Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Timothe is single with no children. He is 40 years old and plans to retire when he reaches 65 in 25 years. Timothe estimates

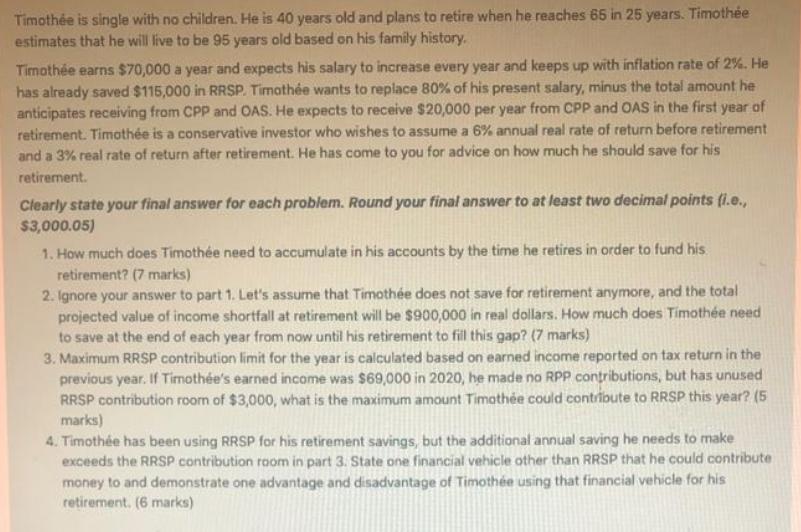

Timothe is single with no children. He is 40 years old and plans to retire when he reaches 65 in 25 years. Timothe estimates that he will live to be 95 years old based on his family history. Timothe earns $70,000 a year and expects his salary to increase every year and keeps up with inflation rate of 2%. He has already saved $115,000 in RRSP. Timothe wants to replace 80% of his present salary, minus the total amount he anticipates receiving from CPP and OAS. He expects to receive $20,000 per year from CPP and OAS in the first year of retirement. Timothe is a conservative investor who wishes to assume a 6% annual real rate of return before retirement and a 3% real rate of return after retirement. He has come to you for advice on how much he should save for his retirement. Clearly state your final answer for each problem. Round your final answer to at least two decimal points (i.e., $3,000.05) 1. How much does Timothe need to accumulate in his accounts by the time he retires in order to fund his retirement? (7 marks) 2. Ignore your answer to part 1. Let's assume that Timothe does not save for retirement anymore, and the total projected value of income shortfall at retirement will be $900,000 in real dollars. How much does Timothe need to save at the end of each year from now until his retirement to fill this gap? (7 marks) 3. Maximum RRSP contribution limit for the year is calculated based on earned income reported on tax return in the previous year. If Timothe's earned income was $69,000 in 2020, he made no RPP contributions, but has unused RRSP contribution room of $3,000, what is the maximum amount Timothe could contribute to RRSP this year? (5 marks) 4. Timothe has been using RRSP for his retirement savings, but the additional annual saving he needs to make exceeds the RRSP contribution room in part 3. State one financial vehicle other than RRSP that he could contribute money to and demonstrate one advantage and disadvantage of Timothe using that financial vehicle for his retirement. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Timothee needs to accumulate 174647143 in his accounts by the time he retires in order to fund his ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started