Question: timeous financial information 5. Select the true statement with regard to internal auditors. Internal auditors must first qualify as a CA(SA) before they can be

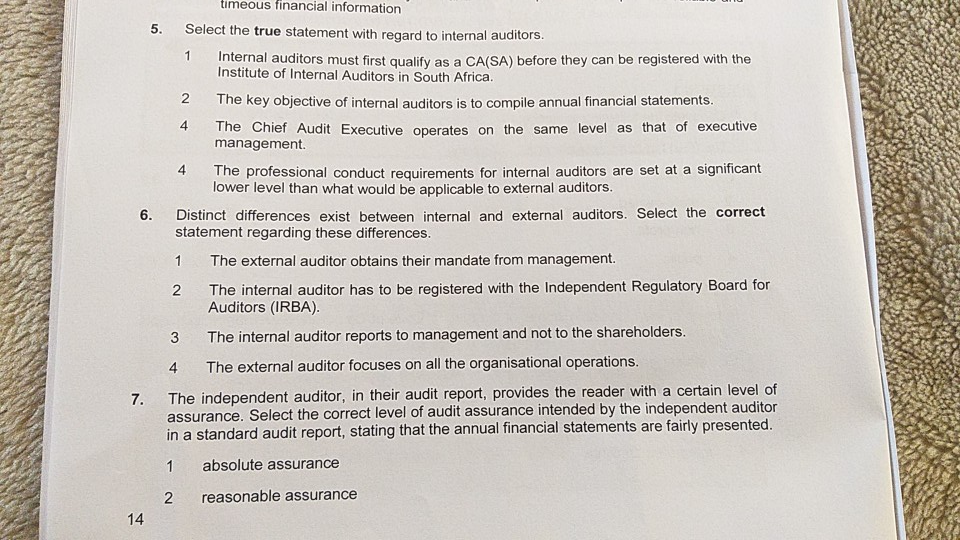

timeous financial information 5. Select the true statement with regard to internal auditors. Internal auditors must first qualify as a CA(SA) before they can be registered with the Institute of Internal Auditors in South Africa. The key objective of internal auditors is to compile annual financial statements. 4 b. The Chief Audit Executive operates on the same level as that of executive management The professional conduct requirements for internal auditors are set at a significant lower level than what would be applicable to external auditors. Distinct differences exist between internal and external auditors. Select the correct statement regarding these differences. 1 The external auditor obtains their mandate from management. 2 The internal auditor has to be registered with the Independent Regulatory Board for Auditors (IRBA). 7. 3 The internal auditor reports to management and not to the shareholders. 4 The external auditor focuses on all the organisational operations. The independent auditor, in their audit report, provides the reader with a certain level of assurance. Select the correct level of audit assurance intended by the independent auditor in a standard audit report, stating that the annual financial statements are fairly presented. 1 absolute assurance 2 reasonable assurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts