Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Timone retired on 30 November 2021 at the age of 67. On retirement, he received the following amounts: A lump sum amount of R69

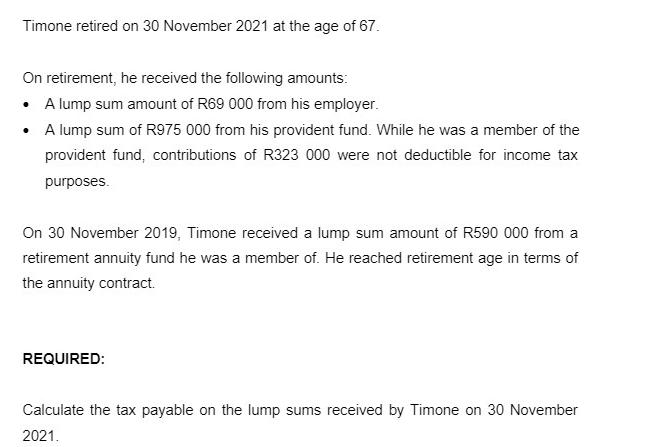

Timone retired on 30 November 2021 at the age of 67. On retirement, he received the following amounts: A lump sum amount of R69 000 from his employer. A lump sum of R975 000 from his provident fund. While he was a member of the provident fund, contributions of R323 000 were not deductible for income tax purposes. On 30 November 2019, Timone received a lump sum amount of R590 000 from a retirement annuity fund he was a member of. He reached retirement age in terms of the annuity contract. REQUIRED: Calculate the tax payable on the lump sums received by Timone on 30 November 2021.

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Lump Sum from Employer R69 000 Taxable Portion R69 000 23 R46 000 Tax payable R46 000 18 R8 280 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started