Timken Accounting Case Study

Needs to be filled in and the questions on the side columns answered

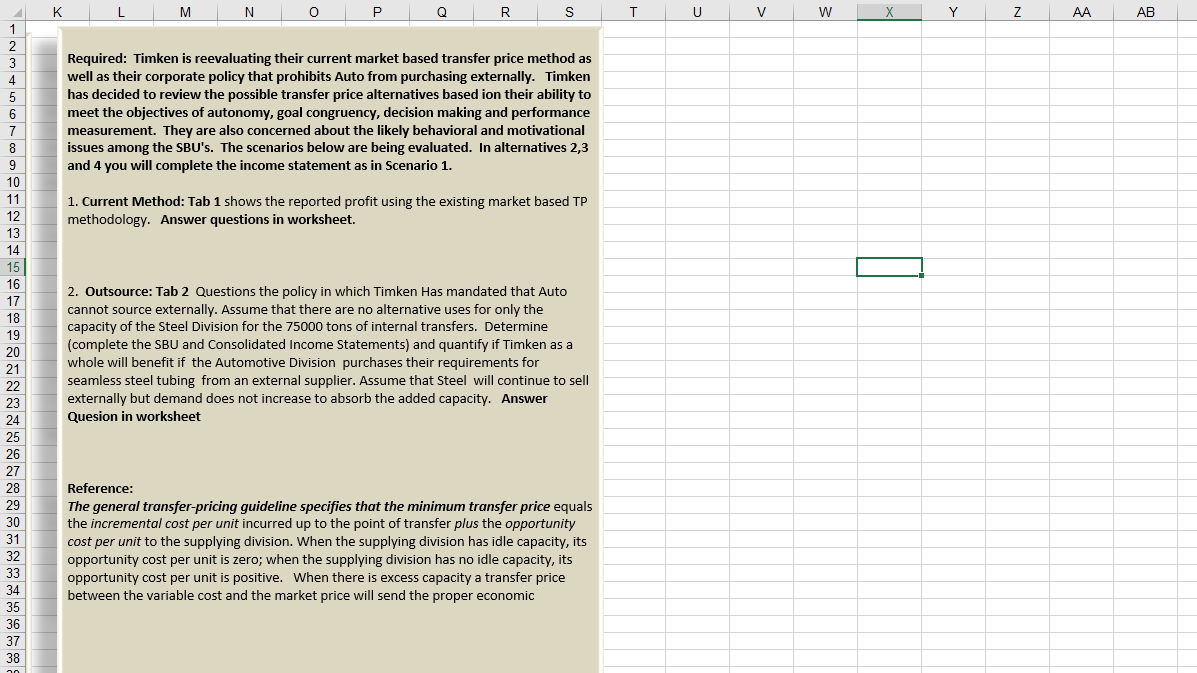

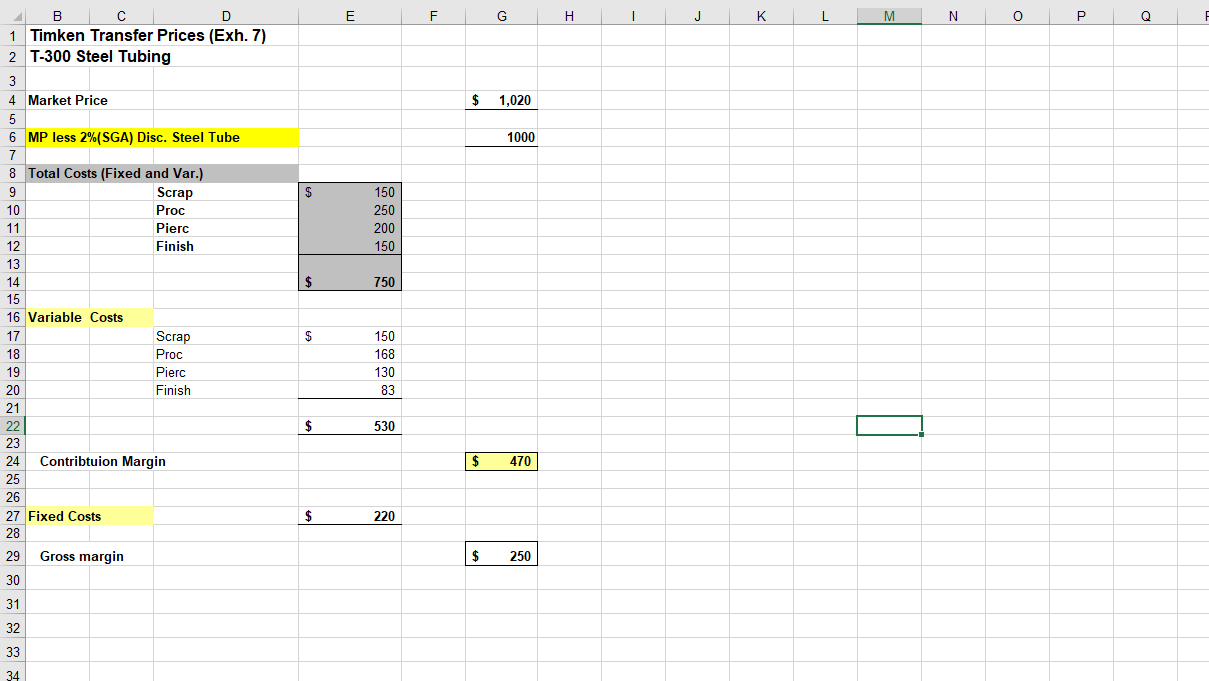

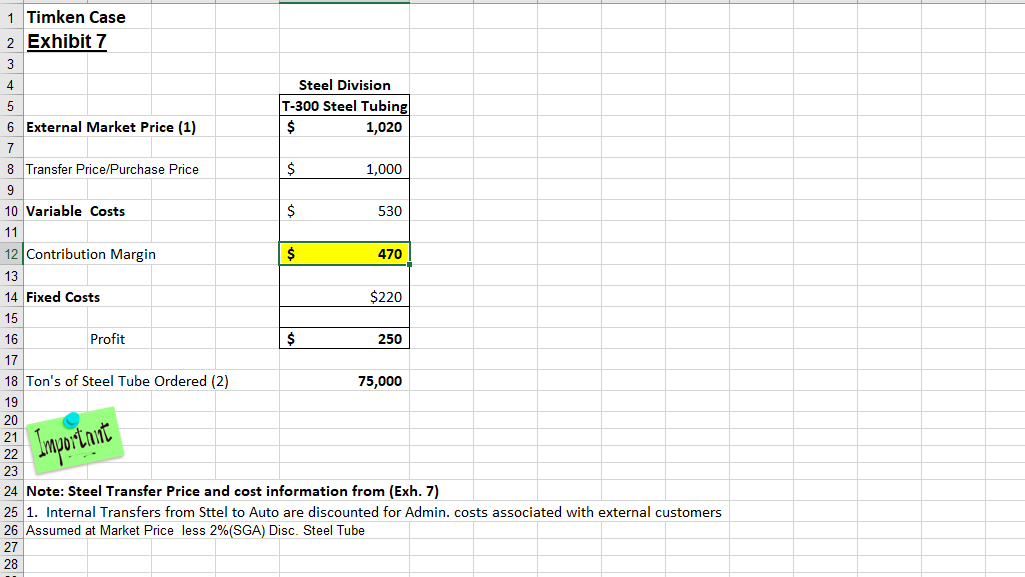

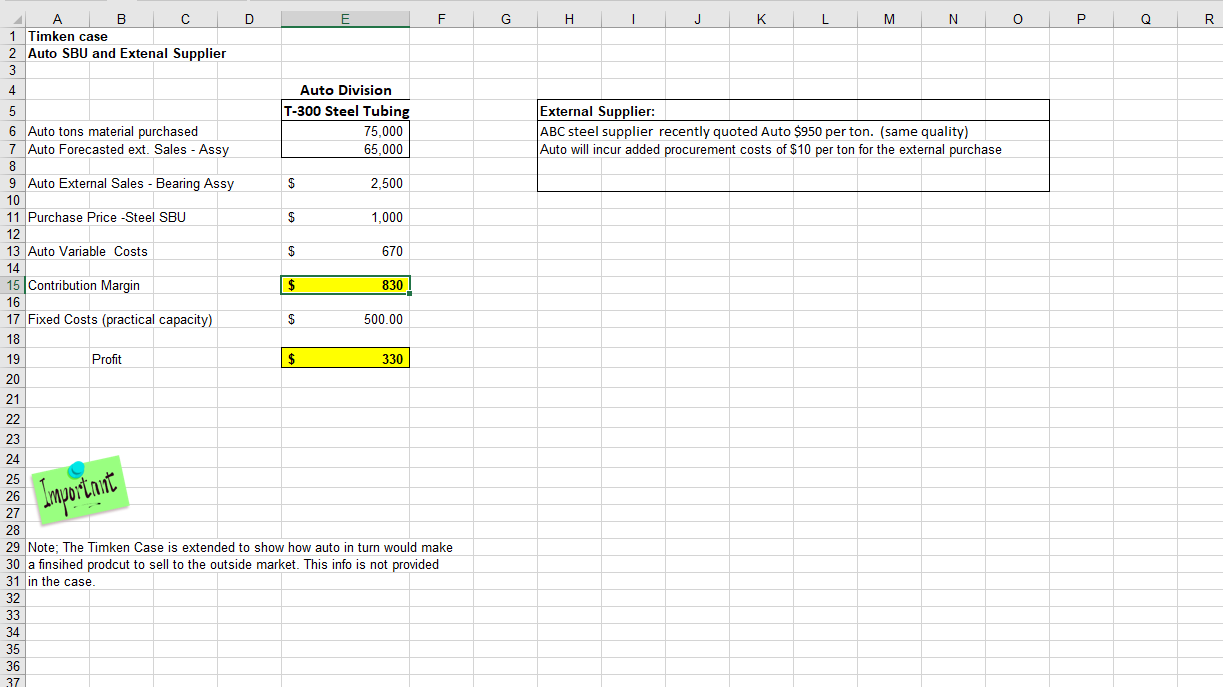

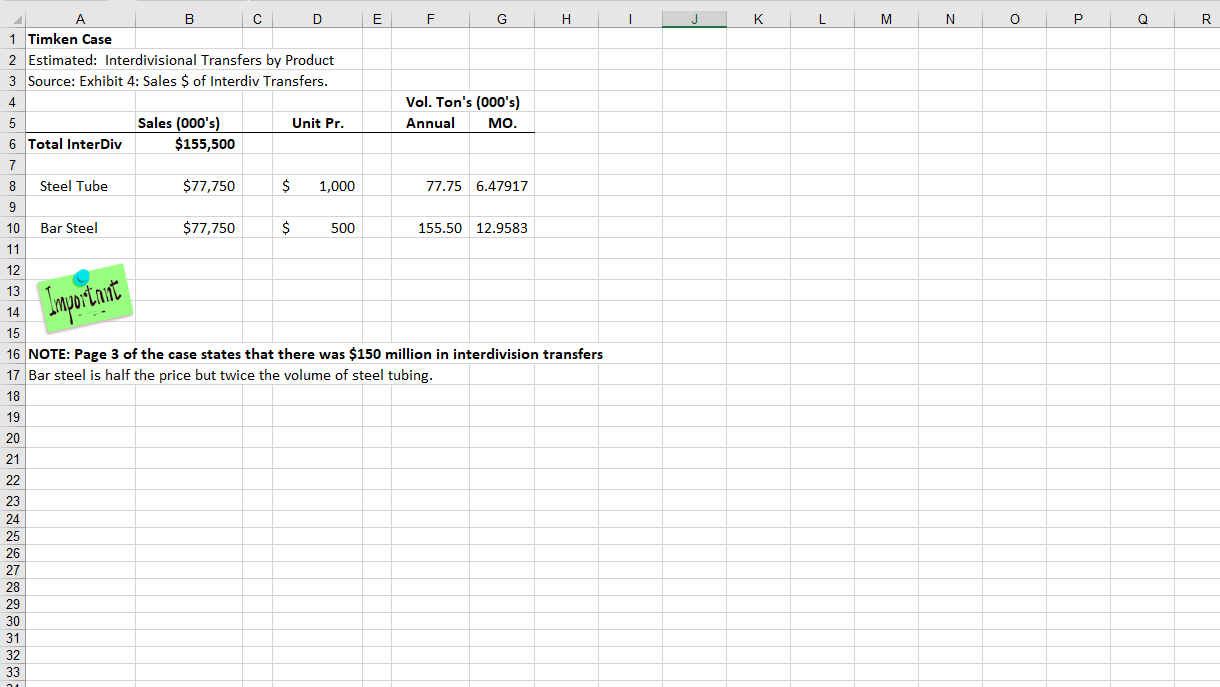

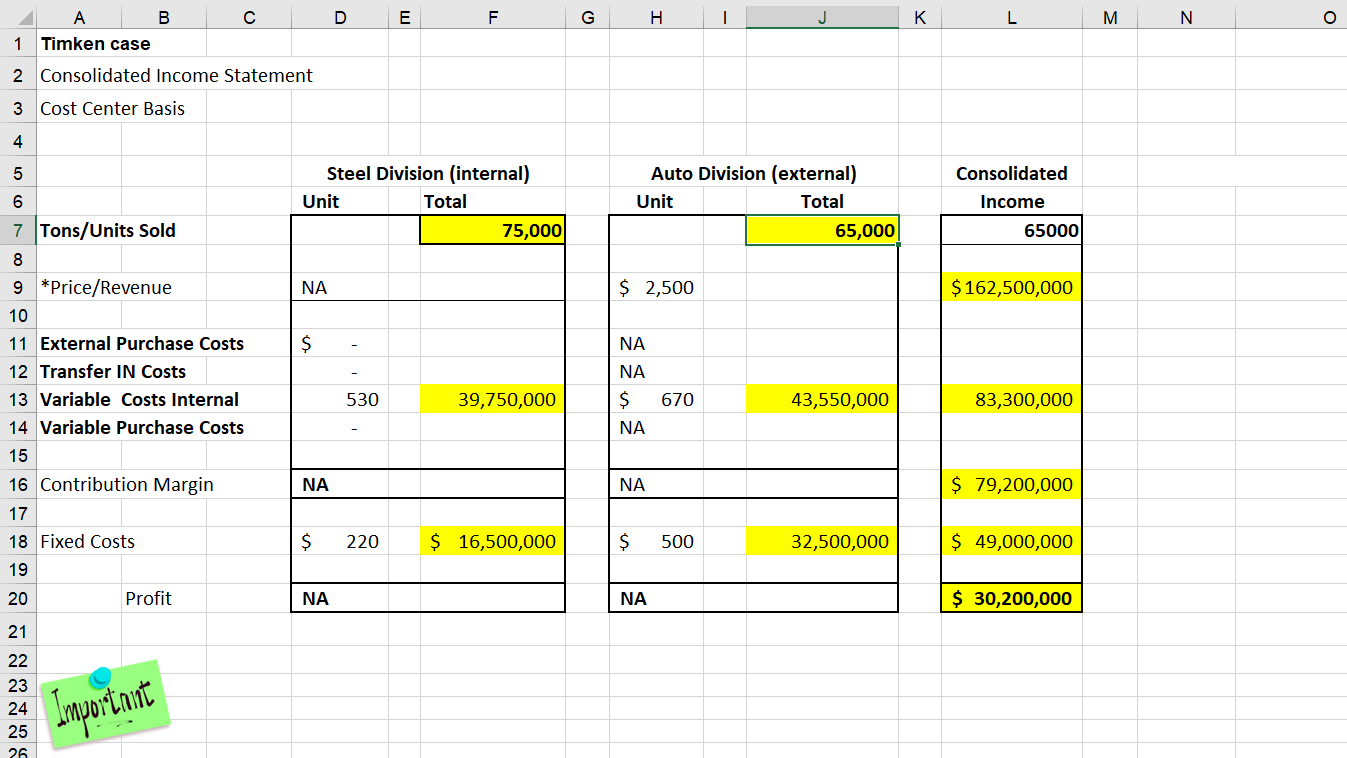

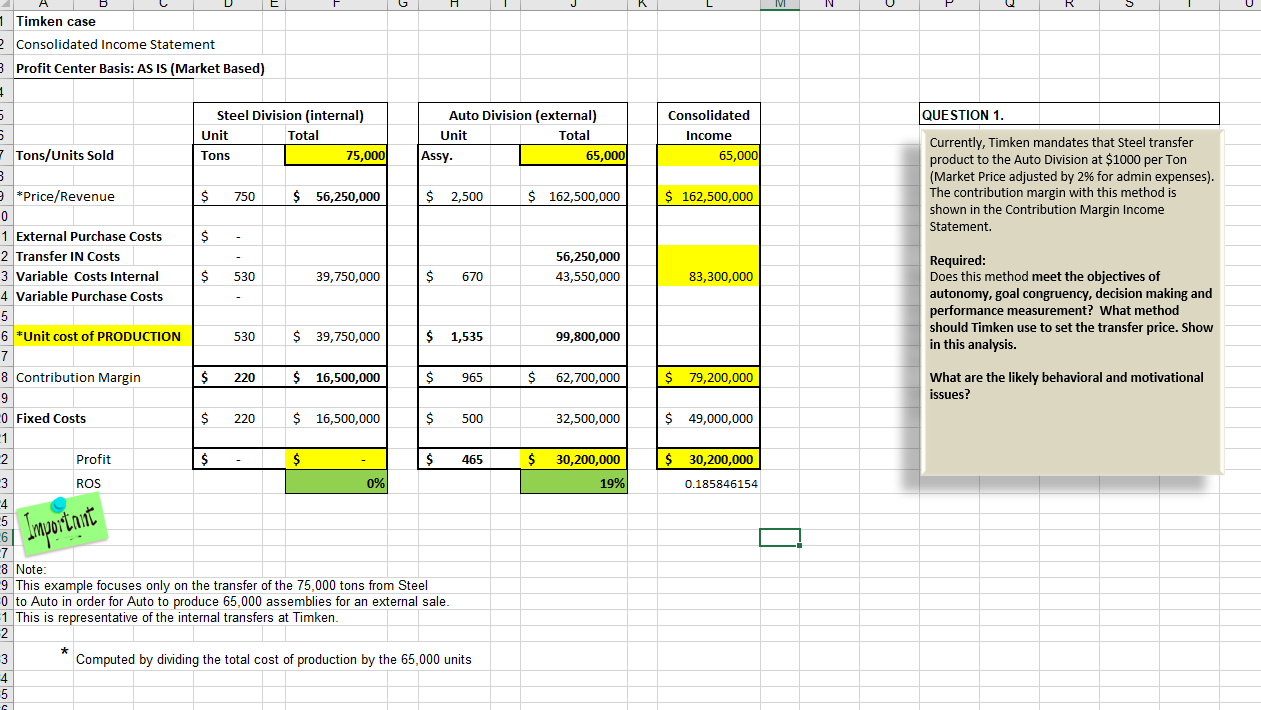

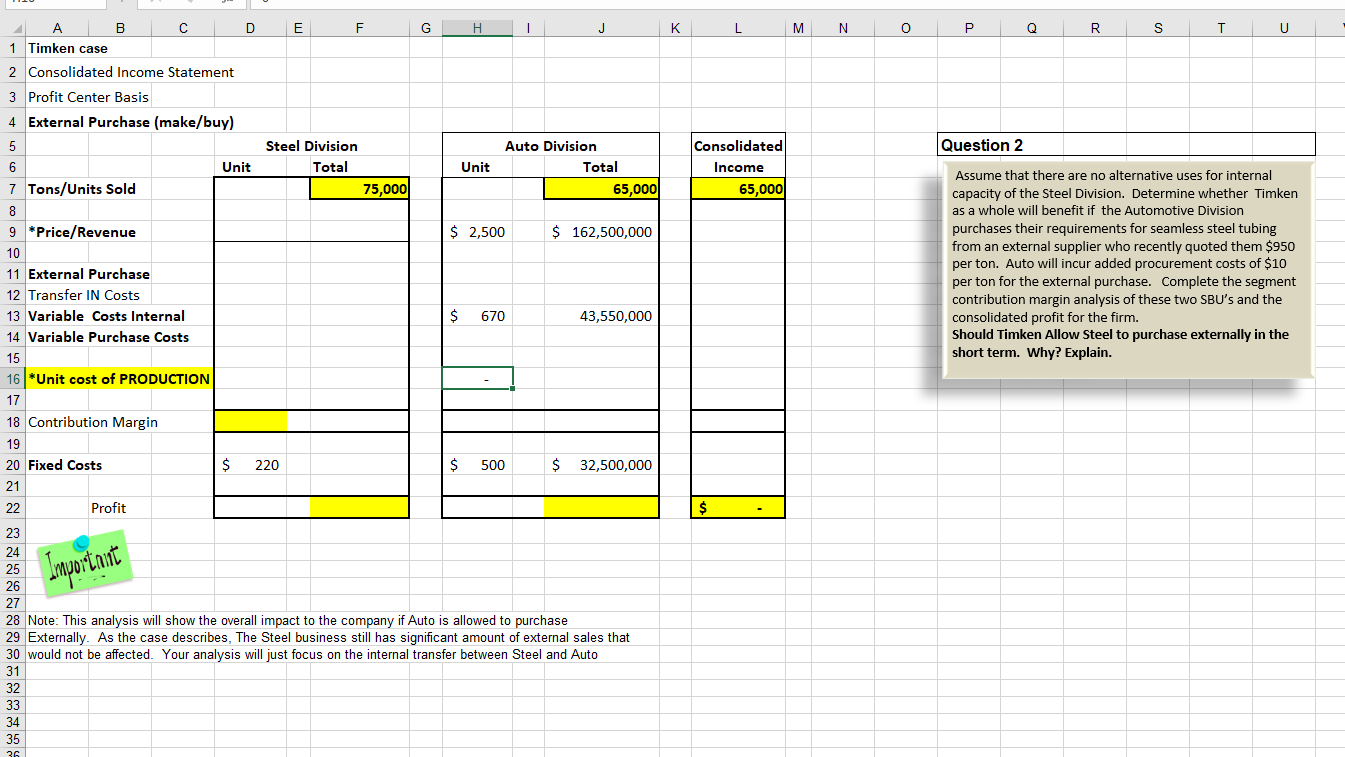

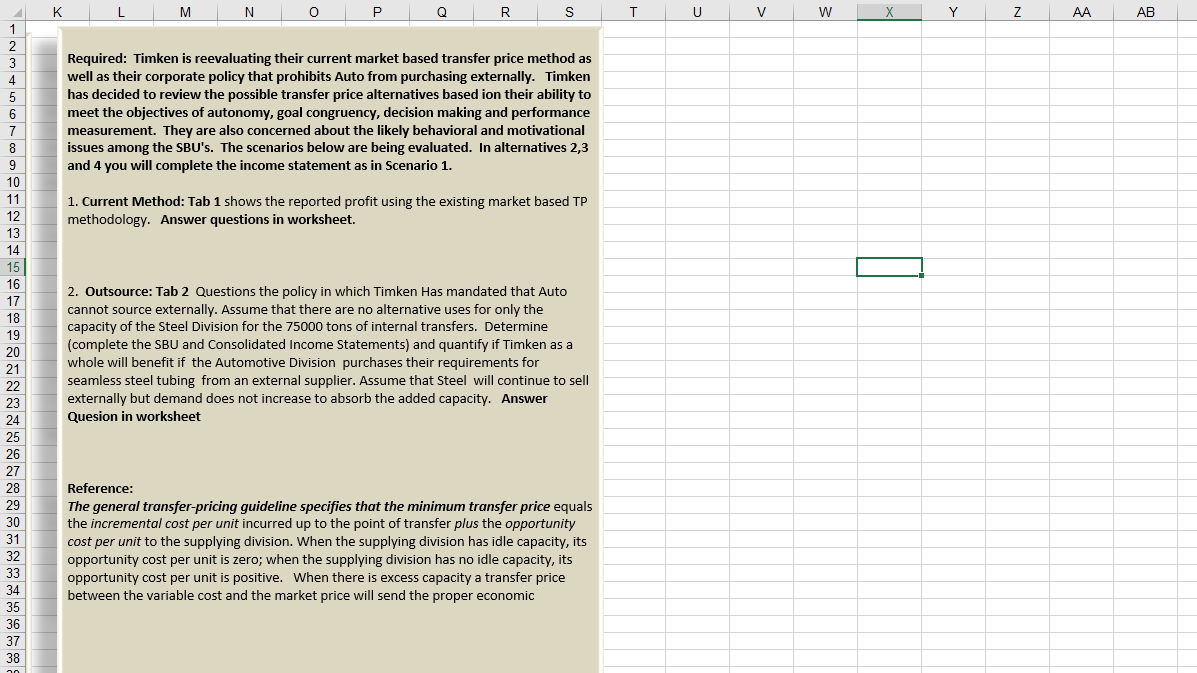

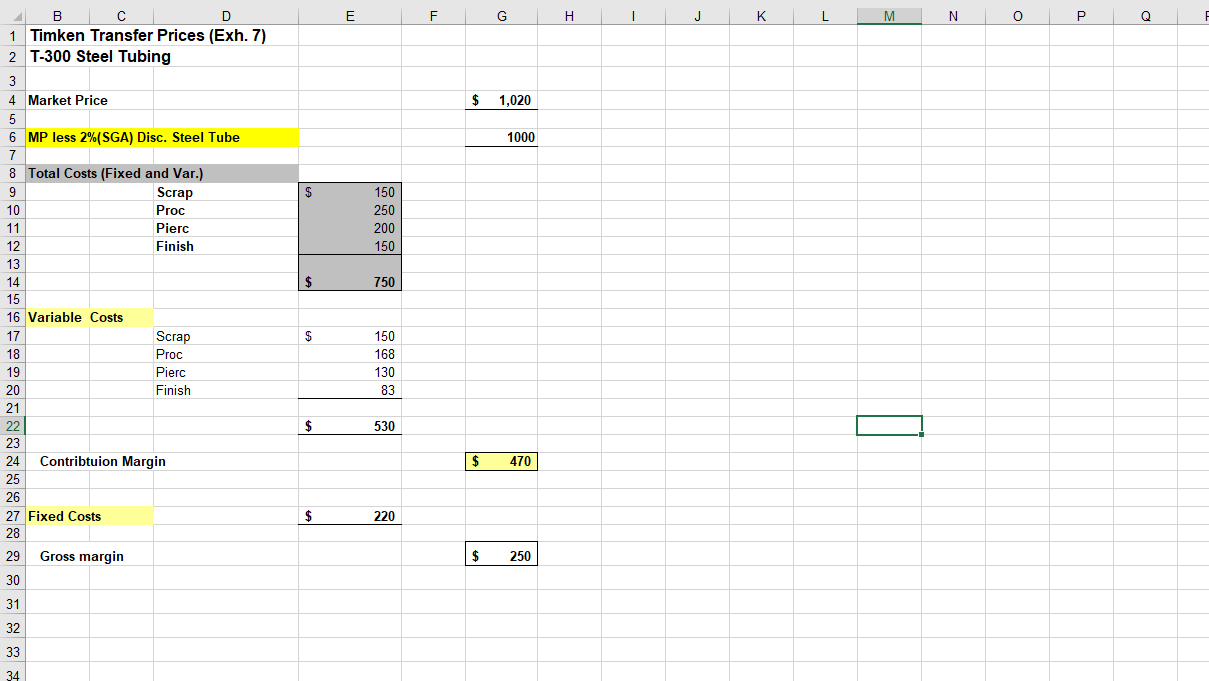

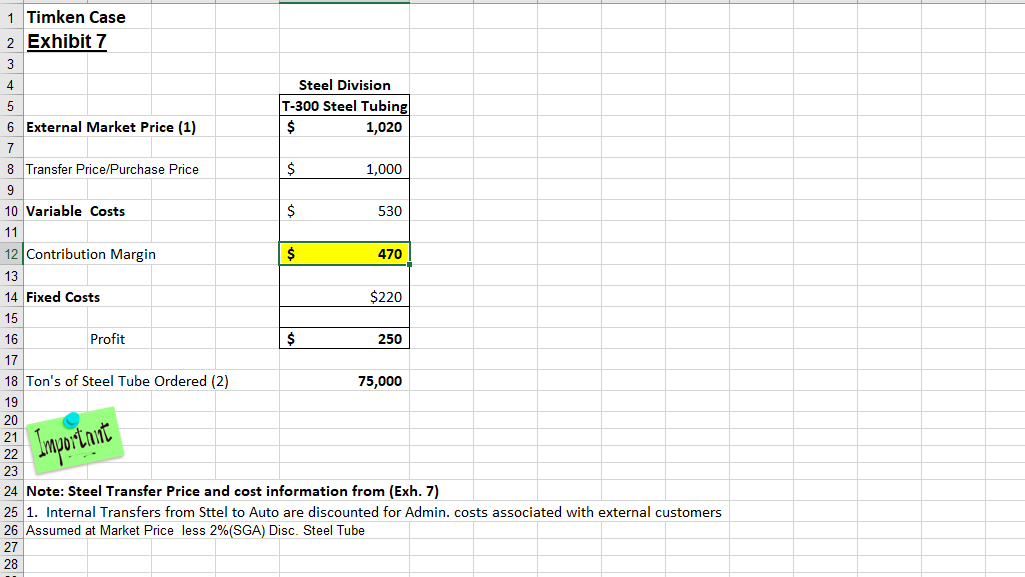

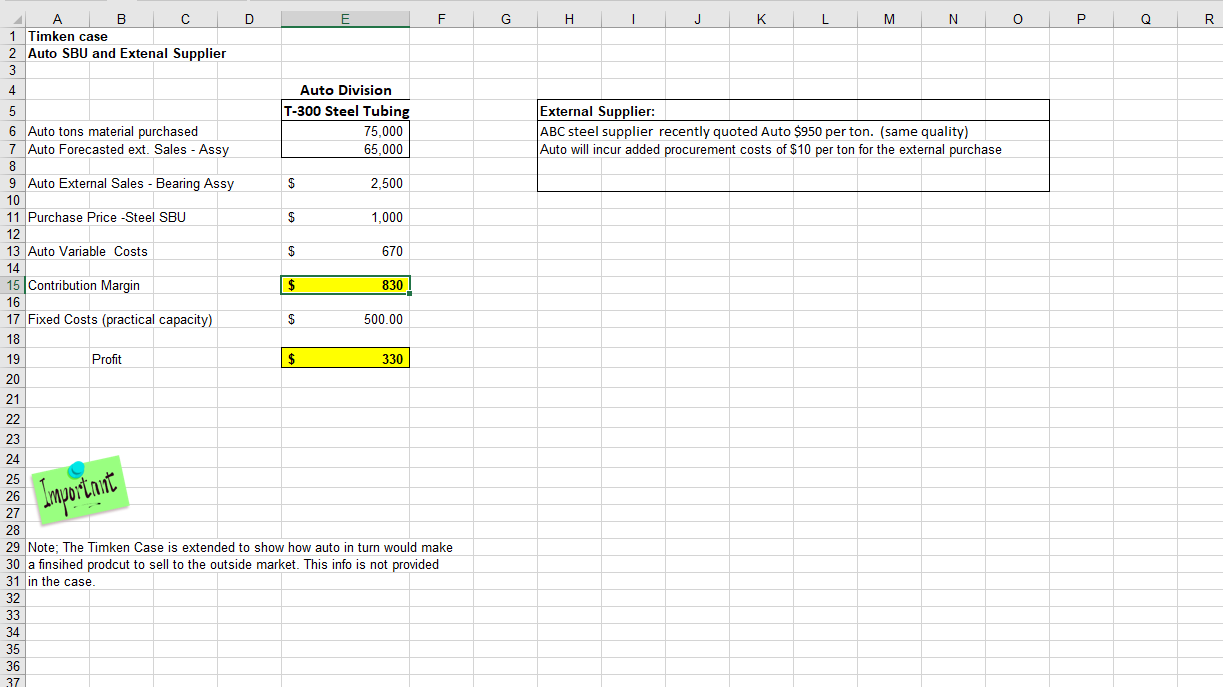

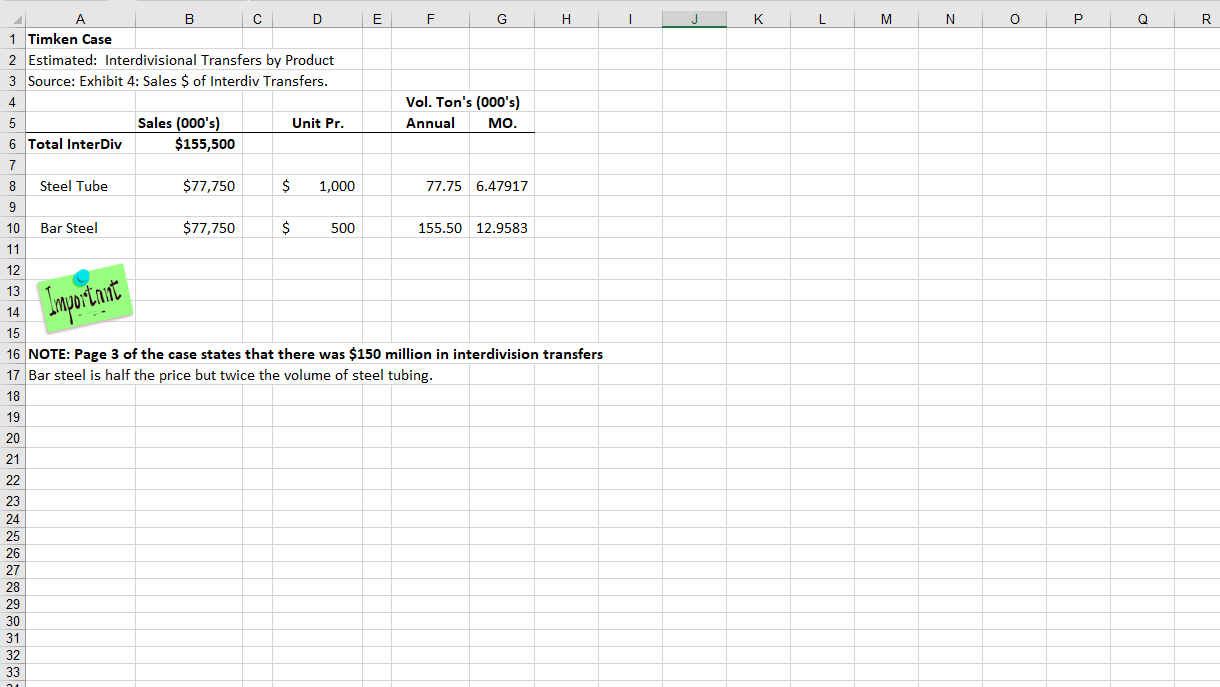

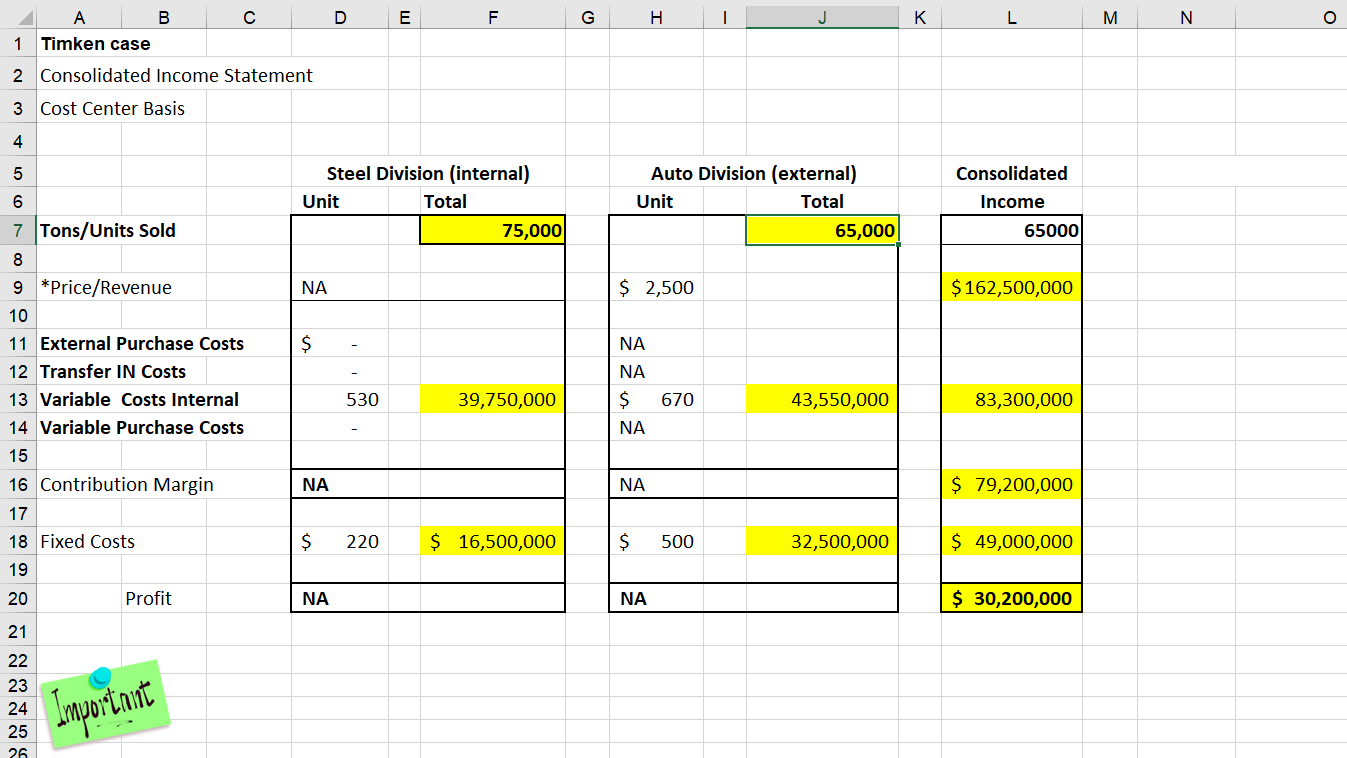

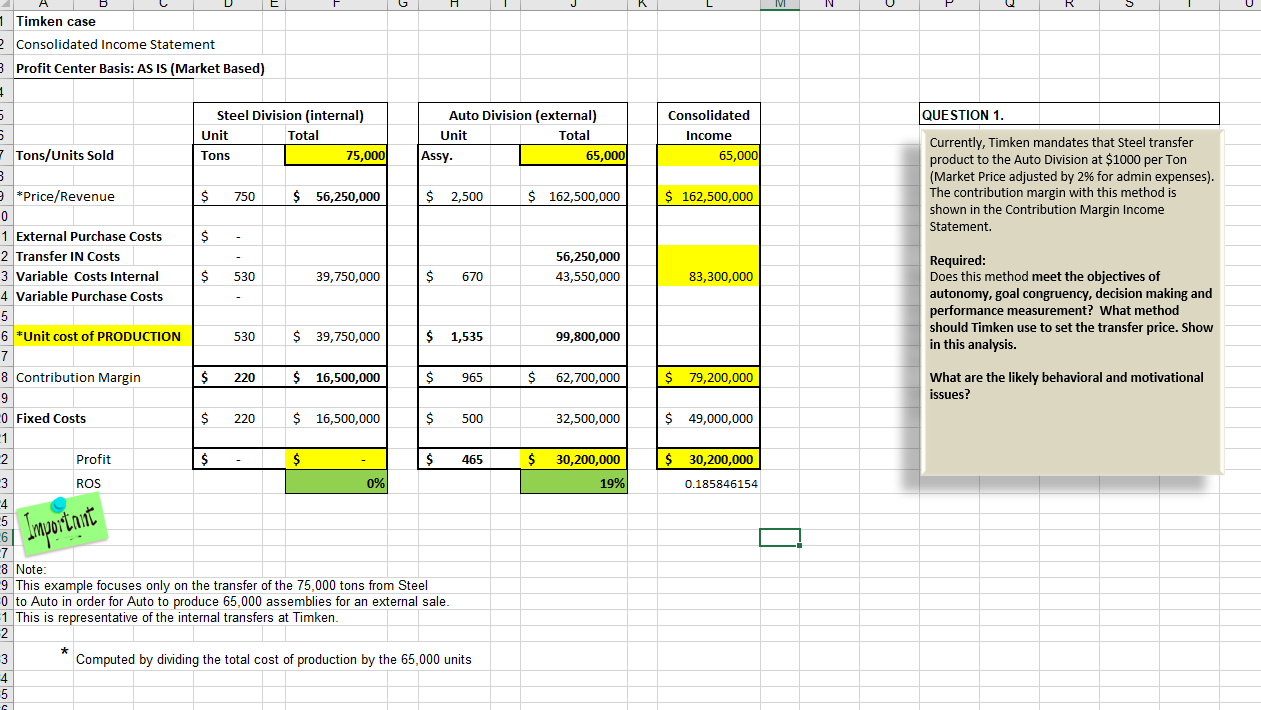

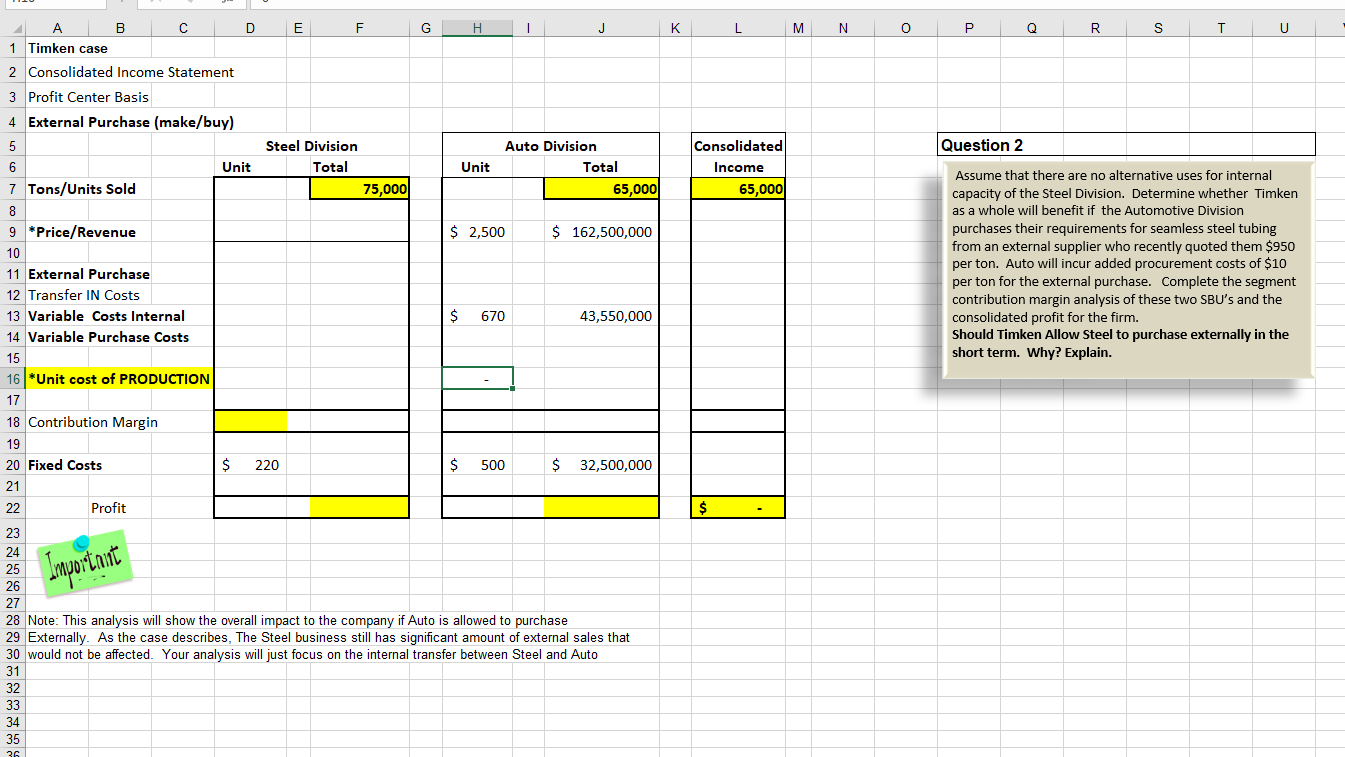

M N 0 Q R S T U V W X Y Z AA AB 1 2 3 5 Required: Timken is reevaluating their current market based transfer price method as well as their corporate policy that prohibits Auto from purchasing externally. Timken has decided to review the possible transfer price alternatives based ion their ability to meet the objectives of autonomy, goal congruency, decision making and performance measurement. They are also concerned about the likely behavioral and motivational issues among the SBU's. The scenarios below are being evaluated. In alternatives 2,3 and 4 you will complete the income statement as in Scenario 1. 8 9 10 1. Current Method: Tab 1 shows the reported profit using the existing market based TP methodology. Answer questions in worksheet. 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 2. Outsource: Tab 2 Questions the policy in which Timken Has mandated that Auto cannot source externally. Assume that there are no alternative uses for only the capacity of the Steel Division for the 75000 tons of internal transfers. Determine (complete the SBU and Consolidated Income Statements) and quantify if Timken as a whole will benefit if the Automotive Division purchases their requirements for seamless steel tubing from an external supplier. Assume that Steel will continue to sell externally but demand does not increase to absorb the added capacity. Answer Quesion in worksheet 29 30 31 32 33 34 35 36 37 38 Reference: The general transfer-pricing guideline specifies that the minimum transfer price equals the incremental cost per unit incurred up to the point of transfer plus the opportunity cost per unit to the supplying division. When the supplying division has idle capacity, its opportunity cost per unit is zero; when the supplying division has no idle capacity, its opportunity cost per unit is positive. When there is excess capacity a transfer price between the variable cost and the market price will send the proper economic E F G H 1 J K L M N o Q F $ 1,020 1000 $ 150 250 200 150 $ 750 B D 1 Timken Transfer Prices (Exh. 7) 2 T-300 Steel Tubing 3 4 Market Price 5 6 MP less 2%(SGA) Disc. Steel Tube 7 8 Total Costs (Fixed and Var.) 9 Scrap 10 Proc 11 Pierc 12 Finish 13 14 15 16 Variable Costs 17 Scrap 18 Proc 19 Pierc 20 Finish 21 22 23 24 Contribtuion Margin 25 26 27 Fixed Costs 28 29 Gross margin 30 $ 150 168 130 83 $ 530 $ 470 $ 220 $ 250 31 32 33 34 1 Timken Case 2 Exhibit 7 3 4 Steel Division T-300 Steel Tubing $ 1,020 5 6 External Market Price (1) 7 8 Transfer Price/Purchase Price $ 1,000 9 10 Variable Costs $ 530 11 12 Contribution Margin $ 470 13 14 Fixed Costs $220 15 16 Profit $ 250 17 18 Ton's of Steel Tube Ordered (2) 75,000 19 20 21 22 23 24 Note: Steel Transfer Price and cost information from (Exh. 7) 25 1. Internal Transfers from Sttel to Auto are discounted for Admin. costs associated with external customers 26 Assumed at Market Price less 2%(SGA) Disc. Steel Tube 27 28 Important G H 1 J K L M N O Q R External Supplier: ABC steel supplier recently quoted Auto $950 per ton. (same quality) Auto will incur added procurement costs of $10 per ton for the external purchase A B D E F 1 Timken case 2 Auto SBU and Extenal Supplier 3 4 Auto Division 5 T-300 Steel Tubing 6 Auto tons material purchased 75.000 7 Auto Forecasted ext. Sales - Assy 65,000 8 9 Auto External Sales - Bearing Assy $ 2,500 10 11 Purchase Price -Steel SBU $ 1,000 12 13 Auto Variable Costs $ 670 14 15 Contribution Margin $ 830 16 17 Fixed Costs (practical capacity) $ 500.00 18 19 Profit $ 330 20 21 22 23 24 25 26 27 28 29 Note; The Timken Case is extended to show how auto in turn would make 30 a finsihed prodcut to sell to the outside market. This info is not provided 31 in the case. 32 33 34 35 36 37 Important F G H I J K L M N 0 Q R Vol. Ton's (000's) Annual MO. B 1 Timken Case 2 Estimated: Interdivisional Transfers by Product 3 Source: Exhibit 4: Sales $ of Interdiv Transfers. 4 5 Sales (000's) Unit Pr. 6 Total InterDiv $155,500 7 8 Steel Tube $77,750 $ 1,000 9 10 Bar Steel $77,750 $ 500 11 77.75 6.47917 155.50 12.9583 12 Important 13 14 15 16 NOTE: Page 3 of the case states that there was $150 million in interdivision transfers 17 Bar steel is half the price but twice the volume of steel tubing. 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 D E F H K L M N . B 1 Timken case o 2 Consolidated Income Statement 3 Cost Center Basis 4 5 Consolidated Steel Division (internal) Unit Total 75,000 Auto Division (external) Unit Total 65,000 Income 65000 NA $ 2,500 $ 162,500,000 $ 6 7 Tons/Units Sold 8 9 *Price/Revenue 10 11 External Purchase Costs 12 Transfer IN Costs 13 Variable Costs Internal 14 Variable Purchase Costs 15 16 Contribution Margin 17 18 Fixed Costs 19 20 Profit NA NA $ NA 530 39,750,000 670 43,550,000 83,300,000 NA NA $ 79,200,000 $ 220 $ 16,500,000 $ 500 32,500,000 $ 49,000,000 NA NA $ 30,200,000 21 22 23 24 25 26 Important Timken case 2 Consolidated Income Statement 3 Profit Center Basis: AS IS (Market Based) 1 5 QUESTION 1. Steel Division (internal) Unit Total Tons 75,000 Auto Division (external) Unit Total Assy. 65,000 Consolidated Income 65,000 Tons/Units Sold Currently, Timken mandates that Steel transfer product to the Auto Division at $1000 per Ton (Market Price adjusted by 2% for admin expenses). The contribution margin with this method is shown in the Contribution Margin Income Statement. S 750 $ 56,250,000 $ 2,500 $ 162,500,000 $ 162,500,000 $ - 56,250,000 43,550,000 $ 530 39,750,000 $ 670 83,300,000 *Price/Revenue 0 1 External Purchase Costs 2 Transfer In Costs 3 Variable Costs Internal 4 Variable Purchase Costs 5 6 *Unit cost of PRODUCTION 7 8 Contribution Margin 9 0 Fixed Costs 1 2 Profit Required: Does this method meet the objectives of autonomy, goal congruency, decision making and performance measurement? What method should Timken use to set the transfer price. Show in this analysis. 530 $ 39,750,000 $ 1,535 99,800,000 $ 220 $ 16,500,000 $ 965 $ 62,700,000 $ 79,200,000 What are the likely behavioral and motivational issues? $ 220 $ 16,500,000 $ 500 32,500,000 $ 49,000,000 $ $ $ 465 $ $ 30,200,000 30,200,000 19% 3 ROS 0% 0.185846154 -4 5 6 Important 8 Note: 9 This example focuses only on the transfer of the 75,000 tons from Steel 0 to Auto in order for Auto to produce 65,000 assemblies for an external sale. 1 This is representative of the internal transfers at Timken. 2 Computed by dividing the total cost of production by the 65,000 units 3 4 5 L M N O Q R S T U Question 2 Consolidated Income 65,000 Assume that there are no alternative uses for internal capacity of the Steel Division. Determine whether Timken as a whole will benefit if the Automotive Division purchases their requirements for seamless steel tubing from an external supplier who recently quoted them $950 per ton. Auto will incur added procurement costs of $10 per ton for the external purchase. Complete the segment contribution margin analysis of these two SBU's and the consolidated profit for the firm. Should Timken Allow Steel to purchase externally in the short term. Why? Explain. B D E F G J 1 Timken case 2 Consolidated Income Statement 3 Profit Center Basis 4 External Purchase (make/buy) 5 Steel Division Auto Division 6 Unit Total Unit Total 7 Tons/Units Sold 75,000 65,000 8 9 *Price/Revenue $ 2,500 $ 162,500,000 10 11 External Purchase 12 Transfer IN Costs 13 Variable Costs Internal $ 670 43,550,000 14 Variable Purchase Costs 15 16 *Unit cost of PRODUCTION 17 18 Contribution Margin 19 20 Fixed Costs $ 220 $ 500 $ 32,500,000 21 22 Profit 23 24 25 26 27 28 Note: This analysis will show the overall impact to the company if Auto is allowed to purchase 29 Externally. As the case describes, The Steel business still has significant amount of external sales that 30 would not be affected. Your analysis will just focus on the internal transfer between Steel and Auto 31 32 33 34 35 36 $ Important M N 0 Q R S T U V W X Y Z AA AB 1 2 3 5 Required: Timken is reevaluating their current market based transfer price method as well as their corporate policy that prohibits Auto from purchasing externally. Timken has decided to review the possible transfer price alternatives based ion their ability to meet the objectives of autonomy, goal congruency, decision making and performance measurement. They are also concerned about the likely behavioral and motivational issues among the SBU's. The scenarios below are being evaluated. In alternatives 2,3 and 4 you will complete the income statement as in Scenario 1. 8 9 10 1. Current Method: Tab 1 shows the reported profit using the existing market based TP methodology. Answer questions in worksheet. 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 2. Outsource: Tab 2 Questions the policy in which Timken Has mandated that Auto cannot source externally. Assume that there are no alternative uses for only the capacity of the Steel Division for the 75000 tons of internal transfers. Determine (complete the SBU and Consolidated Income Statements) and quantify if Timken as a whole will benefit if the Automotive Division purchases their requirements for seamless steel tubing from an external supplier. Assume that Steel will continue to sell externally but demand does not increase to absorb the added capacity. Answer Quesion in worksheet 29 30 31 32 33 34 35 36 37 38 Reference: The general transfer-pricing guideline specifies that the minimum transfer price equals the incremental cost per unit incurred up to the point of transfer plus the opportunity cost per unit to the supplying division. When the supplying division has idle capacity, its opportunity cost per unit is zero; when the supplying division has no idle capacity, its opportunity cost per unit is positive. When there is excess capacity a transfer price between the variable cost and the market price will send the proper economic E F G H 1 J K L M N o Q F $ 1,020 1000 $ 150 250 200 150 $ 750 B D 1 Timken Transfer Prices (Exh. 7) 2 T-300 Steel Tubing 3 4 Market Price 5 6 MP less 2%(SGA) Disc. Steel Tube 7 8 Total Costs (Fixed and Var.) 9 Scrap 10 Proc 11 Pierc 12 Finish 13 14 15 16 Variable Costs 17 Scrap 18 Proc 19 Pierc 20 Finish 21 22 23 24 Contribtuion Margin 25 26 27 Fixed Costs 28 29 Gross margin 30 $ 150 168 130 83 $ 530 $ 470 $ 220 $ 250 31 32 33 34 1 Timken Case 2 Exhibit 7 3 4 Steel Division T-300 Steel Tubing $ 1,020 5 6 External Market Price (1) 7 8 Transfer Price/Purchase Price $ 1,000 9 10 Variable Costs $ 530 11 12 Contribution Margin $ 470 13 14 Fixed Costs $220 15 16 Profit $ 250 17 18 Ton's of Steel Tube Ordered (2) 75,000 19 20 21 22 23 24 Note: Steel Transfer Price and cost information from (Exh. 7) 25 1. Internal Transfers from Sttel to Auto are discounted for Admin. costs associated with external customers 26 Assumed at Market Price less 2%(SGA) Disc. Steel Tube 27 28 Important G H 1 J K L M N O Q R External Supplier: ABC steel supplier recently quoted Auto $950 per ton. (same quality) Auto will incur added procurement costs of $10 per ton for the external purchase A B D E F 1 Timken case 2 Auto SBU and Extenal Supplier 3 4 Auto Division 5 T-300 Steel Tubing 6 Auto tons material purchased 75.000 7 Auto Forecasted ext. Sales - Assy 65,000 8 9 Auto External Sales - Bearing Assy $ 2,500 10 11 Purchase Price -Steel SBU $ 1,000 12 13 Auto Variable Costs $ 670 14 15 Contribution Margin $ 830 16 17 Fixed Costs (practical capacity) $ 500.00 18 19 Profit $ 330 20 21 22 23 24 25 26 27 28 29 Note; The Timken Case is extended to show how auto in turn would make 30 a finsihed prodcut to sell to the outside market. This info is not provided 31 in the case. 32 33 34 35 36 37 Important F G H I J K L M N 0 Q R Vol. Ton's (000's) Annual MO. B 1 Timken Case 2 Estimated: Interdivisional Transfers by Product 3 Source: Exhibit 4: Sales $ of Interdiv Transfers. 4 5 Sales (000's) Unit Pr. 6 Total InterDiv $155,500 7 8 Steel Tube $77,750 $ 1,000 9 10 Bar Steel $77,750 $ 500 11 77.75 6.47917 155.50 12.9583 12 Important 13 14 15 16 NOTE: Page 3 of the case states that there was $150 million in interdivision transfers 17 Bar steel is half the price but twice the volume of steel tubing. 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 D E F H K L M N . B 1 Timken case o 2 Consolidated Income Statement 3 Cost Center Basis 4 5 Consolidated Steel Division (internal) Unit Total 75,000 Auto Division (external) Unit Total 65,000 Income 65000 NA $ 2,500 $ 162,500,000 $ 6 7 Tons/Units Sold 8 9 *Price/Revenue 10 11 External Purchase Costs 12 Transfer IN Costs 13 Variable Costs Internal 14 Variable Purchase Costs 15 16 Contribution Margin 17 18 Fixed Costs 19 20 Profit NA NA $ NA 530 39,750,000 670 43,550,000 83,300,000 NA NA $ 79,200,000 $ 220 $ 16,500,000 $ 500 32,500,000 $ 49,000,000 NA NA $ 30,200,000 21 22 23 24 25 26 Important Timken case 2 Consolidated Income Statement 3 Profit Center Basis: AS IS (Market Based) 1 5 QUESTION 1. Steel Division (internal) Unit Total Tons 75,000 Auto Division (external) Unit Total Assy. 65,000 Consolidated Income 65,000 Tons/Units Sold Currently, Timken mandates that Steel transfer product to the Auto Division at $1000 per Ton (Market Price adjusted by 2% for admin expenses). The contribution margin with this method is shown in the Contribution Margin Income Statement. S 750 $ 56,250,000 $ 2,500 $ 162,500,000 $ 162,500,000 $ - 56,250,000 43,550,000 $ 530 39,750,000 $ 670 83,300,000 *Price/Revenue 0 1 External Purchase Costs 2 Transfer In Costs 3 Variable Costs Internal 4 Variable Purchase Costs 5 6 *Unit cost of PRODUCTION 7 8 Contribution Margin 9 0 Fixed Costs 1 2 Profit Required: Does this method meet the objectives of autonomy, goal congruency, decision making and performance measurement? What method should Timken use to set the transfer price. Show in this analysis. 530 $ 39,750,000 $ 1,535 99,800,000 $ 220 $ 16,500,000 $ 965 $ 62,700,000 $ 79,200,000 What are the likely behavioral and motivational issues? $ 220 $ 16,500,000 $ 500 32,500,000 $ 49,000,000 $ $ $ 465 $ $ 30,200,000 30,200,000 19% 3 ROS 0% 0.185846154 -4 5 6 Important 8 Note: 9 This example focuses only on the transfer of the 75,000 tons from Steel 0 to Auto in order for Auto to produce 65,000 assemblies for an external sale. 1 This is representative of the internal transfers at Timken. 2 Computed by dividing the total cost of production by the 65,000 units 3 4 5 L M N O Q R S T U Question 2 Consolidated Income 65,000 Assume that there are no alternative uses for internal capacity of the Steel Division. Determine whether Timken as a whole will benefit if the Automotive Division purchases their requirements for seamless steel tubing from an external supplier who recently quoted them $950 per ton. Auto will incur added procurement costs of $10 per ton for the external purchase. Complete the segment contribution margin analysis of these two SBU's and the consolidated profit for the firm. Should Timken Allow Steel to purchase externally in the short term. Why? Explain. B D E F G J 1 Timken case 2 Consolidated Income Statement 3 Profit Center Basis 4 External Purchase (make/buy) 5 Steel Division Auto Division 6 Unit Total Unit Total 7 Tons/Units Sold 75,000 65,000 8 9 *Price/Revenue $ 2,500 $ 162,500,000 10 11 External Purchase 12 Transfer IN Costs 13 Variable Costs Internal $ 670 43,550,000 14 Variable Purchase Costs 15 16 *Unit cost of PRODUCTION 17 18 Contribution Margin 19 20 Fixed Costs $ 220 $ 500 $ 32,500,000 21 22 Profit 23 24 25 26 27 28 Note: This analysis will show the overall impact to the company if Auto is allowed to purchase 29 Externally. As the case describes, The Steel business still has significant amount of external sales that 30 would not be affected. Your analysis will just focus on the internal transfer between Steel and Auto 31 32 33 34 35 36 $ Important