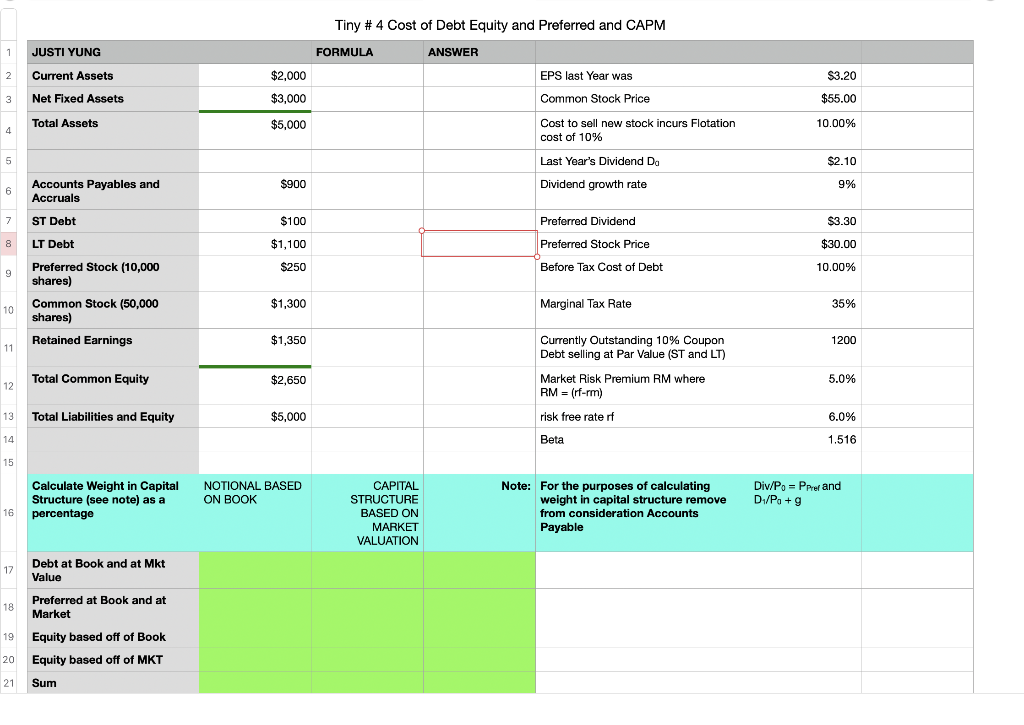

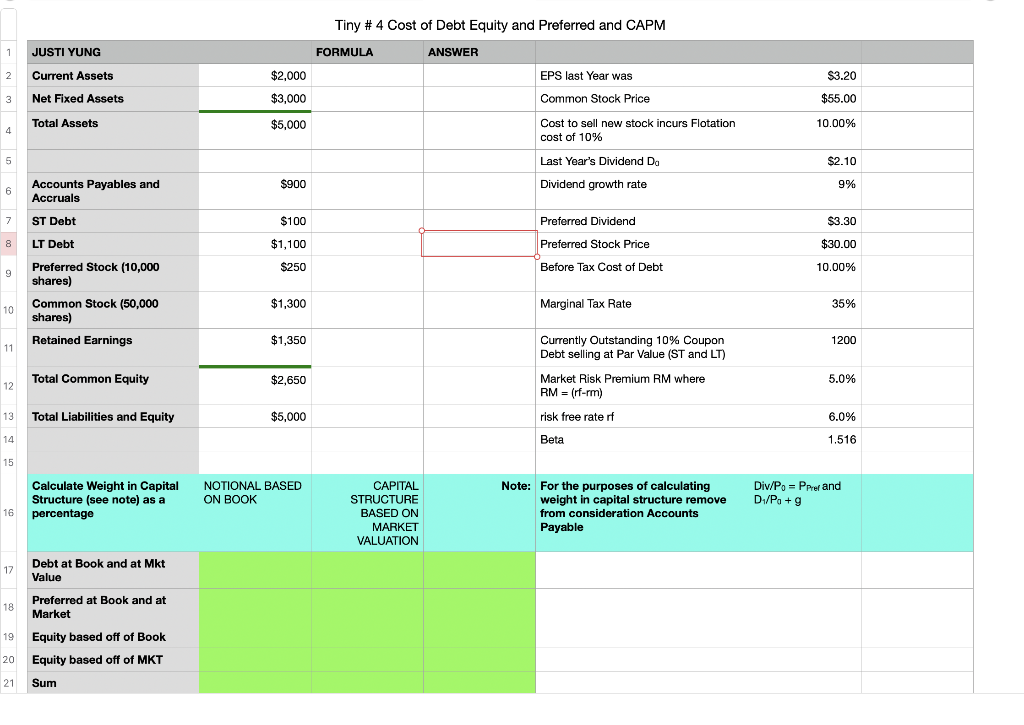

Tiny # 4 Cost of Debt Equity and Preferred and CAPM 1 FORMULA ANSWER JUSTI YUNG Current Assets 2 $2,000 $3.20 EPS last Year was Common Stock Price 3 Net Fixed Assets $3,000 $55.00 Total Assets $5,000 10.00% 4 Cost to sell new stock incurs Flotation cost of 10% 5 Last Year's Dividend Da $2.10 $900 Dividend growth rate 9% Accounts Payables and Accruals 6 7 ST Debt $100 $3.30 Preferred Dividend Preferred Stock Price 8 LT Debt $1,100 $30.00 $250 Before Tax Cost of Debt 10.00% 9 Preferred Stock (10,000 shares) Common Stock (50,000 shares) 10 $1,300 Marginal Tax Rate 35% Retained Earnings $1,350 1200 11 Currently Outstanding 10% Coupon Debt selling at Par Value (ST and LT) Market Risk Premium RM where RM = (rf-rm) Total Common Equity $2,650 5.0% 12 13 Total Liabilities and Equity $5,000 6.0% risk free rate of Beta 14 1.516 15 Calculate Weight in Capital Structure (see note) as a percentage NOTIONAL BASED ON BOOK Div/P, = Perer and D/P. + 16 CAPITAL STRUCTURE BASED ON MARKET VALUATION Note: For the purposes of calculating weight in capital structure remove from consideration Accounts Payable 17 Debt at Book and at Mkt Value 18 19 Preferred at Book and at Market Equity based off of Book Equity based off of MKT 20 21 Sum Tiny # 4 Cost of Debt Equity and Preferred and CAPM FORMULA ANSWER 1 1 JUSTI YUNG rs YT 21 Sum 22 4 Point 23 FORMULA RATE 24 1 Point 25 Calculate Value of the Preferred shares Calculate the weighted cost of Preferred 1 Point 26 27 1 Point 28 29 1 Point Calculate Cost of Equity (DCF) Calculate Cost of EQ with Flotation Costs Weighted Cost of Equity Capital Weighted Cost of EQ with Flotation costs 1 Point 30 1 Point 31 32 33 1 Point After Tax Cost of Debt Calculate the weighted cost of Debt 1 Point 34 35 1 Point 36 WACC using retained earnings and w/o Flotation WACC using new common stock and with Flotation 1 Point 37 38 39 Calculate the CAPM WACC 1 Point 40 Tiny # 4 Cost of Debt Equity and Preferred and CAPM 1 FORMULA ANSWER JUSTI YUNG Current Assets 2 $2,000 $3.20 EPS last Year was Common Stock Price 3 Net Fixed Assets $3,000 $55.00 Total Assets $5,000 10.00% 4 Cost to sell new stock incurs Flotation cost of 10% 5 Last Year's Dividend Da $2.10 $900 Dividend growth rate 9% Accounts Payables and Accruals 6 7 ST Debt $100 $3.30 Preferred Dividend Preferred Stock Price 8 LT Debt $1,100 $30.00 $250 Before Tax Cost of Debt 10.00% 9 Preferred Stock (10,000 shares) Common Stock (50,000 shares) 10 $1,300 Marginal Tax Rate 35% Retained Earnings $1,350 1200 11 Currently Outstanding 10% Coupon Debt selling at Par Value (ST and LT) Market Risk Premium RM where RM = (rf-rm) Total Common Equity $2,650 5.0% 12 13 Total Liabilities and Equity $5,000 6.0% risk free rate of Beta 14 1.516 15 Calculate Weight in Capital Structure (see note) as a percentage NOTIONAL BASED ON BOOK Div/P, = Perer and D/P. + 16 CAPITAL STRUCTURE BASED ON MARKET VALUATION Note: For the purposes of calculating weight in capital structure remove from consideration Accounts Payable 17 Debt at Book and at Mkt Value 18 19 Preferred at Book and at Market Equity based off of Book Equity based off of MKT 20 21 Sum Tiny # 4 Cost of Debt Equity and Preferred and CAPM FORMULA ANSWER 1 1 JUSTI YUNG rs YT 21 Sum 22 4 Point 23 FORMULA RATE 24 1 Point 25 Calculate Value of the Preferred shares Calculate the weighted cost of Preferred 1 Point 26 27 1 Point 28 29 1 Point Calculate Cost of Equity (DCF) Calculate Cost of EQ with Flotation Costs Weighted Cost of Equity Capital Weighted Cost of EQ with Flotation costs 1 Point 30 1 Point 31 32 33 1 Point After Tax Cost of Debt Calculate the weighted cost of Debt 1 Point 34 35 1 Point 36 WACC using retained earnings and w/o Flotation WACC using new common stock and with Flotation 1 Point 37 38 39 Calculate the CAPM WACC 1 Point 40