Answered step by step

Verified Expert Solution

Question

1 Approved Answer

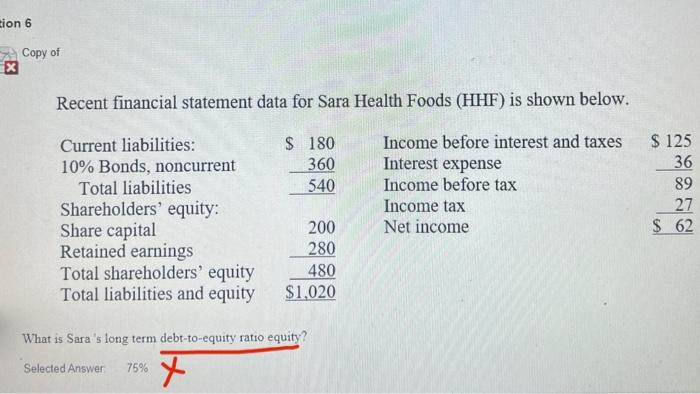

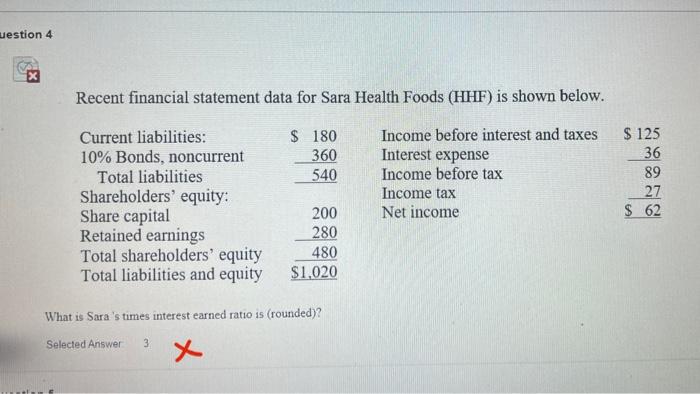

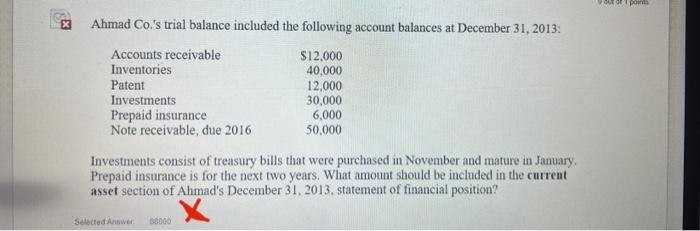

tion 6 x Copy of Recent financial statement data for Sara Health Foods (HHF) is shown below. Current liabilities: $ 180 Income before interest

tion 6 x Copy of Recent financial statement data for Sara Health Foods (HHF) is shown below. Current liabilities: $ 180 Income before interest and taxes Interest expense 10% Bonds, noncurrent 360 540 Income before tax Income tax Net income Total liabilities Shareholders' equity: Share capital Retained earnings. Total shareholders' equity Total liabilities and equity 200 280 480 $1,020 What is Sara's long term debt-to-equity ratio equity? Selected Answer 75% + $ 125 36 89 27 $ 62 uestion 4 Recent financial statement data for Sara Health Foods (HHF) is shown below. Income before interest and taxes Interest expense Income before tax Income tax Net income Current liabilities: 10% Bonds, noncurrent Total liabilities Shareholders' equity: Share capital Retained earnings Total shareholders' equity Total liabilities and equity $ 180 360 540 200 280 480 $1,020 What is Sara's times interest earned ratio is (rounded)? Selected Answer 3 x $ 125 36 89 27 $ 62 Ahmad Co.'s trial balance included the following account balances at December 31, 2013: Accounts receivable $12,000 40,000 Inventories Patent Investments Prepaid insurance Note receivable, due 2016 12,000 30,000 6,000 50,000 Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current" asset section of Ahmad's December 31, 2013, statement of financial position? Selected Answer 08000 tion 6 x Copy of Recent financial statement data for Sara Health Foods (HHF) is shown below. Current liabilities: $ 180 Income before interest and taxes Interest expense 10% Bonds, noncurrent 360 540 Income before tax Income tax Net income Total liabilities Shareholders' equity: Share capital Retained earnings. Total shareholders' equity Total liabilities and equity 200 280 480 $1,020 What is Sara's long term debt-to-equity ratio equity? Selected Answer 75% + $ 125 36 89 27 $ 62 uestion 4 Recent financial statement data for Sara Health Foods (HHF) is shown below. Income before interest and taxes Interest expense Income before tax Income tax Net income Current liabilities: 10% Bonds, noncurrent Total liabilities Shareholders' equity: Share capital Retained earnings Total shareholders' equity Total liabilities and equity $ 180 360 540 200 280 480 $1,020 What is Sara's times interest earned ratio is (rounded)? Selected Answer 3 x $ 125 36 89 27 $ 62 Ahmad Co.'s trial balance included the following account balances at December 31, 2013: Accounts receivable $12,000 40,000 Inventories Patent Investments Prepaid insurance Note receivable, due 2016 12,000 30,000 6,000 50,000 Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current" asset section of Ahmad's December 31, 2013, statement of financial position? Selected Answer 08000 tion 6 x Copy of Recent financial statement data for Sara Health Foods (HHF) is shown below. Current liabilities: $ 180 Income before interest and taxes Interest expense 10% Bonds, noncurrent 360 540 Income before tax Income tax Net income Total liabilities Shareholders' equity: Share capital Retained earnings. Total shareholders' equity Total liabilities and equity 200 280 480 $1,020 What is Sara's long term debt-to-equity ratio equity? Selected Answer 75% + $ 125 36 89 27 $ 62 uestion 4 Recent financial statement data for Sara Health Foods (HHF) is shown below. Income before interest and taxes Interest expense Income before tax Income tax Net income Current liabilities: 10% Bonds, noncurrent Total liabilities Shareholders' equity: Share capital Retained earnings Total shareholders' equity Total liabilities and equity $ 180 360 540 200 280 480 $1,020 What is Sara's times interest earned ratio is (rounded)? Selected Answer 3 x $ 125 36 89 27 $ 62 Ahmad Co.'s trial balance included the following account balances at December 31, 2013: Accounts receivable $12,000 40,000 Inventories Patent Investments Prepaid insurance Note receivable, due 2016 12,000 30,000 6,000 50,000 Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current" asset section of Ahmad's December 31, 2013, statement of financial position? Selected Answer 08000 tion 6 x Copy of Recent financial statement data for Sara Health Foods (HHF) is shown below. Current liabilities: $ 180 Income before interest and taxes Interest expense 10% Bonds, noncurrent 360 540 Income before tax Income tax Net income Total liabilities Shareholders' equity: Share capital Retained earnings. Total shareholders' equity Total liabilities and equity 200 280 480 $1,020 What is Sara's long term debt-to-equity ratio equity? Selected Answer 75% + $ 125 36 89 27 $ 62 uestion 4 Recent financial statement data for Sara Health Foods (HHF) is shown below. Income before interest and taxes Interest expense Income before tax Income tax Net income Current liabilities: 10% Bonds, noncurrent Total liabilities Shareholders' equity: Share capital Retained earnings Total shareholders' equity Total liabilities and equity $ 180 360 540 200 280 480 $1,020 What is Sara's times interest earned ratio is (rounded)? Selected Answer 3 x $ 125 36 89 27 $ 62 Ahmad Co.'s trial balance included the following account balances at December 31, 2013: Accounts receivable $12,000 40,000 Inventories Patent Investments Prepaid insurance Note receivable, due 2016 12,000 30,000 6,000 50,000 Investments consist of treasury bills that were purchased in November and mature in January. Prepaid insurance is for the next two years. What amount should be included in the current" asset section of Ahmad's December 31, 2013, statement of financial position? Selected Answer 08000

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Debt to Equity Ratio Total Liabiliti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started