Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tina is the sole owner of Tina's Lawn Mowing, Incorporated (TLM). In one year, TLM collects $2110000 from customers to mow their lawns. TLM's

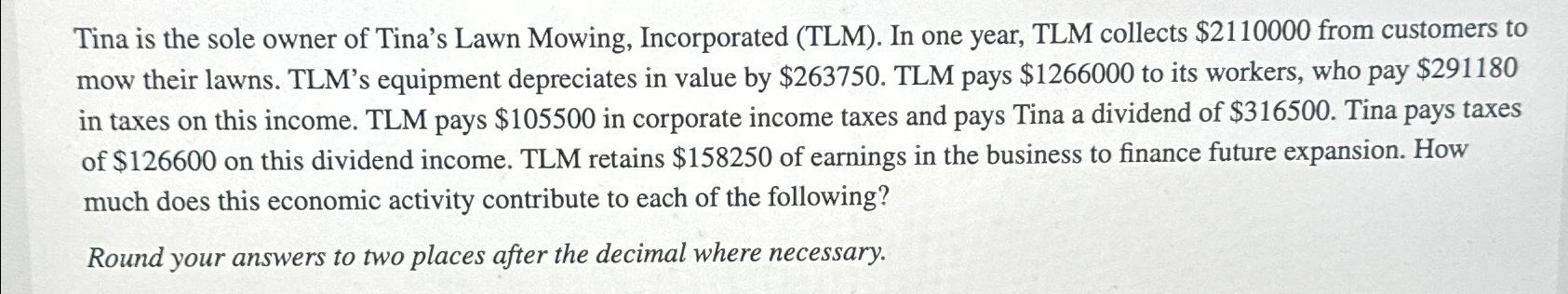

Tina is the sole owner of Tina's Lawn Mowing, Incorporated (TLM). In one year, TLM collects $2110000 from customers to mow their lawns. TLM's equipment depreciates in value by $263750. TLM pays $1266000 to its workers, who pay $291180 in taxes on this income. TLM pays $105500 in corporate income taxes and pays Tina a dividend of $316500. Tina pays taxes of $126600 on this dividend income. TLM retains $158250 of earnings in the business to finance future expansion. How much does this economic activity contribute to each of the following? Round your answers to two places after the decimal where necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine how much this economic activity contributes to each of the following lets calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started