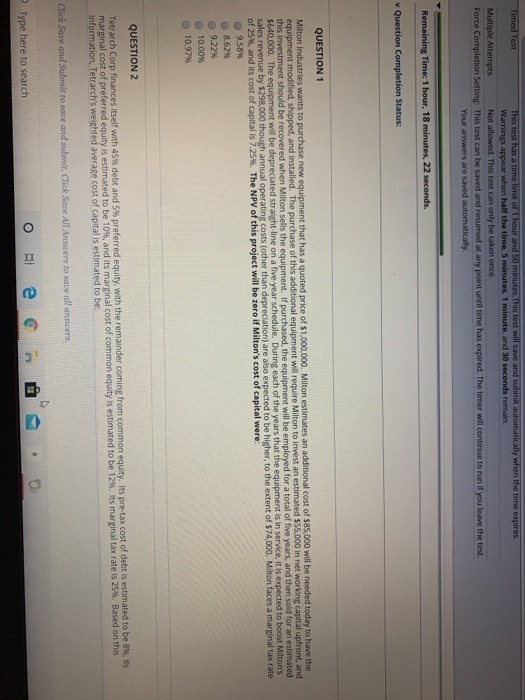

Timed Test This test has a time limit of 1 hour and 50 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time. 5 minutes, 1 minute, and 30 seconds remain Multiple Attempts Not allowed. This test can only be taken once. Force Completion Setting This test can be saved and resumed at any point until time has expired. The time will continue to run if you leave the test. Your answers are saved automatically. Remaining Time: 1 hour, 18 minutes, 22 seconds. Question Completion Status: QUESTION 1 Milton Industries wants to purchase new equipment that has a quoted price of $1,000,000. Milton estimates an additional cost of $85,000 will be needed today to have the equipment modified, shipped, and installed. The purchase of this additional equipment will require Milton to invest an estimated $55,000 in networking capital upfront, and this investment should be recovered when Milton sells the equipment. If purchased, the equipment will be employed for a total of five years, and then sold for an estimated 5640,000. The equipment will be depreciated straight line on a five-year schedule. During each of the years that the equipment is in service, it is expected to boost Milton sales revenue by $298.000 though annual operating costs (other than depreciation) are also expected to be higher, to the extent of $74,000. Milton faces a marginal tax rate of 25%, and its cost of capital is 7.25%. The NPV of this project will be zero if Milton's cost of capital were: 9.58% 8.62% 9.22% 10.00% 10.97% QUESTION 2 Tetrarch Corp finances itself with 45% debt and 5% preferred equity, with the remainder coming from common equity. Its pre-tax cost of debt is estimated to be 8%, its marginal cost of preferred equity is estimated to be 10%, and its marginal cost of common equity is estimated to be 12%. Its marginal tax rate is 25%. Based on this Information, Tetrarch's weighted average cost of capital is estimated to be Click Save and Submit to save and submit. Click Save All Answers to save all answers. Type here to search Timed Test This test has a time limit of 1 hour and 50 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time. 5 minutes, 1 minute, and 30 seconds remain Multiple Attempts Not allowed. This test can only be taken once. Force Completion Setting This test can be saved and resumed at any point until time has expired. The time will continue to run if you leave the test. Your answers are saved automatically. Remaining Time: 1 hour, 18 minutes, 22 seconds. Question Completion Status: QUESTION 1 Milton Industries wants to purchase new equipment that has a quoted price of $1,000,000. Milton estimates an additional cost of $85,000 will be needed today to have the equipment modified, shipped, and installed. The purchase of this additional equipment will require Milton to invest an estimated $55,000 in networking capital upfront, and this investment should be recovered when Milton sells the equipment. If purchased, the equipment will be employed for a total of five years, and then sold for an estimated 5640,000. The equipment will be depreciated straight line on a five-year schedule. During each of the years that the equipment is in service, it is expected to boost Milton sales revenue by $298.000 though annual operating costs (other than depreciation) are also expected to be higher, to the extent of $74,000. Milton faces a marginal tax rate of 25%, and its cost of capital is 7.25%. The NPV of this project will be zero if Milton's cost of capital were: 9.58% 8.62% 9.22% 10.00% 10.97% QUESTION 2 Tetrarch Corp finances itself with 45% debt and 5% preferred equity, with the remainder coming from common equity. Its pre-tax cost of debt is estimated to be 8%, its marginal cost of preferred equity is estimated to be 10%, and its marginal cost of common equity is estimated to be 12%. Its marginal tax rate is 25%. Based on this Information, Tetrarch's weighted average cost of capital is estimated to be Click Save and Submit to save and submit. Click Save All Answers to save all answers. Type here to search