Answered step by step

Verified Expert Solution

Question

1 Approved Answer

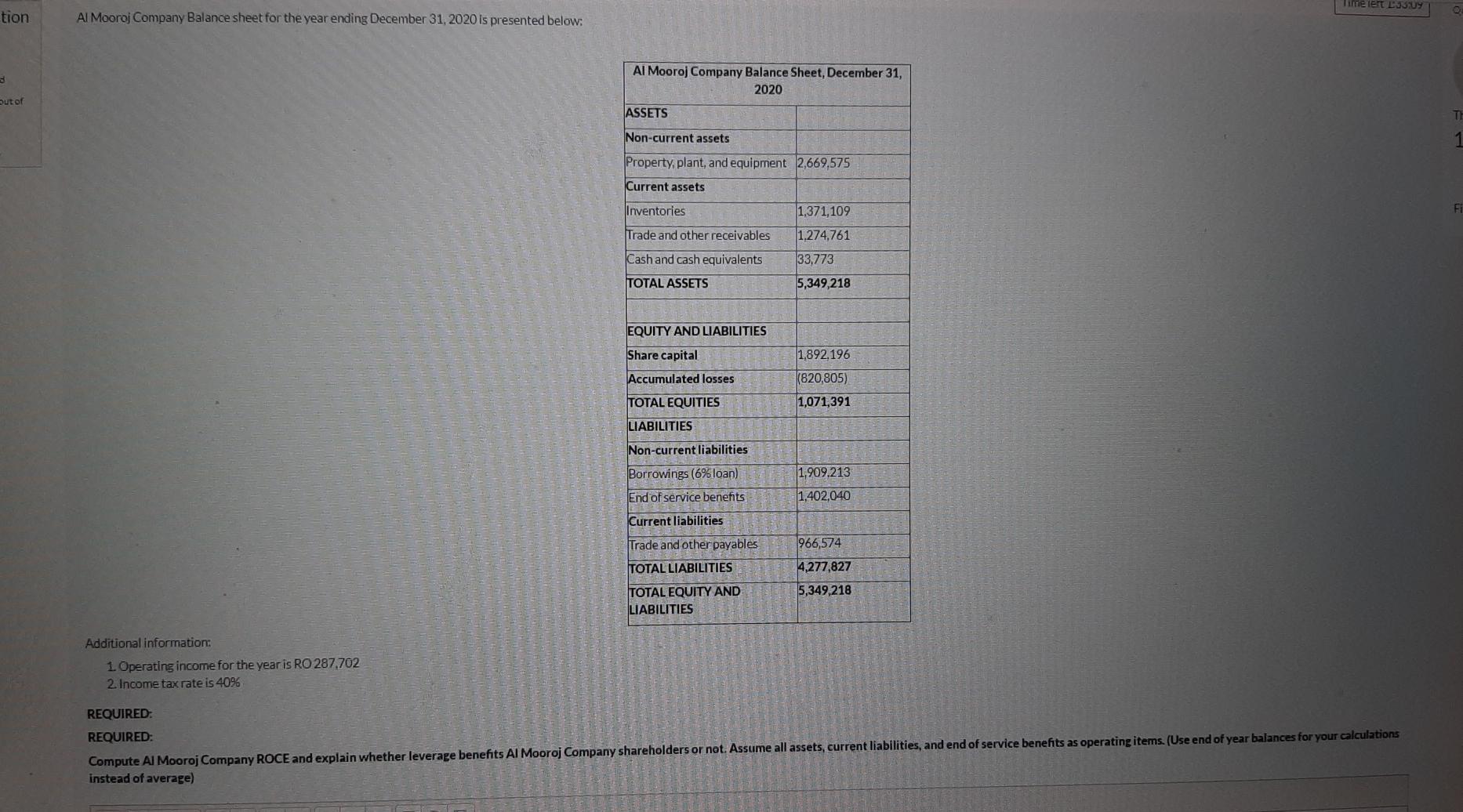

Timelet LUGU tion Al Mooroj Company Balance sheet for the year ending December 31, 2020 is presented below: Al Mooroj Company Balance Sheet, December 31,

Timelet LUGU tion Al Mooroj Company Balance sheet for the year ending December 31, 2020 is presented below: Al Mooroj Company Balance Sheet, December 31, 2020 Out of TE ASSETS Non-current assets 1 Property, plant, and equipment 2,669,575 Current assets Inventories 1,371,109 Fi Trade and other receivables 1.274,761 33,773 Cash and cash equivalents TOTAL ASSETS 5,349,218 EQUITY AND LIABILITIES Share capital 1,892.196 Accumulated losses (820,805) TOTAL EQUITIES 1,071,391 LIABILITIES Non-current liabilities Borrowings (6% loan) End of service benefits 1,909.213 1,402,040 Current liabilities Trade and other payables 966,574 TOTAL LIABILITIES 4,277,827 5,349,218 TOTAL EQUITY AND LIABILITIES Additional information: 1. Operating income for the year is RO 287,702 2 Income tax rate is 4096 REQUIRED REQUIRED Compute Al Mooroj Company ROCE and explain whether leverage benefits Al Mooroj Company shareholders or not. Assume all assets, current liabilities, and end of service benefits as operating items. (Use end of year balances for your calculations instead of average)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started