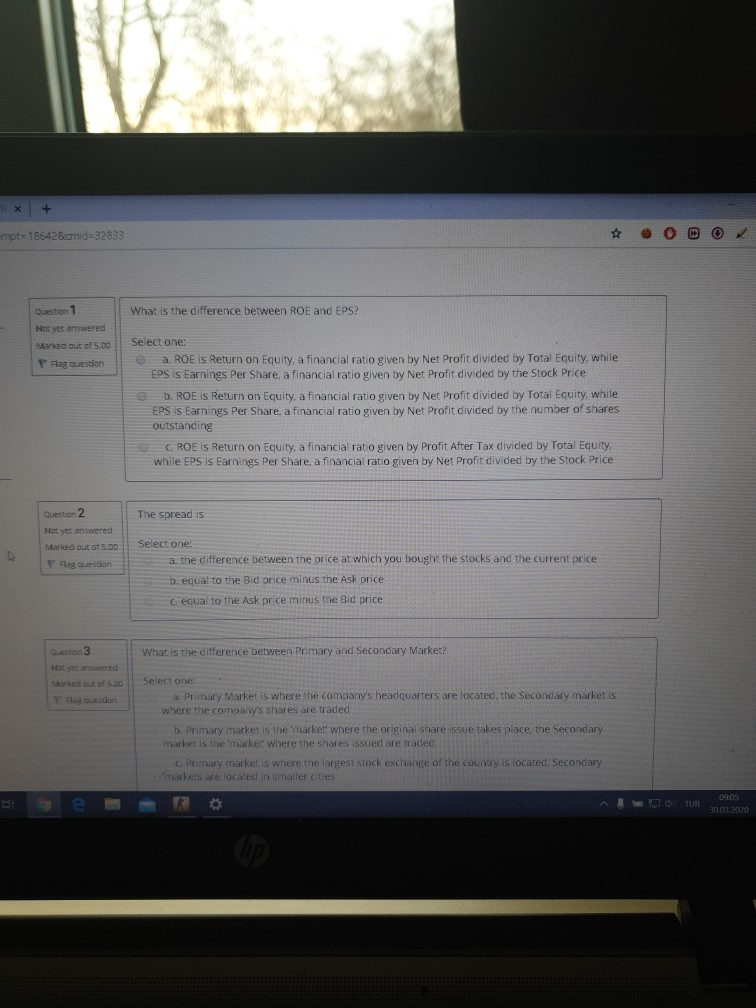

timed assignmen i have 1 hour x + npt=18542Bcomid=32833 What is the difference between ROE and EPS? Question 1 Not yet answered Marked out of

timed assignmen i have 1 hour

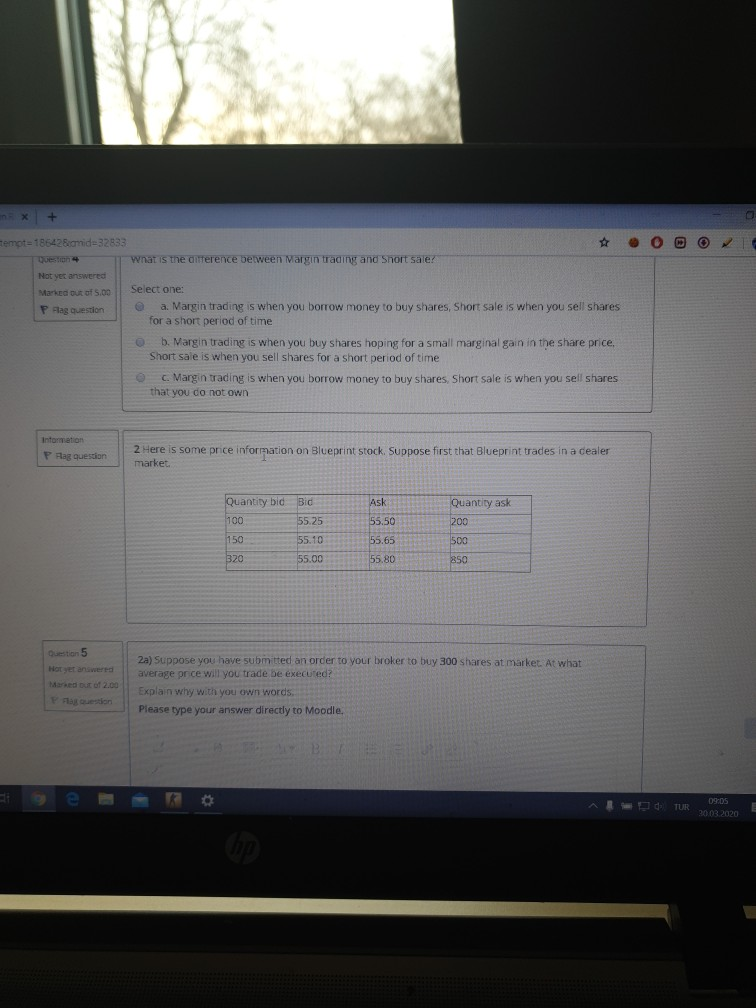

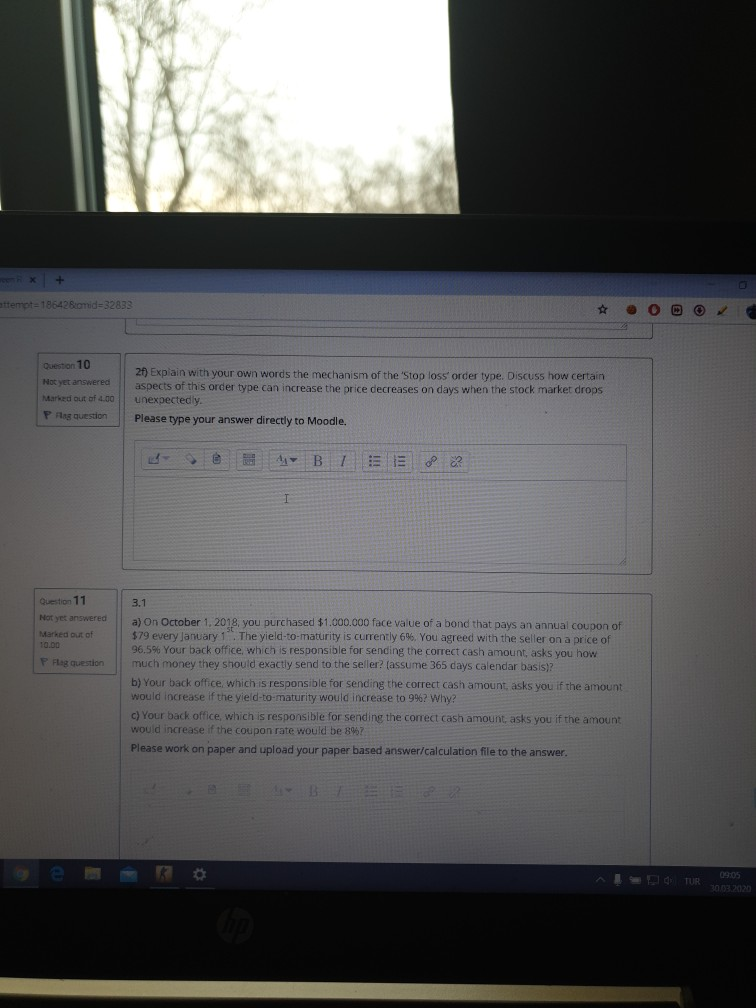

x + npt=18542Bcomid=32833 What is the difference between ROE and EPS? Question 1 Not yet answered Marked out of 5.00 P Flag question Select one: a. ROE IS Return on Equity, a financial ratio given by Net Profit divided by Total Equity, while EPS is Earnings Per Share, a financial ratio given by Net Profit divided by the Stock Price b. ROE is Return on Equity, a financial ratio given by Net Profit divided by Total Equity, while EPS is Earnings Per Share a financial ratio siven by Net Profit divided by the number of shares outstanding CROE IS Return on Equity, a financial ratio given by Profit After Tax divided by Total Equity while EPS is Earnings Per Share, a financial ratio given by Net Profit divided by the stock Price The spread is Question 2 Not yet answered Marked out of 5.00 Pflag auestion Select one: a. the difference between the price at which you bought the stocks and the current price b. equal to the Bid price minus the Ask price Cequal to the Ask price minus the Bid price 03 What is the difference between Primary and Secondary Market? DE O 5.00 Select one: Primary Market is where the company's headquarters are located, the Secondary market is where the company's shares are traded b. Primary market is the market where the original share issue takes place the Secondary market is the market where the shares issued are traded c Primary market is where the largest stock exchange of the country is located. Secondary markets are located in smaller cities E UR 2020 remot 186428cmid=32833 What is the difference between Margin trading and short sale! Not yet answered Marked out of 5.00 Select one: P Ang question a. Margin trading is when you borrow money to buy shares, Short sale is when you sell shares for a short period of time b. Margin trading is when you buy shares hoping for a small marginal gain in the share price. Short sale is when you sell shares for a short period of time C. Margin trading is when you borrow money to buy shares Short sale is when you sell shares that you do not own Information Prag question 2 Here is some price information on Blueprint stock. Suppose first that Blueprint trades in a dealer market. Quantity bid Quantity ask 200 100 Bid 55.25 55.10 55.00 500 150 520 850 Question 5 2a) Suppose you have submitted an order to your broker to buy 300 shares at market. At what average price will you trade be executed? Explain why with you own words. Please type your answer directly to Moodle. * + attempt=18642Bcomid=32833 Om @ Question 10 Not yet answered Marked out of 4.00 P Flag question 2f) Explain with your own words the mechanism of the 'Stop loss order type. Discuss how certain aspects of this order type can increase the price decreases on days when the stock market drops unexpectedly Please type your answer directly to Moodle. Question 11 Not yet answered Marked out of 10.00 P Flag question 3.1 a) On October 1, 2018, you purchased $1.000.000 face value of a bond that pays an annual coupon of $79 every lanuary 1 The yield-to-maturity is currently 6%, you agreed with the seller on a price of 96.5% Your back office, which is responsible for sending the correct cash amount, asks you how much money they should exactly send to the seller tassume 365 days calendar basis b) Your back office, which is responsible for sending the correct cash amount asks you if the amount would increase if the yield-to-maturity would increase to 9%? Why? c) Your back office, which is responsible for sending the correct cash amount asks you if the amount would increase if the coupon rate would be 8%? Please work on paper and upload your paper based answer/calculation file to the answer. 09:05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started