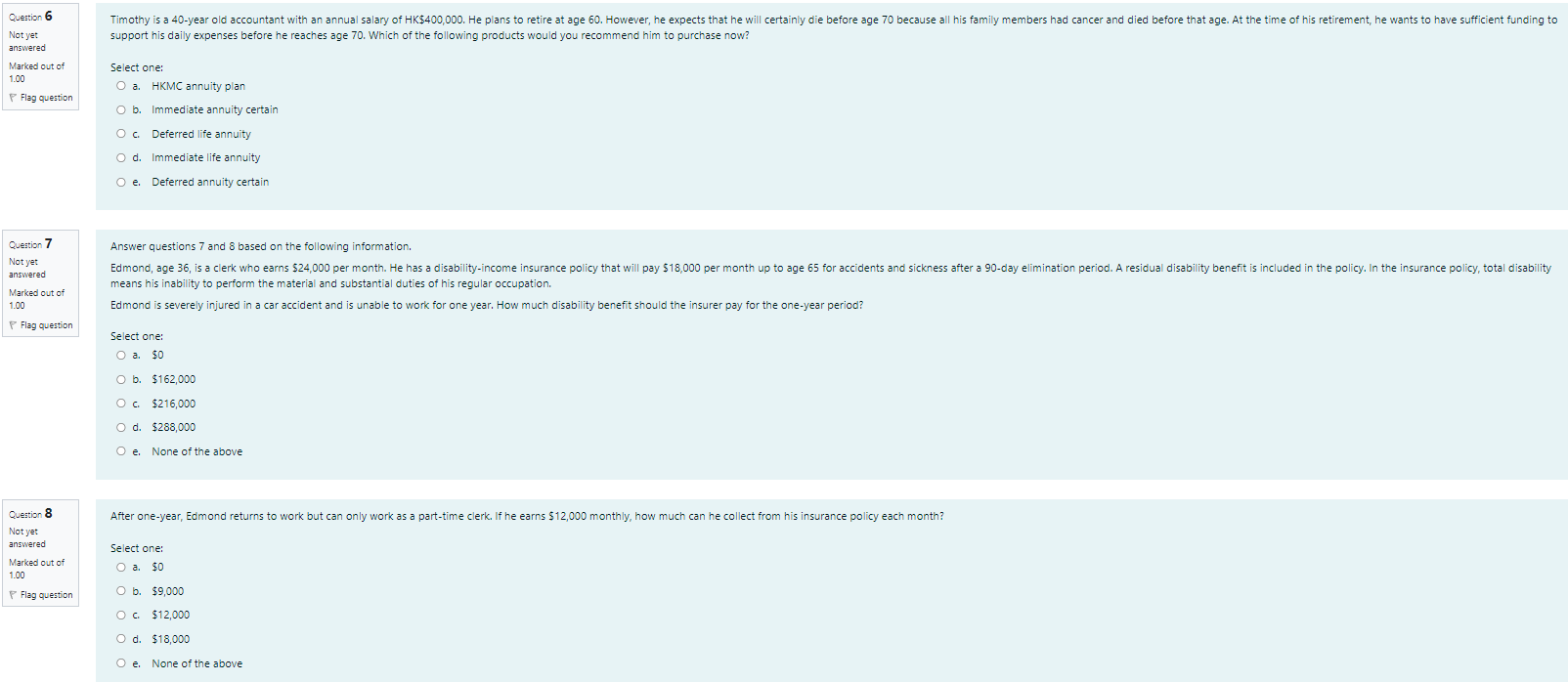

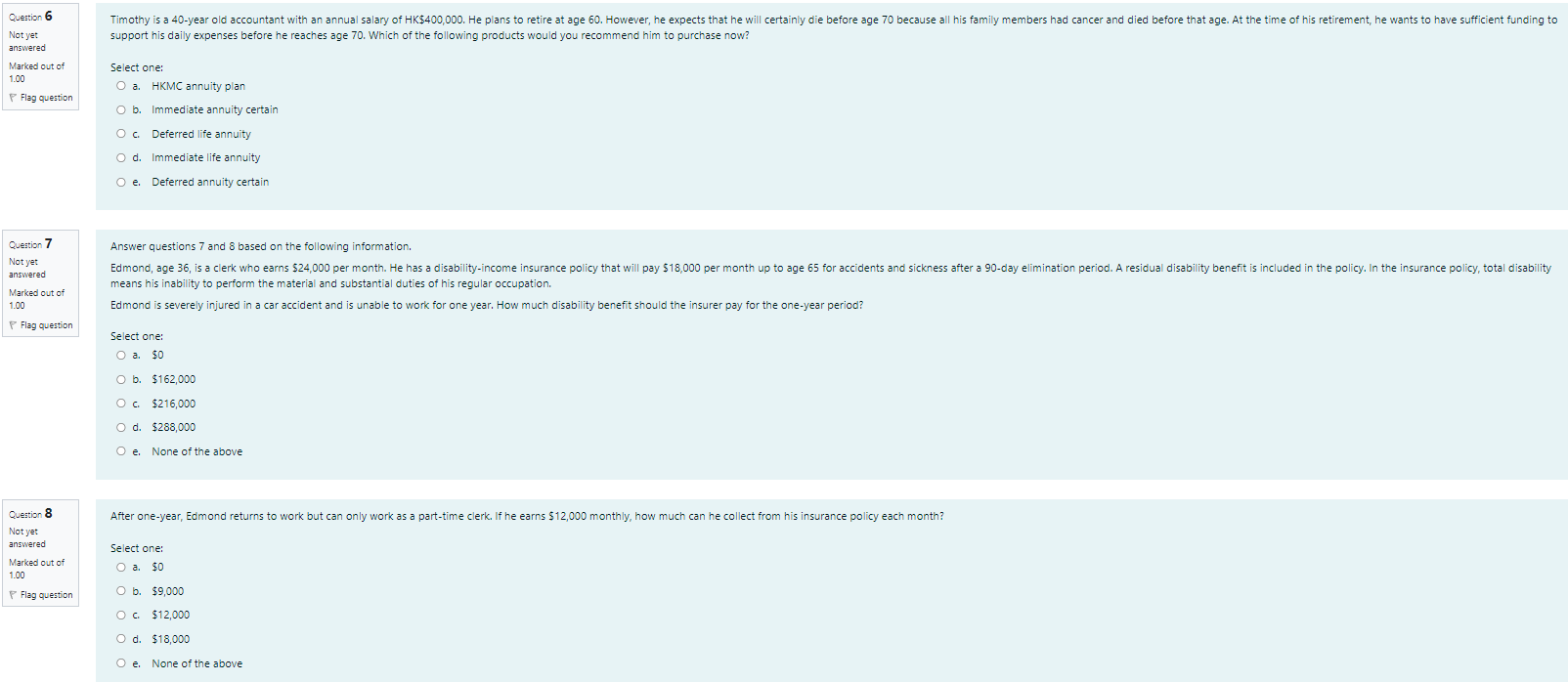

Timothy is a 40-year old accountant with an annual salary of HK$400,000. He plans to retire at age 60. However, he expects that he will certainly die before age 70 because all his family members had cancer and died before that age. At the time of his retirement, he wants to have sufficient funding to support his daily expenses before he reaches age 70. Which of the following products would you recommend him to purchase now? Question 6 Not yet answered Marked out of 1.00 Select one: O a HKMC annuity plan Flag question O b. Immediate annuity certain Oc Deferred life annuity O d. Immediate life annuity O e Deferred annuity certain Question 7 Not yet answered Marked out of 1.00 Answer questions 7 and 8 based on the following information. Edmond, age 36, is a clerk who earns $24,000 per month. He has a disability-income insurance policy that will pay 518,000 per month up to age 65 for accidents and sickness after a 90-day elimination period. A residual disability benefit is included in the policy. In the insurance policy, total disability means his inability to perform the material and substantial duties of his regular occupation. Edmond is severely injured in a car accident and is unable to work for one year. How much disability benefit should the insurer pay for the one-year period? Flag question Select one: O a $0 O b. $162,000 Oc $216,000 . $ O d. $288,000 Oe. None of the above After one-year, Edmond returns to work but can only work as a part-time clerk. If he earns $12,000 monthly, how much can he collect from his insurance policy each month? Question 8 Not yet answered Marked out of 1.00 Select one: O a $0 Flag question O b. $9,000 OC $12,000 O d. $18,000 Oe. None of the above Timothy is a 40-year old accountant with an annual salary of HK$400,000. He plans to retire at age 60. However, he expects that he will certainly die before age 70 because all his family members had cancer and died before that age. At the time of his retirement, he wants to have sufficient funding to support his daily expenses before he reaches age 70. Which of the following products would you recommend him to purchase now? Question 6 Not yet answered Marked out of 1.00 Select one: O a HKMC annuity plan Flag question O b. Immediate annuity certain Oc Deferred life annuity O d. Immediate life annuity O e Deferred annuity certain Question 7 Not yet answered Marked out of 1.00 Answer questions 7 and 8 based on the following information. Edmond, age 36, is a clerk who earns $24,000 per month. He has a disability-income insurance policy that will pay 518,000 per month up to age 65 for accidents and sickness after a 90-day elimination period. A residual disability benefit is included in the policy. In the insurance policy, total disability means his inability to perform the material and substantial duties of his regular occupation. Edmond is severely injured in a car accident and is unable to work for one year. How much disability benefit should the insurer pay for the one-year period? Flag question Select one: O a $0 O b. $162,000 Oc $216,000 . $ O d. $288,000 Oe. None of the above After one-year, Edmond returns to work but can only work as a part-time clerk. If he earns $12,000 monthly, how much can he collect from his insurance policy each month? Question 8 Not yet answered Marked out of 1.00 Select one: O a $0 Flag question O b. $9,000 OC $12,000 O d. $18,000 Oe. None of the above