Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Timeout Inc., a privately-owned manufacturing company had the following information for the year 2020. Property taxes, factory Commission paid to salespersons Supervisor's salary, factory

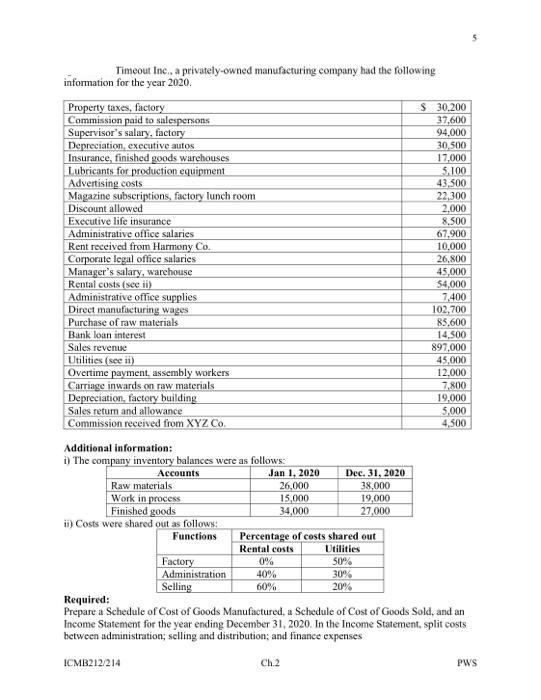

Timeout Inc., a privately-owned manufacturing company had the following information for the year 2020. Property taxes, factory Commission paid to salespersons Supervisor's salary, factory Depreciation, executive autos Insurance, finished goods warehouses Lubricants for production equipment Advertising costs Magazine subscriptions, factory lunch room Discount allowed Executive life insurance Administrative office salaries Rent received from Harmony Co. Corporate legal office salaries Manager's salary, warehouse Rental costs (see ii) Administrative office supplies Direct manufacturing wages Purchase of raw materials Bank loan interest Sales revenue Utilities (see ii) Overtime payment, assembly workers Carriage inwards on raw materials Depreciation, factory building Sales return and allowance Commission received from XYZ Co. Additional information: i) The company inventory balances were as follows: Accounts Raw materials Work in process Finished goods ii) Costs were shared out as follows: Functions Factory Administration Selling ICMB212/214 Jan 1, 2020 26,000 15,000 34,000 0% 40% 60% Dec. 31, 2020 38,000 Percentage of costs shared out Rental costs Utilities 50% 30% 20% 19,000 27,000 Ch.2 $ 30,200 37,600 94,000 30,500 17,000 5.100 43,500 22,300 2,000 8,500 67,900 10.000 26,800 45,000 $4,000 7.400 102,700 85.600 14,500 897,000 45,000 12,000 Required: Prepare a Schedule of Cost of Goods Manufactured, a Schedule of Cost of Goods Sold, and an Income Statement for the year ending December 31, 2020. In the Income Statement, split costs between administration; selling and distribution; and finance expenses 7,800 19,000 5,000 4,500 PWS

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started